Opinion

Covid-19 has forever changed client-bank relations: 53% of Israelis prefer to hold video calls than visit the branch

Global survey finds widespread adoption of digital banking, but banks have to up their game if they want to hold on to their customers

According to a global customer survey Accenture conducted in 28 countries, the Covid-19 crisis has led to new records in the adoption of digital banking services. We’ve seen an increase of approximately 60% in the use of banking apps (at least once a week) among private customers over the past two years.

Customers visiting a bank. Photo: Shaul Golan

Customers visiting a bank. Photo: Shaul Golan In Israel, the usage of bank apps is even higher. About 65% of customers use the banks’ mobile app at least once a week and about 55% would prefer to open an account or purchase a new banking product through the app.

The findings of the study can be seen as an achievement of the digital transformation process that banks have been carrying out over the past decade. However, one must understand the risk of further advancing the digital transformation without emphasizing the personal human aspect that customers seek. Our study also found that consumer trust, the fundamental value that forms the basis of the customer-bank relationship, has declined significantly.

If in 2018 some 43% of bank customers expressed confidence in the bank's ability to care for and advise in relation to the financial situation of their clients. In 2020 during the crisis, this figure plummeted to 29%. There has also been a drop (from 51% in 2020 to 37% in 2018) in the proportion of customers who have expressed confidence in their bank’s management of their personal financial information.

So how do you deal with this crisis and how do you make consumer trust and loyalty rise? Human contact – this will most likely be the differentiation factor between the banks.

Personal human contact is required by customers and is a significant factor in improving customer trust. While customers prefer the digital channels, when they want to open an account or perform a complex banking operation many customers prefer to communicate with the bank through the telephone channels and visit the branch (39% and 34%, respectively).

Personal human contact in the digital world is not about opening additional branches, but rather an intelligent combination of human contact throughout the customer's journey via phone or video call.

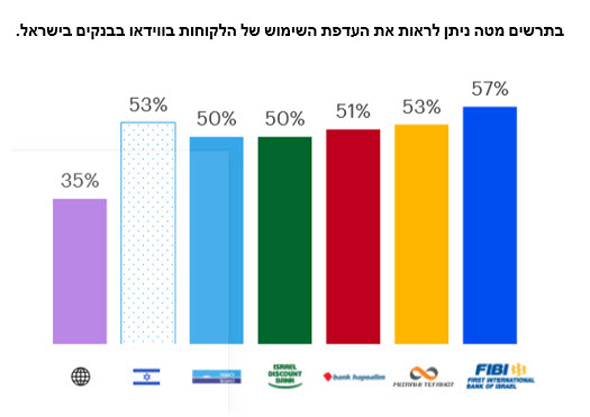

The Covid-19 crisis exposed us all to advanced video services such as ‘Zoom’. Our research findings also show that about 53% of Israelis prefer to communicate with the bank via video call over visiting the branch, which is high compared to the global average of about 35%.

The chart shows the preference for customers' video usage in Israeli banks.

The chart shows the preference for customers' video usage in Israeli banks.

In an era in which banks are constantly in competition with non-banking entities, digital banks, and global platforms such as GAFA, the video channel will be a differentiator that harmoniously integrates into the digital experience.

Video communication does not amount to giving the customer permission to connect to a video platform but much more. Video should support the various customer journeys and should be integrated into a multichannel concept.

The video channel needs to enable a new dialogue tailored to the future and it must provide an experience that goes beyond a virtual face-to-face conversation. Video interaction should combine customer screen sharing, advanced simulations, appropriate products and services as well as the ability to add bank experts to the call when needed.

This type of move is strategic and requires banks to make significant technological moves and change organizational perceptions. From the technological aspect, the solution must be cloud-based, enable service-based payments and be scalable. It should also create a single unified view for the customer and the banker based on the right information and processes, integrating third-party solutions, and adapting the bank's technological architecture to support these moves.

If we return to the million-dollar question in the banking industry about the customs of consumers the day after Covid-19, it is safe to say that digital channels will grow stronger, but it is important to remember the human touch that will lead to an increase in the trust and loyalty of consumers.

Ofir Golombek. Photo: Elad Gutman

Ofir Golombek. Photo: Elad Gutman Ofir Golombek is the Financial Services Lead at Accenture Israel