A Billion Dollars Or Bust

Unicorn School Lesson 1: $100 billion egos and the mentality of a watermelon

The founders of Tipalti, Gong, and Next Insurance, whose companies’ valuations have leapt beyond $2 billion offer insights and tips for building unicorns

“$2 billion is just a point in time, in another two years you’ll be talking to me about how we got to $10 billion,” Chen Amit, the co-founder and CEO of fintech company Tipalti said when I ask if it’s reasonable that the company makes $100 million annually, and is valued at $2 billion. “That valuation was reasonable a month or two before we closed the raising round. After we closed the round, it was a gift, and now $2 billion is history. Each one of the people in this room has redefined the category they operate in, and we now have a good chance of reaching $100 billion.”

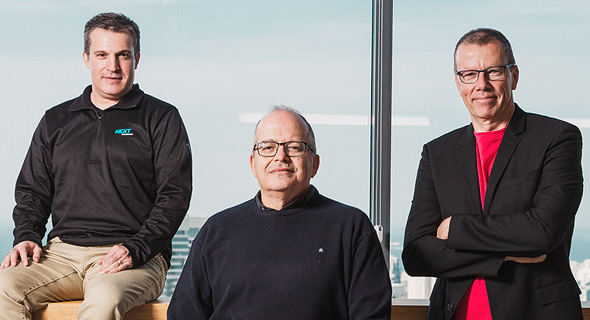

Right to left: Amit Bendov, Chen Amit, and Alon Huri. Photo: Tommy Harpaz

Right to left: Amit Bendov, Chen Amit, and Alon Huri. Photo: Tommy Harpaz

“In order to tickle our fancy, someone needs to come with $10 billion or $15 billion purchase offer to even get us to answer the phone,” said Amit Bendov, CEO and co-founder of Gong, a software startup, when I asked how much he’d agree to sell his company for. Then he throws in an agricultural metaphor, “Let’s say you’re growing a watermelon, but it’s still the size of a tangerine. You’re sure it’s a watermelon, but someone comes along and offers to buy it for the price of an orange. But, if I know that within another three years it will grow into a watermelon - even a complete plot of watermelons - why should I agree to sell it for the price of an orange? No one’s going to pay the price of a watermelon for it now, because they simply can’t picture it yet. They can’t see the clear path that it will take to become a watermelon, something that we are definitely able to see with our company.”

“I can clearly see how points align for a company to be worth $7 billion or $10 billion,” said Alon Huri, CGRO and co-founder of Next Insurance. And then he warms up: “I feel that it could even reach $20 billion or $30 billion,” and then he warms up even more. “There’s a crazy scenario where Next could reach a valuation of $100 billion. It gives me chills, how likely that possibility is, and how amazing it is.”

“My father has an apartment for investment purposes that he always rents out for 20% less than it would go for in the market, just to be safe. We also operate that way: the minute that an investor signs off on an investment at Next Insurance they already have made the deal of their life. The next financing round will be the easiest, since existing investors have already doubled their investment.”

“It’s part of the global trend,” Bendov concludes the debate. “We are living in a transitional period, like that which took place 100 years ago. The top three wealthiest people in the world come from the tech sector. There are also companies like Zoom or Snowflake who only a moment ago were startups, and now suddenly are valued at tens of billions of dollars. Television producers once made a TV series about ICQ’s exit. Nowadays an exit like that would barely make a small newspaper story. We were excited about the billion that Waze made, and until now that was enough, but that isn’t our path anymore.”

What is the path then?

“There is a generation of entrepreneurs here who got started in 2000, made exits, and don’t have any pressure to sell. We know how to do things differently, we possess accumulated knowledge. No one in this room thinks that $2 billion is the peak of their aspirations.”