Transmit Security’s serial unicorn entrepreneurs strike again

The Israeli cybersecurity company’s recent $543 million round was just the latest on a long list of successes by its founders, Mickey Boodaei and Rakesh Loonkar, highlighting how much easier it is for returning entrepreneurs to raise funds and recruit employees

11:4225.06.21

Mickey Boodaei has been running one of the most successful high-tech companies in Israel under the radar for seven years. On Tuesday, Transmit Security, recorded the largest fundraising round in Israeli cyber history with a $543 million Series A round, led by Insight Partners and General Atlantic funds, valuing the company at $2.2 billion.

Boodaei is well-known in Israeli tech. He was one of the founders of Imperva, and in 2006 teamed up with Rakesh Loonkar, his Transmit co-founder, to set up Trusteer, a fraud protection platform sold to IBM within seven years of its inception as part of IBM's largest acquisition in the cybersecurity world. It was these successful moves that enabled Boodaei and Loonkar to self-finance the founding of Transmit in 2014. The two gave the new company an owner’s loan that was repaid shortly after the company’s launch.

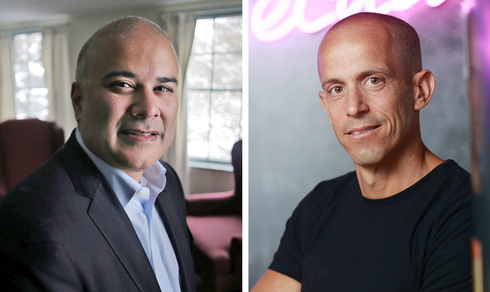

Transmit Security founders Rakesh Loonkar (left) and Mickey Boodaei Photo: Amit Shaal, Getty Imagesצילום: עמית שעל, גטי אימג'ס

However, Boodaei is not the first entrepreneur to strike success multiple times. Transmit is part of a small group of unicorns and growth companies set up by experienced entrepreneurs, often with deep pockets from previous paydays. A very partial list includes: Shlomo Kramer's Cato Networks, Assaf Rappaport's Wiz and the other founders of Adallom, and Ido Susan's DRIVENETS, who previously sold Intucell to Cisco for almost half a billion dollars. These names are joined by serial entrepreneurs turned serial investors, such as Avigdor Willenz who has registered exits in the billions over the years.

Relationships worth millions

There are a few reasons why returning or serial entrepreneurs, as those who have set up more than three companies are commonly referred to, manage to set up large companies very quickly, and experience is just one of those reasons. Relationships and equity are just as important.

Personal relationships, or networking, include one’s acquaintance with the market and its prominent investors, as well as one’s reputation in the industry. Rappaport, for example, raised funds for Wiz quickly thanks to the investors who accompanied him since Adallom. Furthermore, serial entrepreneurs have an advantage in recruiting, after all, who would not want to work on the new venture of someone who has already proved successful, and the employees in his previous company paid off their mortgages with their stock options.

In addition, serial entrepreneurs, especially those who experienced a quick and successful payday, often mention an ambition to set up a "long-term" company and avoid selling it even as tempting offers start to flow. "Rakesh and I have been through a lot in life," Boodaei told Calcalist in April. "We’ve checked the boxes of selling companies and taking them public, but have yet to lead a giant company and that was something that was important for us on a personal level." Wiz’s Rappaport shared a similar sentiment in a Calcalist op-ed writing “when you take a great deal of money at a high valuation, you remove from the table good options for acquisition at a valuation of hundreds of millions of dollars. This didn’t suit Adallom, but it does work for Wiz.” Amit Bendov, the founder of Gong, which recently raised funds at a $7.2 billion valuation, told Calcalist in December 2020 that “there is a generation of entrepreneurs here who got started in 2000, made exits, and don’t have any pressure to sell. We know how to do things differently, we possess accumulated knowledge. No one in this room views $2 billion as the peak of their aspirations.”

While having aspirations is all good and well, without serious equity being accumulated, it is doubtful that these aspirations could be discussed in such confidence. Even at a time when big money is flowing into the industry, almost indiscriminately, an entrepreneur who sets up his or her first company will often go through a grueling fundraising journey including attending conferences and events, trying to hunt down investors, and build a network of connections from scratch. Entrepreneurs describe months in which they did not take a salary from the company they set up so they could pay others. The reality of serial entrepreneurs is completely different, even if they choose not to inject equity into the new company, they are often inundated with investment requests from large, well-known funds.

“Money is being pushed in your direction”

Israel’s tech industry breaks fundraising records every quarter, but the lion’s share of this capital is channeled to growth companies. Investments in Israeli startups in 2020 amounted to $11.5 billion, a fourfold increase within a decade (according to data from Israeli’s Innovation Authority). Since 2015, however, there has been a consistent decline in seed investments, meaning investments in young companies, usually without a product or customers. Furthermore, according to the Innovation Authority's annual report, which was released earlier this month, the number of new startups in Israel has been declining since 2014. Within five years, the number of new startups in Israel fell from about 1,400 in 2014 to an estimated 850 companies in 2019 and about 520 in 2020.

Earlier this year, commenting on Transmit’s second-place ranking on Calcalist’s list of the most promising startups for 2021, Boodaei referred to entrepreneurs looking for a quick payday saying "I just hope that people who complete their first exit then come back for a second round that is different." However, in the same interview, he also said that “money is being pushed in your direction and you require a lot of willpower to reject it. It’s money that fuels itself until things explode. The capital is nearly free for the taking and you can’t fault those who do.”

Transmit raised this last round, even though there was no urgent need for it. The original owner's loan was repaid a few years ago and the company’s annual revenues of about $100 million made Transmit into a profitable company that does not need outside capital. This could also explain information obtained by Calcalist that most of the fundraising took place in a secondary form and most of the capital will be divided among the two founders of the company and its 200 employees.

"We discovered that one of the things that was difficult for us was to explain to everyone the value and potential of the company,” Boodaei told Calcalist this week. “We were a company that hadn't raised money and the employees, analysts, clients, and media had nothing to compare us with other companies and that is a problem. We concluded that partnering with the VC funds will show that the VC world believes in our market, our company, our people, and our potential to grow quickly. This serves as a measurable validation for everyone."

Boodaei and Loonkar’s situation is certainly different from that of most of the entrepreneurs who arrive at big funding rounds with diluted capital and minor holdings of a few percent in the company. Before the acquisition, they were both major shareholders in their company and their employees had a small holding, that is why Boodaei said, "we won't be significantly diluted, but there is a goal we are trying to achieve and we believe that we can reach far faster growth in today's market and that our potential is far more significant.”

No passwords

Transmit provides some of the world's largest organizations with risk identification and biometric authentication solutions, which make it possible to completely eliminate the use of passwords. Organizations lose millions of dollars annually and place themselves and their customers at high risk due to password-based authentication that is inherently unsafe, delivers poor user experience, leaves customers unsatisfied, and places brands at risk of jeopardizing their reputations.

Transmit Security employees Photo: Amit Shaalצילום: עמית שעל

Research shows 55% of consumers stop using a website because the login process is too complex, while 87.5% find themselves locked out of an online account after too many failed login attempts. Even worse, 92% of consumers will completely abandon a website without completing a purchase instead of going through the steps to recover or reset login credentials.

In addition, passwords also pose a significant threat to data security. Weak passwords lead to more than 80% of all security breaches and are the cause of most account takeovers, an issue that bothers consumers and businesses alike. Transmit's solutions address all stages of authentication, from connecting to a service to providing smart permissions to customers and employees. Thus, the company helps organizations improve the customer experience, significantly improve security capabilities and meet the various requirements, at a cheaper price and in a shorter time than traditional identification solutions.

Transmit's technology is already used by large organizations around the world, including six of the seven largest financial institutions in the U.S., including UBS and Santander; along with digital brands and service providers operating in Europe, Asia, and Latin America. The company headquarters are based in Tel Aviv, where most of its R&D takes place, as well as part of the marketing and sales activities. The company has additional offices in the U.S, England, Mexico, Brazil, Australia, and Germany.

Boodaei also noted that it is easier to raise money nowadays. "It is very easy to raise funds and we knew we wouldn't have to work hard to do so. It was very easy for us to raise for several reasons. We have long relationships with the funds we chose to work with. They knew us and the business and we met regularly so there was no need to convince them that we are a worthy company. It was mainly a procedural process with such and such checkmarks. There are quite a few funds that have taken part in the investment, and in each of them we find a value that we believe will help us."

"We want them to understand that we are a leading player in our world. We are targeting a huge market of tens of billions and want to act in a very aggressive manner that will allow us to reach higher growth rates than we have today," Boodaei said. "An IPO has always been a goal, and when VC funds come in it only emphasizes it. Every fund has that expectation and while it's not something I have a set date for, it's something that will come."