Interview

“There’s almost no important medical technology that’s not completely Israeli or has a big Israeli component”

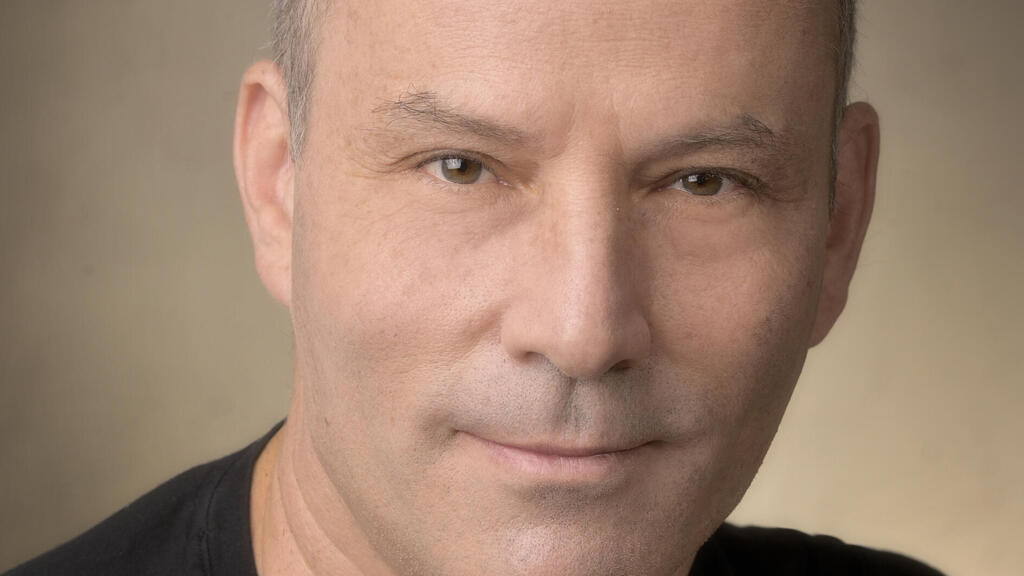

In an in-depth exclusive interview, Eyal Lifschitz, co-founder & managing general partner of Peregrine Ventures, Israel's first dedicated healthcare VC fund, gets to the heart of Israeli medtech and where it’s headed

Eyal Lifschitz is a business founder and entrepreneur with years of experience establishing and managing medical technology companies and their business development efforts, but when it comes to the role he has held for the past 20+ years, co-founder and managing general partner of Peregrine Ventures, Israel's first dedicated healthcare VC fund, he is rather matter of fact.

“Back in April 2001, when my brother Boaz and I founded Peregrine,” he says, “we were Israel’s first dedicated life science VC fund. We have been doing that ever since.”

How does Peregrine operate?

“The way that we work is that we are in constant contact with the big strategic companies, major players including Medtronic, Boston Scientific, Bristol-Myers Squibb, Johnson & Johnson, etc. Each of them have a few portfolio companies of ours which they follow and we meet with them 4-6 times a year and update them on what is going on with those companies. Before clinical trials we share with them the protocol, then we come to them with the results. These meetings eventually lead to the decision to buy some of our portfolio companies. Some of the biggest exits in our industry in Israel were done that way.

“The second element of those meetings is that we discuss with the strategic companies what technologies they are looking for in 3-5 years from now and we invest accordingly. So when a startup company has been in touch with these big strategic companies, through us, for all this time, the chances that it will NOT get acquired is rather low. This also explains the success rate that we have and why experienced entrepreneurs and other funds like to have us sitting around their table because when it comes to an M&A, and most exits in the life science field are via M&A and less via public stock markets, we can provide the experience and knowledge to help the portfolio companies get acquired. It’s all about building trust and ensuring that the portfolio company continues to be in the focus of the strategic company during those long years of R&D. Our portfolio companies all understand that we are here for them for the long haul.”

Investing in the life sciences is so vast, what areas of the medical field do you focus on?

“I would divide it into three categories: pharma, medical devices, and digital health. In pharma it’s mainly oncology and autoimmune diseases, very new things - new targets, new ways to treat cancer, new ways to make the body able to recognize cancer. Cancer is very smart, it has hundreds of different ways to hide and when we unlock it our own immune system is able to recognize the cancer and heal the body. This is where the new biological drugs are going, and that’s really what’s of interest to us. We are talking about completely new developments in cancer treatments.

“On the medical devices side, we focus on therapeutic single product use devices. The important distinction here is on the word 'therapeutic'. It’s less about a diagnostic or a CT or an MRI. We are dealing with either an implant or a catheter-based procedure. In the past these procedures used to be done with a 10 or 15 cm cut, opening the chest for heart surgery or the knee for knee surgery, or the head for head surgery. But now these procedures can be done by only opening it 2 or 5 mm. It’s the same procedure, but it reduces the chance of infection, reduces the hospital stay (sometimes from 8-12 days to merely overnight) and a much quicker patient recovery period.

“The third area of companies we invest in, when we talk about digital health, is when medical software actually becomes a medical grade tool. It’s not just an app that monitors if you feel good or if you ate enough calories today. I am talking about something that is FDA approved and gets reimbursed. For example, a technology that can be actually used as a sensor that is approved by the FDA to know if a heart failure patient gets a lung infection and needs to be hospitalized.

“These are the three areas of investment we pursue, based of course on the input we get from the major strategic companies I mentioned previously. The companies we invest in can be in Israel, but also in other countries. We invest in the best technologies providing the best opportunities within those categories.”

How many portfolio companies do you currently have and how much do you invest in them?

“At the moment we have over 40 active portfolio companies in all of those spaces. We have a very late stage fund, for companies that we have been working with for many years, in which we invest per round between $10-30 million. However, if it’s an early stage or a mid-stage opportunity, we can invest from a few hundreds of thousands of dollars to $12 million per company in total.”

Can you share an example of your successes?

“A very good example is an Israeli startup named Valtech Cardio which specializes in transcatheter repair or replacement of the heart’s mitral and tricuspid valves. The company started in our incubator, which is a partnership that includes global pharmaceutical giant Bristol-Myers Squibb (BMS), medical devices and diagnostics company BD (Becton Dickinson and Company), Elbit Systems, and institutions such as Tel Aviv University, Ben-Gurion University of the Negev, and Shaare Zedek Medical Center.

“As we worked with them we came to realize that the reason initially the valves they developed were not selling well, only a few thousands were sold, was not because they were not needed. In the U.S. alone, between 6-7 million people have heart failure and require heart valve repair or replacement, however in most of those cases, it was deemed too risky to open up and operate on the patients up to perform the procedure, because they were at such high-risk. But if an alternate way to access the area, via a transfemoral (through the leg) approach, avoiding the need for invasive open heart surgery, or through the shoulder, could be used to perform the heart valve repair or replacement, without opening the chest, that would have a great impact - and it did. We helped grow the company and eventually we were able to sell - only the repair part of Valtech technology - to Edwards for over $700 million. And the other part of Valtech, the valve replacement program, for which we started a new company called CardioValve, we sold this year to Venus Medtech, a Chinese structural heart disease treatment company, in a $380 million transaction. All this came from one Israeli medical startup.”

How involved is Peregrine with its portfolio companies?

“We are mostly involved at the very beginning of the process, if we invested early, with business development and such. We are also very active towards the end of the process, in selling the company, which tends to be the last two years of the process. One of our main roles is to help our portfolio companies stand on their own two feet. In order to do that, we also want to ensure that they recruit a very good management team, from Israel and abroad, because we don’t manage the portfolio companies. We will always be there to support them, but they must manage themselves.”

What about diversity in the field of medical tech?

“Diversity is very important to us. In fact, I don’t think that there is any area in which you will see more women as founders, CEOs, and CTOs than in the pharma space, and I see it within our portfolio companies. In biotech women are extremely dominant across the industry. But the bottom line is that we look for the best companies to invest in regardless of gender, race, religion, and location. We care about quality.”

So where is the medtech industry headed?

“What we saw, and it started at the beginning of the pandemic, was that the share price, the market cap, of the big medical players compared to other types of companies, went up strongly and across the board and across the industries. This included manufacturers, medical equipment producers and suppliers, you name it. Their share prices all rose while those in other industries crashed. This is because in the U.S., Israel, Europe, and around the western world for decades medical infrastructure was severely neglected. There simply were not enough hospitals, beds for patients, medical equipment, and medical staff. But now with the rise of the pandemic, governments around the world have been forced to, and will have to continue to, invest more in medical infrastructures. This is very good news for the Boston Scientifics and other medical device companies of the world. But, in order for those medical device companies to continue to grow they cannot simply rely on their internal R&D divisions. They must acquire more new technology. This is where Israel comes into the picture. They buy more technology in Israel than they buy in Boston or Silicon Valley. If you look at the last 30 years, there is almost no important technology - CTs, MRIs, stents, robotics, etc. - which came to the market that is not completely Israeli or has a very big Israeli component in it. The pandemic pushed it all forward.

“As for the next decade, it will only get stronger. Up till now you had amazing medical technology, but it was all kept in the hospitals. But people are realizing that hospitals are dangerous and full of infections and they want to stay away. There will be pressure to perform, as much as possible, medical procedures outside of hospitals in external medical clinics. However, in order to achieve this the procedures must be less invasive, cause less infections, cost less, etc. which is exactly what innovative medtech technology does.

“The next step will be not sending patients to external medical clinics, but having them stay at home. This involves monitoring the patients at home and performing medical tests at home. This is only possible through technology. It will be easier, quicker, and ultimately safer. And this is why those big players I mentioned earlier will continue acquiring medtech companies more and more.”

Finally, why did you name your company Peregrine Ventures?

“The peregrine is a falcon, a bird of prey. It’s something I have always been interested in. It is not very big. It is best known for its diving speed during flight - which can reach more than 300 km (186 miles) per hour - making it not only the world's fastest bird, but also the world's fastest animal. The peregrine falcons are thought to enjoy binocular vision, eight times better than our own. The peregrine falcon knows how to fly high and search for exactly what it is looking for and they never miss when they swoop down on their target. So, as far as Peregrine Ventures goes, we try to emulate the vision, focus, and pinpoint precision of the peregrine falcon when we make our decisions."