Interview

Merlin: Selling sabra cyber to Uncle Sam

In an exclusive joint interview, David Phelps, Chairman & CEO of Merlin Cyber, and Shay Michel, Managing Partner of Merlin Ventures, share how their company helps Israeli startups penetrate the lucrative US federal cyber security market; Michel: “Israel is no longer the ‘start-up nation’, but the the ‘scale-up nation’”

It’s no secret that Israeli companies seek to penetrate markets outside their own borders, and Israeli cybersecurity startups are no exception. With the evergrowing rise in global cyber threats, governments around the world are seeking immediate help - including from Israeli cyber experts. Merlin is a U.S.-based company with a presence in Israel made up of three main areas that help businesses accelerate their scale and prepare to sell to American federal cyber markets: Merlin Ventures, which helps with strategic investments in cybersecurity companies, Merlin Cyber, which helps them with their go-to-market strategies, and Merlin Labs, an internal organization that leverages engineering expertise and bringing the technologies together. As an American VC, Merlin launched a Tel Aviv office in 2020 to complement the investments it is already making in the U.S. Market. By doing this, Merlin’s Tel Aviv team has been able to accelerate investing in early stage Israeli companies that will further strengthen the U.S.-Israeli partnership. CTech sat down with David Phelps, Chairman and CEO of Merlin Cyber, and Shay Michel, Managing Partner of Merlin Ventures, to learn more about how their company helps Israeli startups penetrate the lucrative U.S. federal cyber security market.

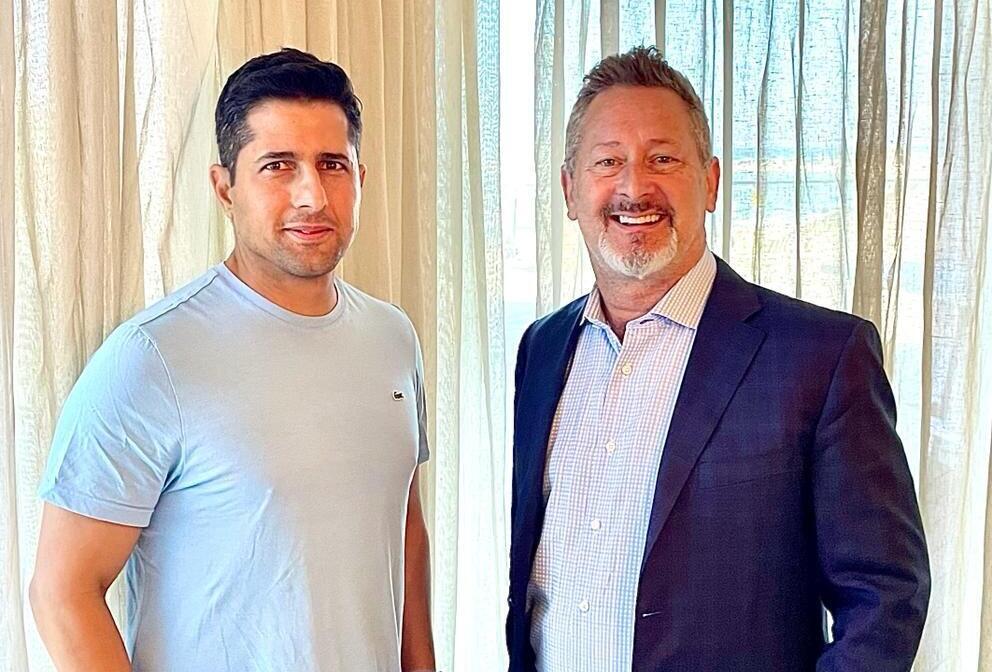

1 View gallery

From left: Shay Michel - Managing Partner of Merlin Ventures, David Phelps - Chairman & CEO of Merlin Cyber

(Photo: Seth Spergel)

What is it about Israel that originally attracted you to it?

Phelps: “Well, it’s a combination of two things. First, I had been to Israel several times in the 1980’s when I was serving in the U.S. Navy, coming in and out of the Haifa port. Over that time I got to know and develop really good relationships on the ground with the Israeli people and build up a lot of confidence in the country as a whole. Then, years later with Merlin Cyber, the need to invest in early-stage cyber security companies grew and Israel, known for being the genesis of so many cyber security companies, was the natural place for that.”

The federal cybersecurity market in the United States is estimated at $200 billion and every cyber company aspires to sell to it, especially after President Joe Biden passed the cybersecurity enforcement order ($9 billion budget to strengthen the state's resilience to cyber attacks). But private companies are discovering that penetration into the federal market is a major challenge. How do you help young Israeli companies sell cyber technologies to the US government?

Michel: “Israel is a small country and the main market for us is the U.S. market. The U.S. cybersecurity market has been growing tremendously in recent years. The opportunity that Merlin is trying to bring to Israeli cyber companies is very unique. Up until now it was considered taboo for Israeli cyber startups to approach the vast U.S. federal security market in order to work with them. In fact, until about five years ago, Israeli companies were pretty much solely going the commercial route. That is until they had reached the glass ceiling when the market began shrinking and everyone began looking for other new opportunities. We at Merlin saw this trend beginning a couple of years ago and we understood that our added impact for Israeli cyber startups is to help them approach the U.S. governmental cyber market - local, state, and federal - in the right way so that they can succeed in working with them. So, we see our opportunity as twofold, to connect Israeli cyber startups with the American cyber commercial market and secondly, when they are ready, to prepare them to be able to connect with the U.S. federal cyber market in the right way. We see ourselves as the pipeline between the Israeli cyber startups and the U.S. market, from early stage to exit to help them achieve their goals.

Phelps: “In addition to getting early-stage companies ready for the market, we also provide Israeli cyber startups with the confidence that they can do it. Then, once they do get into the market, we provide them with the access, as there are a lot of compliance, regulations, contract and security issues, plus many bureaucratic processes, things that Israeli cyber startups simply wouldn’t be able to handle on their own. By having a partner in Merlin that’s not just investing in technology, but thinking about the whole continuum - the technology, their product, going to market, helping them with their business in the context of the federal market which is very regulated but also very large - that’s the end-to-end value that we bring.

"On the government side, the federal establishments need the latest technologies, so that’s also a big part of what we do. We look at what the customer needs are, what problems they are trying to solve, and how we can make a match that helps solve it.”

What have you learned from this process of preparing Israeli cyber startups to be able to work with the U.S. federal cyber market?

Michel: “One thing I learned from my time at Merlin and from Seth Spergel, Managing Partner at Merlin Ventures, is that just coming with a cyber solution is not enough, you need to understand how big companies work, how the U.S. federal market works, because if you are not ready, when you want to sell, you will find that you are still a year away. Merlin provides data, knowledge, and years of experience, basically everything needed to help a startup get prepared for the next big thing.

"Another thing I learned is that Israeli startups that are building themselves up tend to think only in the short term, 12 or 16 months forward until the next funding round, but with Merlin we look at the whole big picture and the long term view. We raise issues and ideas that they never thought about from thinking only in the short term. All the startups we work with must be prepared and do their homework. I like to say that Israel is no longer the ‘start-up nation’, we are now the ‘scale-up nation’ and we are also the Cyber Nation. If we want to play with the big boys, we need to know how to think long term from the very beginning. By the way, that’s why most first-time Israeli startups don’t succeed, but second and third-timers do, they learn from their past experiences.”

What are you looking for in a company before you work with or invest in them?

Phelps: “I think we need to divide the answer into two categories: emerging vs. more established companies. With emerging tech, say a Series A company, looking to come into the market, I am looking for differentiating technology. Rather than having one of many, I look for things that are truly needed by our customer, which shows that we really understand the market and what market needs it fits, and I also look for the adjacencies of what other technical partners we have. We’ve sold billions of dollars of software to the federal government, so where are those install bases at customers that could use this technology so that we can accelerate the sales. Making such a connection could be the difference between ‘months to revenue’ or ‘years to revenue’.

"For larger companies, we typically will partner with the number one companies in a category, but we are very selective. It’s a complex market with a lot of compliance and there’s a lot of investment, so we want to make sure to find the right partners that already have great success commercially, then we’ll partner with them in the federal market and really accelerate their revenue.”

Many startups have been laying off employees recently, yet at the same time the high-tech industry has a huge shortage of skilled workers. What do you make of it?

Phelps: In cybersecurity companies there is still a huge demand for skilled workers and there are still shortages, but they are not as acute as they were. So there are more people in the market, but at the end of the day there are still more positions open than there are people. So cyber, as opposed to other industries, is still growing at a pretty fast rate, especially in the U.S. federal government, because of persistent threats from nation-states, for example, and so they are continuing to invest ahead of the curve. So, with the federal market one of the advantages is that budgets are consistent every year with steady growth, but within that overall budget, cyber is growing at one of the fastest rates, so it’s a really exciting time to be a cybersecurity company, even if the macro economics are softening.

"Also, the technology need is there also because the threats continue to evolve, so one of the things that’s great about Israel is the amount of R&D they put in this area. It’s an amazing place to find the talent and bring the next generation technology to market. So that’s why we at Merlin are here in Israel very early, we view it as a long term investment, we are not just in and out of the market in a quarter or a year, we have a multiyear view when it comes to working with Israeli companies.”

Do you see any challenges Israeli cyber startups will have raising seed or A rounds in the near future?

Michel: “I don’t foresee any problems with the seed round investments due to the economy. Yes, we saw drops in valuation, first in the U.S. and then in Israel, but I think many smart Israeli entrepreneurs showed a lot of resilience as they waited out the last couple of months and we will see a market correction as we exit the ‘panic mode’.

"Now, when it comes to the A rounds, we are seeing new parameters. Growth is not enough anymore. So entrepreneurs who got their seed money will have to show numbers and money - and not just hype. I believe that those startups that can prove their numbers and money will get the funding in A rounds.”

What is your view of growth engines?

Michel: “I am so glad you asked this important question because a growth engine is something very important for a startup. One of the reasons that Merlin has a presence in Israel is to be a growth engine for startups - and I am talking about A round and above. One of the biggest growth engines for Israel is enablement to come to new markets. At Merlin we are working on a special project which I cannot disclose at this time, but perhaps in a few months, which we believe will serve as a growth engine for new markets, and it’s very exciting. The cybersecurity market is growing and I predict great things ahead.

"Another key element is bringing strategic investors. Of course you must always focus on growth, but also keep your customers, work with them, be kind to them, teach them and grow together with them.”

How do you see the ties Merlin is building between the two countries?

Phelps: “The relationships between the U.S. and Israel have always been strong and the work we are doing at Merlin is further increasing those bonds in the areas of defense and resiliency in the global market which we are in, but at the same time it provides great access to technology, employment and overall benefit. Of course, we don’t just invest in the technology, but also in the people, especially the management teams. It’s the people together behind the technology that make the difference.”

Michel: "I am a proud Israeli living in Israel and David is an American living in the U.S., and Merlin is an American company with an office in Israel. Many people ask me why is Merlin as a company so heavily invested in Israel as opposed to other countries? Well, our chairman David Phelps is a big believer in the Israeli market as is the entire Merlin Ventures team. This is the market we as a company want to grow with. If someone says that Merlin is ‘betting on Israel’ they would be wrong. Israel is anything but a ‘bet’, we are totally sure about what we are doing here.”

First published: 09:52, 04.07.22