CTech’s Wednesday Roundup of Israeli Tech News

Two cybersecurity companies with links to Israel placed on U.S. blacklist. Tel Aviv-based startup seeking regulatory nod to pay employees in bitcoin. Public data doesn’t capture extent of Chinese-Israeli deals

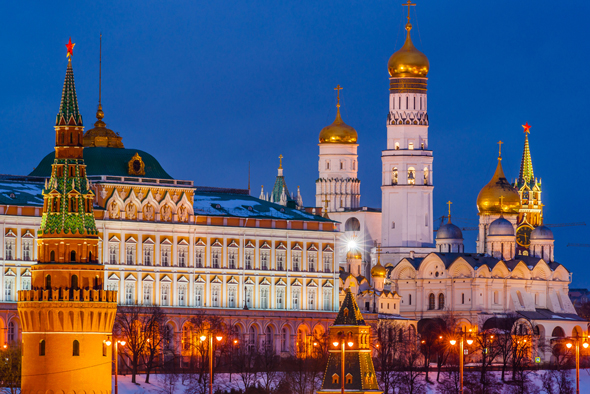

Two cybersecurity companies with links to Israel placed on U.S. blacklist. The U.S. Treasury is accusing a number of companies of aiding the Kremlin to develop advanced offensive cyber technology. Read more

Public data doesn’t capture extent of Chinese-Israeli deals, says businessman Amir Gal-Or Having spent the past decade living and working in Hong Kong and Beijing, businessman Amir Gal-Or is one of the early pioneers of the tightening business ties between China and Israel. “Many of the deals remain undocumented,” said Mr. Gal-Or in an interview with Calcalist. Read more

Tel Aviv-based startup seeking regulatory nod to pay employees in bitcoin. Social engagement startup Spot.IM hopes to offer employees the option of getting paid at least a portion of their wage in cryptocurrency. Read more

Israel prevented over 200 alleged potential terror attacks by using social media monitoring tools, Israeli official says. In 2017, Yisrael Katz, then Israel's minister of intelligence affairs, confirmed that Israel uses a predictive policing system that relies heavily on social media to identify and sometimes detain Palestinians thought to be potential attackers. Read more

Company developing AR headset for surgeons raises $11.5 million. A spin-off of Israeli defense and electronics contractor Elbit, Beyeonics develops surgical visors that stream high-resolution images and data in real time directly to surgeons’ eyes. Read more

Toolmaker Stanley Black & Decker invests in Israeli wireless charging company. Humavox develops a technology that enables wireless charging in everyday objects through the transmission of radio frequency waves. Read more

Fidelity sells $122 million of frutarom shares following its announced acquisition. Fidelity now holds a 5.06% stake (fully diluted) in Frutarom, worth around $300 million. In May, NYSE-listed IFF agreed to pay $7.1 billion for Frutarom in a cash and stock deal that will see Frutarom become a subsidiary of IFF once the merger goes through. Read more

Prince William to visit Israel, Palestinian territories. During a five-day tour of the region in late June, Prince William will visit Tel Aviv, the West Bank, and Jerusalem. Read more

News Briefs

More businesses opt to pay ransom money to hackers, survey finds. Read more

China’s TuSimple selects flash-based storage system to train autonomous driving algorithms. Read more

Personal health assistant startup Brook raises $4 million. Read more