Mapping Israel’s booming crypto ecosystem

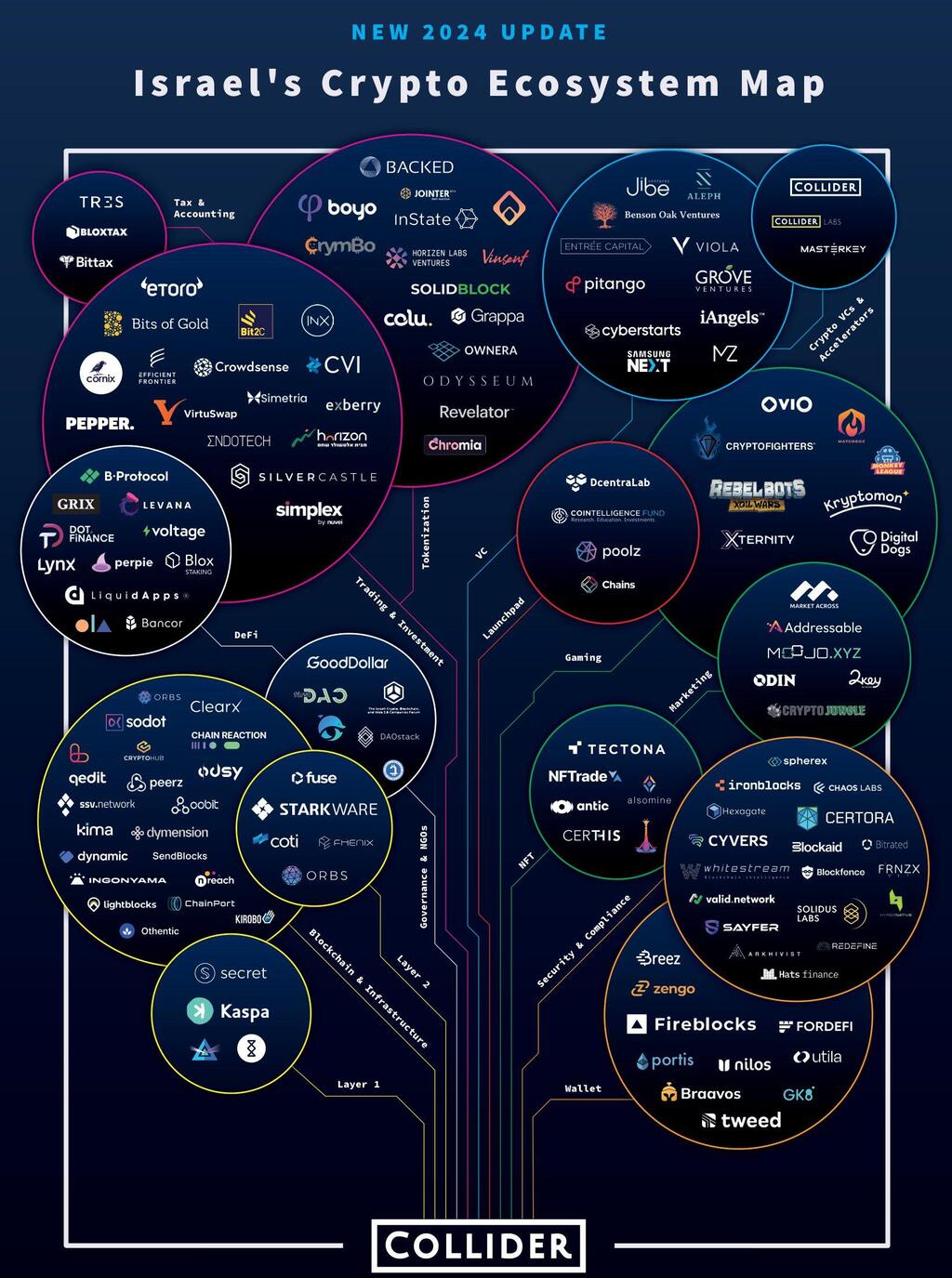

Against all odds, and amid the war, the Israeli crypto market is flourishing, driven by the bull market that followed the approval of the first Bitcoin ETF. Over $100 million has been raised by startups since October 7th, with the first Decacorn of the local industry also emerging, according to the Israeli Ecosystem Map published by VC Collider

Since the outbreak of the war, the Israeli high-tech scene has embraced the motto “Israel delivers no matter what”. The local crypto ecosystem appears to be unaffected by, and even accelerating despite, the economic impact of the war, thanks to the remarkable growth the industry as a whole has experienced in the last few months.

In January, the U.S. Securities and Exchange Commission approved multiple Bitcoin ETFs, a regulatory stamp of approval that paved the way for a significant surge in crypto asset prices, with increases exceeding 70%. The existence of such investment vehicles allowed over $11 billion to flow into the space, bringing significant attention and recognition to the crypto ecosystem, including the Israeli one. Research from Collider, the largest crypto-focused fund in Israel, covering all local startups in the sector, shows that the Israeli crypto industry has flourished despite the war, raising more than $100 million since October 7th.

The new crypto bull market had a positive impact on the local Israeli ecosystem, with the number of builders in the space poised to grow significantly in the short to medium term. Israel, home to over 145 companies, has seen considerable progress since the war erupted. Collider recently published its second edition of the Israeli Crypto Ecosystem Map, noting that firms such as Blockaid, Ingonyama, Tres, Fordefi, Utila, Addressable, Oobit, and others have collectively raised around $115 million since October 7th. Moreover, Starkware, the company behind one of Ethereum’s largest zero-knowledge rollups, has emerged as a Decacorn, reaching a $20 billion valuation with the launch of their $STARK token.

The rising market certainly provides fresh oxygen to an industry that was severely hit after a convoluted 2022, including the collapse of the famous centralized exchange FTX. Since Bitcoin’s inception, significant progress has been made. Numerous companies in the space have become unicorns and decacorns, and the number of developers has increased substantially. BlackRock’s Larry Fink has dubbed tokenized securities as “The Next Generation for Markets,” and transactions on certain blockchains now cost less than $0.01, enabling a myriad of new use cases. Moreover, the market has recently seen large institutional players such as PayPal entering the crypto space, while firms like Goldman Sachs, BNY Mellon, Swift, BNP Paribas, Citi, Lloyds, and others have announced the successful completion of some initial blockchain experiments.

“Recently, we have seen a significant increase in the number of entrepreneurs building in the crypto space, especially in areas like security and infrastructure," notes Avishay Ovadia, Founding Partner of Collider. "As the largest local fund, we are doubling down on our investments in Israel, there is an incredibly large pool of talent here."

The crypto ecosystem is highly technical, with many founders in the local industry having backgrounds in elite intelligence units (8200, 81, Mamram) or academia. “Despite the war, and many founders being called as reservists, Israeli companies have continued to innovate and build remarkable products”, Ovadia stressed.

Furthermore, the security sector in crypto is dominated by Israeli companies, with a significant number of them founded by alumni of local cyberintelligence units. Fireblocks, Blockaid, Ironblocks, Certora, and Chaos Labs are among the leading projects in the space. Interestingly, founders with an academic background tend to focus on the infrastructure arena, particularly in the multiparty computation (MPC), zero-knowledge (ZK) proofs, and fully homomorphic encryption (FHE) spaces. Starkware, Kaspa, Ingonyama, Odsy, and Fhenix are the most prominent names in these sectors.

Sebastian Lehrer is an Analyst at Collider Ventures