Japan's Orix, Mitsubishi Tanabe Pharma Considering Additional Israeli Investments

Israel's Minister of Economy Eli Cohen met with the CEOs of both companies during a state visit to Japan

15:5029.11.17

Israel's Minister of Economy Eli Cohen left Sunday on a state visit to Japan, where he is meeting with state officials and industry leaders.

For daily updates, subscribe to our newsletter by clicking here.

On Tuesday, Mr. Cohen met with the CEOs of two Orix Corporation and Mitsubishi Tanabe Pharma Corporation, to interest them in investments in Israel.

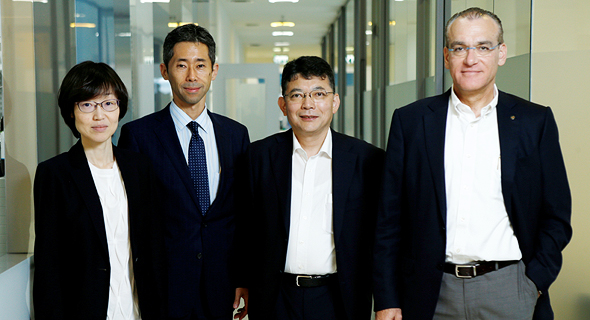

NeuroDerm CEO Oded Lieberman with Mitsubishi Tanabe representatives. Photo: Amit Sha'alצילום: עמית שעל

Tokyo-headquartered Orix is a financial services group with almost 35,000 employees and an investment portfolio of energy, infrastructure, transportation and real-estate assets in almost 40 countries worldwide. In May, the company paid $627 million for a 22.1% stake in Israeli geothermal energy producer Ormat Technologies Inc., becoming its biggest shareholder.

Pharmaceutical company Mitsubishi Tanabe Pharma Corporation is a member of the Mitsubishi UFJ Financial Group, Inc. In July, the company bought Israeli pharmaceutical company NeuroDerm Ltd. for $1.1 billion, in what is currently the largest ever acquisition of an Israel-based company by a Japanese company.

In 2014, Japan's largest e-commerce corporation Rakuten Inc. paid $900 for the popular Israeli messaging app. In 2016, the corporation participated in a funding round for Israel linked credit line company BlueVine.

In June, Japan's telecommunication company Softbank Group Corporation announced a $100 million investment in Boston-headquartered, Israel-linked Cybereason, which uses behavioral analytics to detect cybersecurity threats.

Related articles

Orix and Mitsubishi Tanabe expressed interest in the Israeli market and its diverse investment opportunities, the ministry said in a statement.

Japanese corporations participated in 31 funding rounds for Israeli companies in the past three years, according to September data from Israel-based venture capital firm Viola Ventures. The number of investments is on the rise, from 7 rounds in 2015 to 13 in 2017.