Opinion

Thematic investing: taking stock after a year of market volatility

The past year’s market volatility and macro shocks have raised a challenge to the thematic investing boom, but also offer a chance to reappraise the benefits of the investment approach. Overall, thematic funds continue to attract net inflows as investors seek alternatives to traditional sector-based portfolios in their search for long-term outperformance

Thematic strategies have been one of the fastest-growing investment segments of recent years, both for the broader industry as well as for Qontigo, administrator of STOXX and DAX indices.

Thematic funds represent 2.7% of all assets under management in equity funds globally, up from 0.8% ten years ago. Qontigo’s STOXX Thematics family, meanwhile, now counts over two dozen indices targeting structural and forward-looking themes disrupting our modern societies.

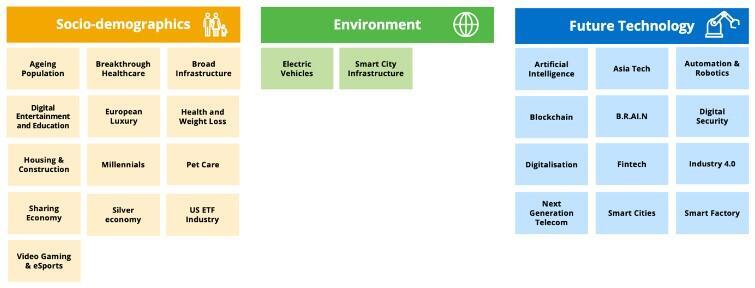

The themes have been chosen considering their scope and durability, and to avoid fads. Each one represents a cross-industry concept and can be categorized within the three broad pillars of socio-demographics, the environment and future technology.

The indices seek to identify the beneficiaries of the underlying structural changes (megatrends) using innovative selection methodologies based on criteria such as revenue or intellectual property related to the theme in question.

Flows continue despite market pullback

The market volatility and macroeconomic disruptions of 2022 proved to be a considerable challenge for investors, but in particular for the more growth-style, tech-focused thematic portfolios. By nature, thematic portfolios also carry a higher risk than do broader strategies and can therefore be more volatile in times of market stress.

Price performance has been difficult. On average, the 28 STOXX thematic indices lost almost 10 percentage points more than the benchmark STOXX Global 1800 in 2022, after outperforming in five of the previous six years.

But volatility can work both ways, which means that many of the themes have the potential to outperform the market in the eventual recovery. Also, the adjusted equal weighting of constituents in many ETFs ensures that the thematic portfolios are often more diversified than corresponding sector or market indices.

Moreover, the market turmoil of 2022 did not fully dent investor interest. Through November, passive ETFs that invest in themes received net inflows of $13.9 billion in 2022.

Importantly, the segment continued to break new ground with innovative solutions that respond to investors’ specific needs. On June 20, Eurex, a leading global derivatives exchange, listed its first futures on thematic strategies, which track the STOXX Global Breakthrough Healthcare, STOXX Global Digitalisation and STOXX Global Digital Security indices. A total of 160 passive thematic ETFs were launched between January and the end of November 2022, just under a quarter of all funds introduced over the period, according to Qontigo data.

Meanwhile, the availability of ever more sophisticated data sources will continue to generate new possibilities in thematics, regardless of the market backdrop. The index category has shown some of the most ingenious combinations of data inputs, selection methodologies and sustainability criteria.

No longer cutting it

The past year’s market volatility has nonetheless offered a chance to reappraise the benefits of thematic investment. Specifically, it is important to remember that a thematic approach is for the long term. Moreover, investing along themes appears to be more fitting for our era of technological advances and macro shocks than is implementing the traditional sector-focused approach.

A sector-based allocation no longer cuts it in the current environment, as we wrote in a white paper published in March. What we need is something that is more targeted and that really captures trends.

A different investment profile

Thematic investing is daring — it relies on a prediction of future growth as opposed to past reports. It provides diversification and extends its duration and time horizon by investing in trends that outpace the annual, or even quarterly, earnings calendar that dominates equity markets.

Multi-year (or -decade) trends such as urbanization in developing nations or the automation of factories will not falter due to temporary market snags.

In the short term, economic swings are likely to hurt investors’ risk appetite. But 2023 may present a different market background to this year’s, with global inflation possibly surmounting its peak and central bankers lifting their feet off the monetary breaks. This should have a supportive effect on risk appetite.

If markets then regain some stability and share prices start reflecting fundamental drivers once more, thematic indices should recover their standing. 2022’s testing times would have therefore presented a great opportunity to reappraise the advantages, and value, of the investment strategy.

Christoph Schon is a Senior Principal at Qontigo’s Applied Research