Why are Chinese investors shying away from Israeli tech?

New study reveals a sharp decline in investments since 2018 due to Beijing’s shifting priorities and a watchful Washington

Elihay Vidal 16:1328.01.21

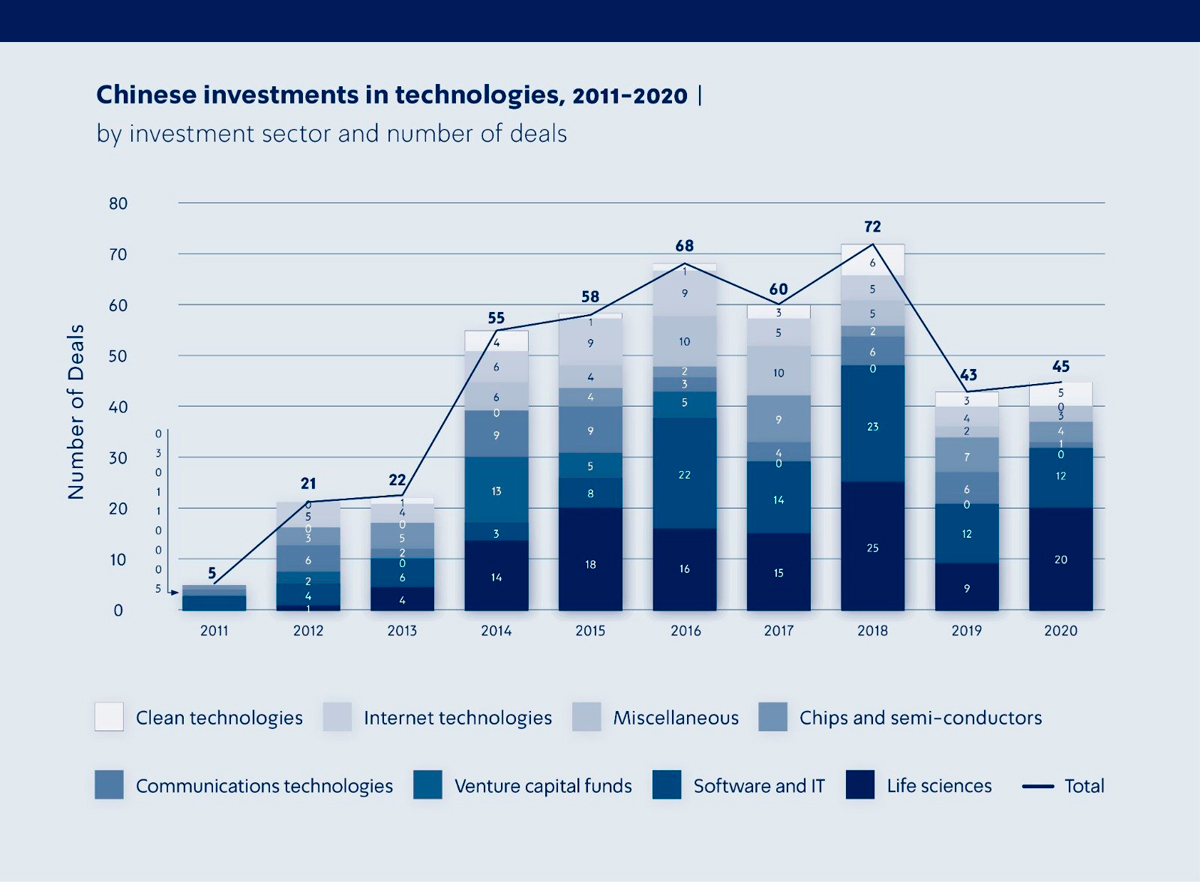

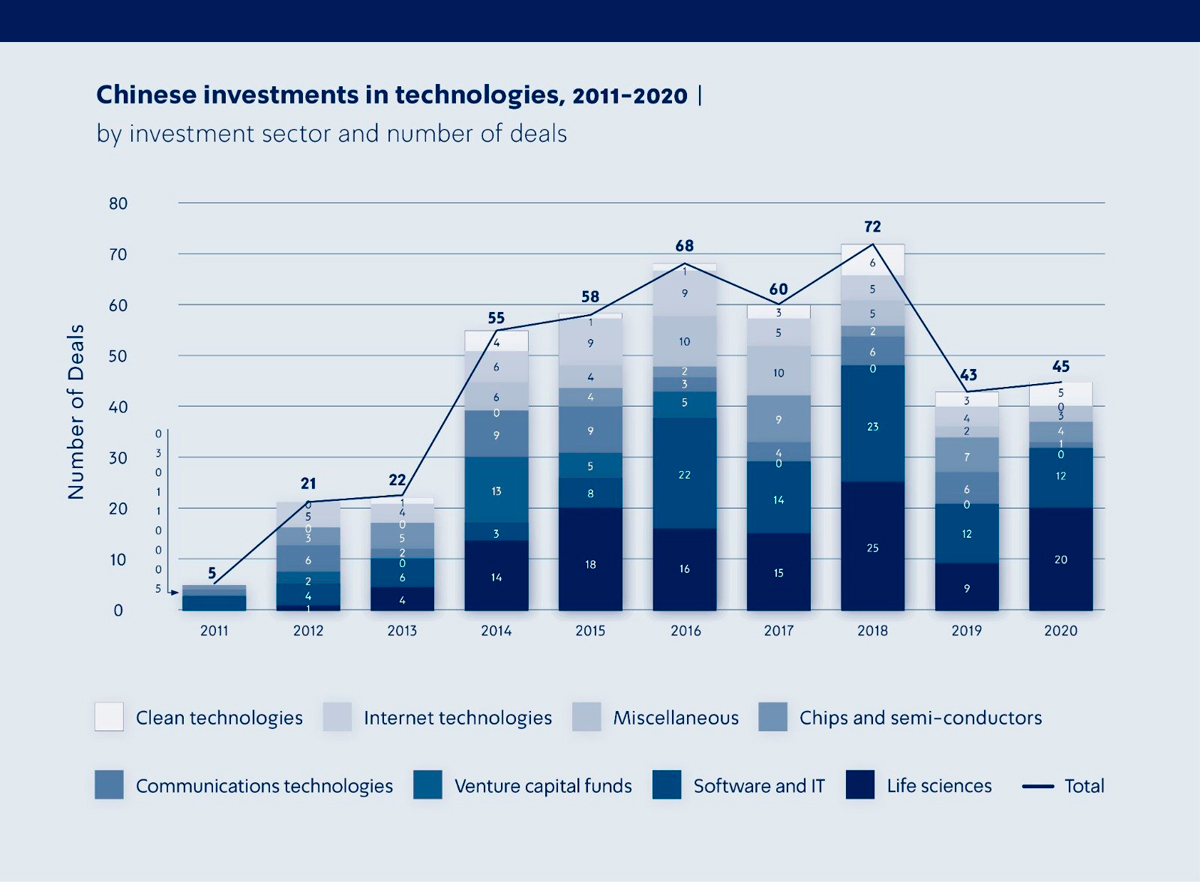

Even though China’s involvement in the Israeli economy has largely grown over the past decade, particularly when it comes to the local tech sector, a new study indicates that the peak of Chinese investments came in 2018 and has been in decline over the past two years.

The study, authored by Dr. Doron Ella for the Institute of National Security Studies, revealed that between 2014 and 2018 there was a steady rise in Chinese investments, especially in the tech sector, both in the number of investments and their volume, but that trend reversed after hitting the zenith and investments have been in decline, indicating somewhat of a halt to China’s penetration of the Israeli economy, similar to the decline in China’s overall global investments.

Dr. Doron Ella. Photo: Courtesy

Cinese investments in technologies 2011-2020מקור: המכון למחקרי ביטחון לאומי INSS

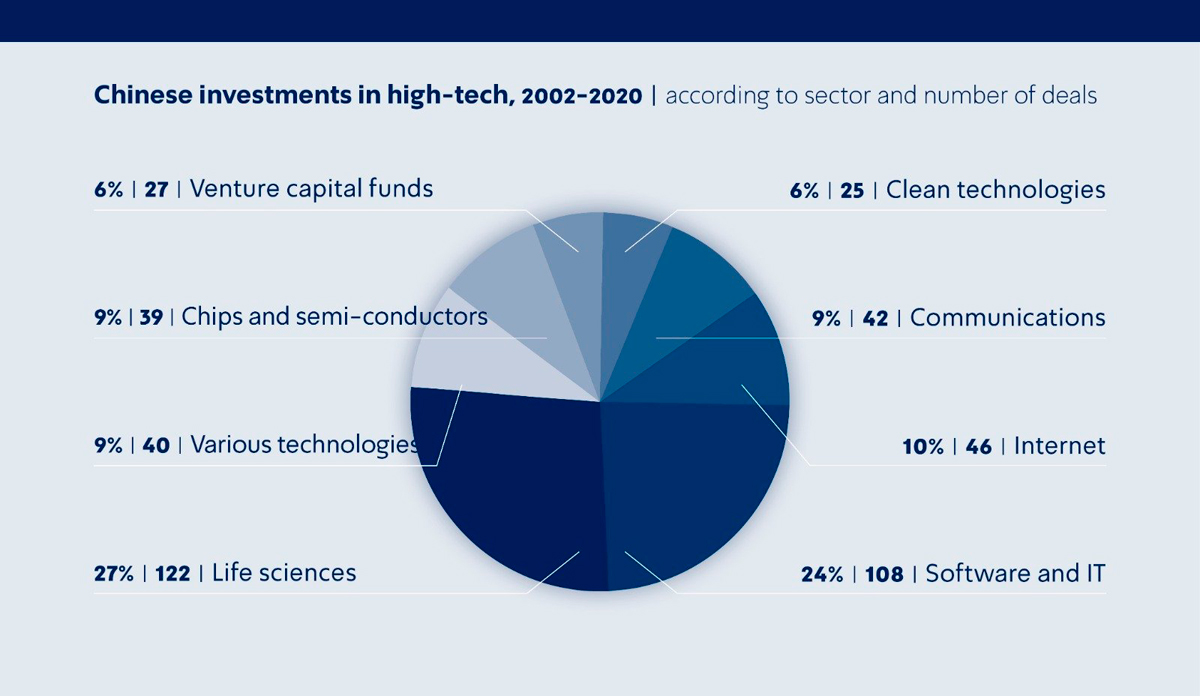

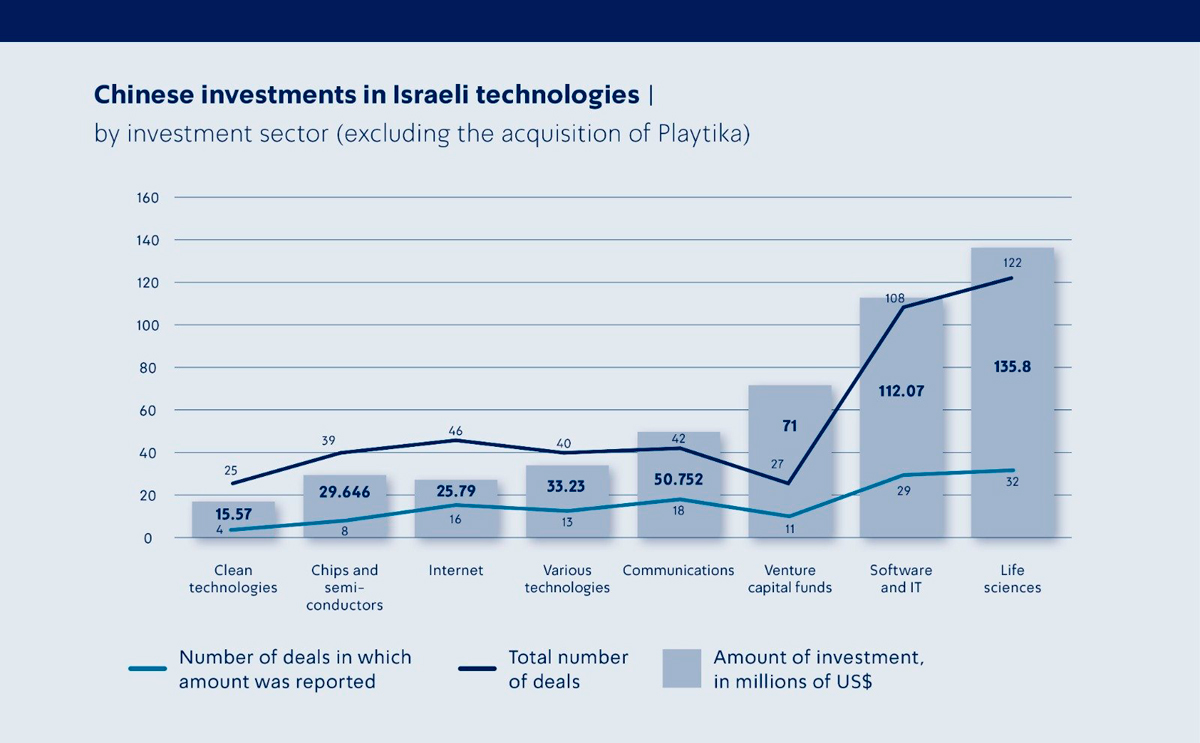

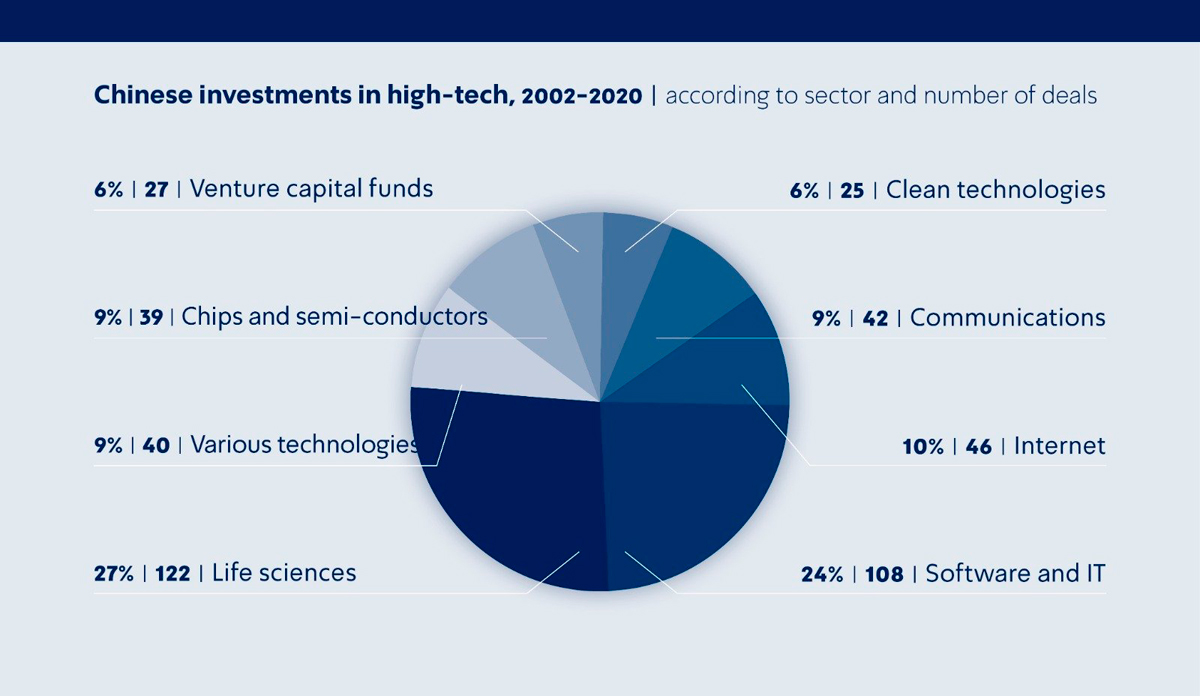

According to the study, Chinese investments gradually increased over the last two decades, and especially from 2014 onward, with most of the money going to the tech sector (449 deals at a reported valuation of $9 billion, out of a total of 463 deals worth $19.4 billion). Ella stressed that the sums invested in the tech sector are not always transparently reported and that often the reported sum of a certain financing round includes capital raised from several investors lumped together, which suggests that the actual numbers may be significantly higher than the ones recorded in the databases his study was based on (IVC, Crunchbase, and local and international media reports).

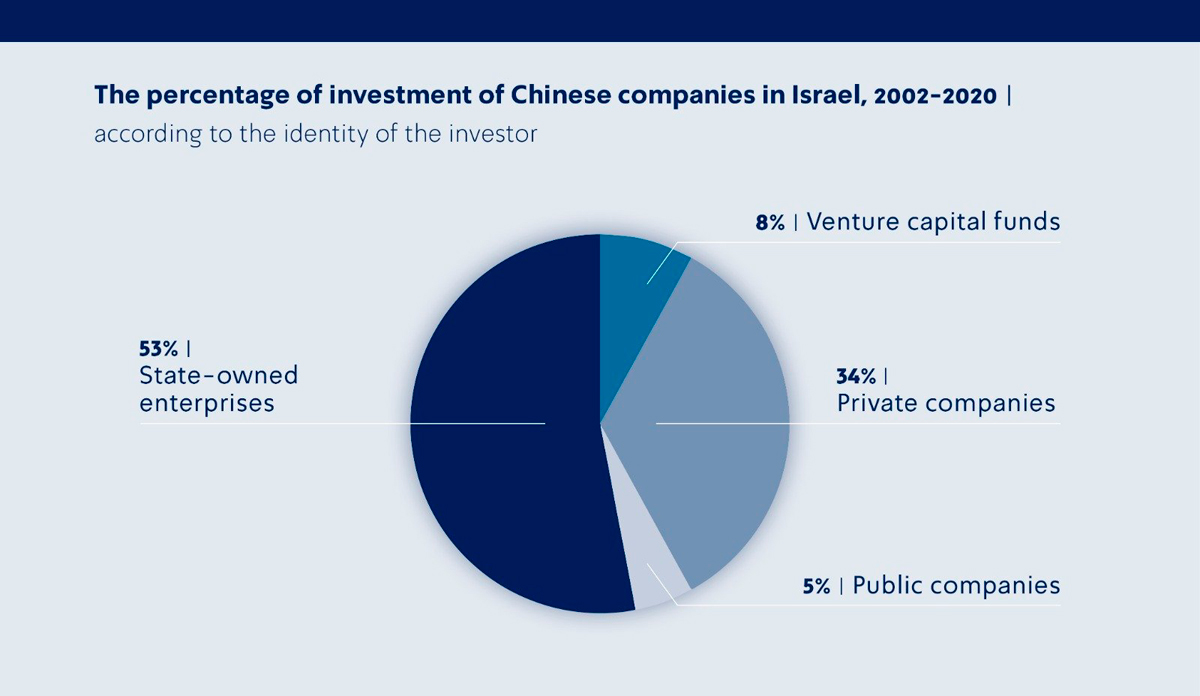

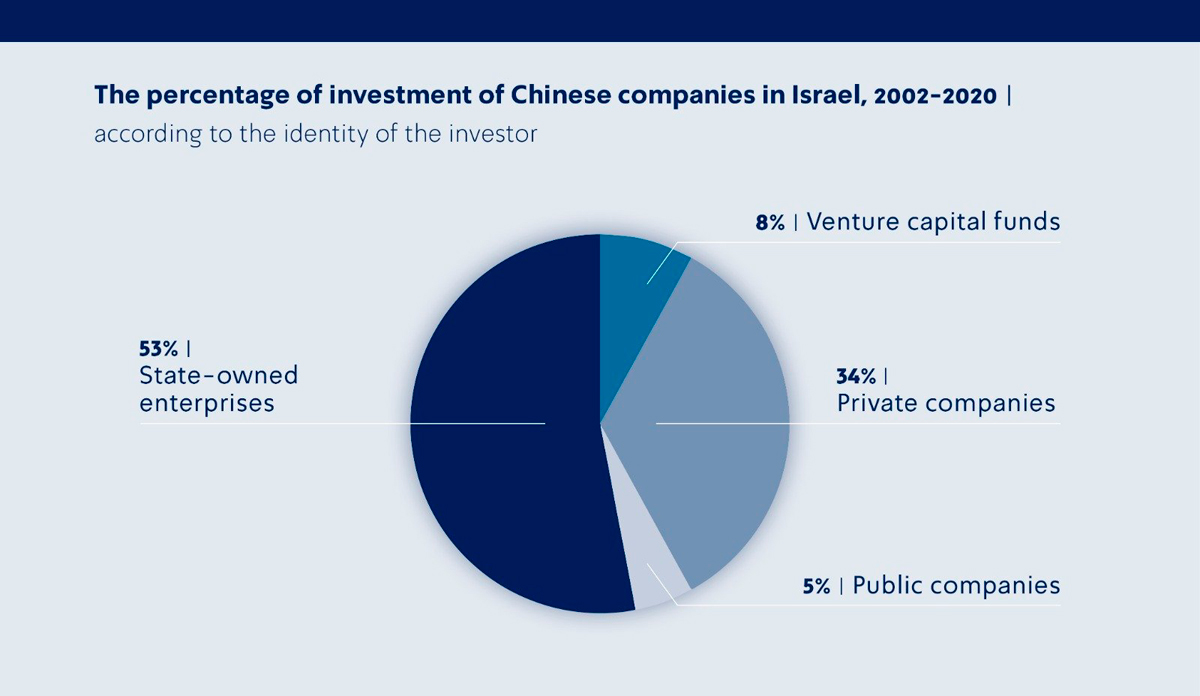

The Percentage of investment of Chinese companies in Israel, 2002-2020מקור: המכון למחקרי ביטחון לאומי INSS

Chinese investments in high-tech 2002-2020מקור: המכון למחקרי ביטחון לאומי INSS

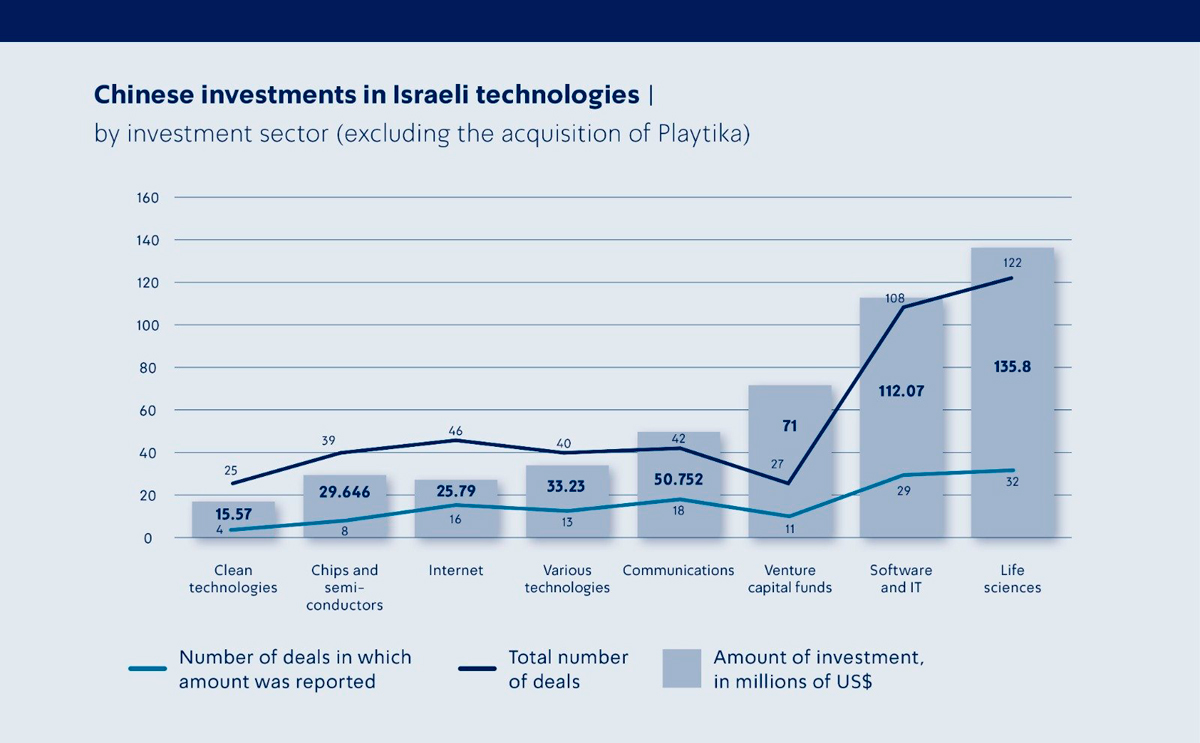

Chinese investments in Israeli technologiesמקור: המכון למחקרי ביטחון לאומי INSS

Ella wrapped up his study by noting that it is difficult to reach long-term conclusions based on two years of data and that it would take a longer time frame to determine if indeed Chinese investments in Israel have come to a halt. He stresses that “Israel must thoroughly and consistently examine foreign investments to ensure that China, or any other country, doesn’t gain control of strategic infrastructure, especially in the fields of water and energy. Moreover, Israel must update the fields that fall under the purview of the foreign investment oversight agency and bolster the agency’s work, and at the same time examine adding sub-sectors of the tech industry, like chips and semiconductors, certain life science sub-sectors and software and IT under the agency’s responsibility.

“Bolstering Israel’s official oversight agency will help build trust with the Americans, who possess a sophisticated and up-to-date mechanism of their own and have a goal of strengthening similar mechanisms in other developed countries. To conclude, the snapshot provided, though backed by data, offers just a portion of the overall picture, in which investments make up only one dimension of general economic relationships, which beyond their financial value, are tightly linked to technology, data, and strategic clout. In order to properly navigate the complex arena that features both its strategic ally and an important trade partner, Israel must, to begin with, establish an accurate and dependable representation of its market activity and the superpower’s involvement in it,” Ella concluded.