State of the unicorns 2024: The fall of the Zombiecorns

A number of unicorns crashed after the euphoria of the tech bubble of 2020-2021 and became worthless zombies. These companies were mired in criminal entanglements, and relied on misrepresentation of data and charm to cover up a lack of real business activity

During the peak of the tech bubble in 2020-2021, a billion-dollar company wasn’t considered especially significant. Companies with unproven technology and minimal sales of only millions of dollars easily obtained a billion-dollar valuation. There was a widespread sense of euphoria and confidence that another $100 million could be raised at any moment. But then came 2022, and the fall was painful. Interest rates began to rise, investors quickly took a step back, and large corporations realized that a downturn was looming, halting acquisitions, leading to a snowball effect.

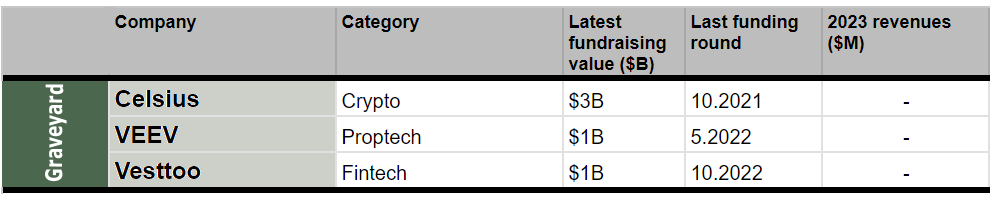

Concerns that had once been swept under the rug re-surfaced. The industry learned that it was not immune to criminal behavior and severe upheavals. When it comes to unicorns that raised hundreds of millions, or even billions, of dollars, the fall is much more painful, impacting employees, investors, and public trust. Notable cases included the crash of crypto company Celsius, led by Alex Mashinsky, in 2022, and insurtech company Vesttoo in 2023. Both faced asset freezes, and some founders have been accused of criminal activity. These extreme cases highlight that the tech industry is not immune to deception and fraud, just like any other industry.

The two companies both reached billion-dollar valuations, considered so attractive that they managed to attract top investors. When Vesttoo reached a billion dollar valuation, many investors in the fintech industry regretted not having invested in it. Shortly after, when the company crashed, they were quick to rejoice at the misfortune of the investors. Poor due diligence is another characteristic of the bubble era of 2020-2021 when many rushed to invest in companies where the due diligence process relied on checks conducted by other investors.

3 View gallery

Unicorn founders, Iddo Gino, Yaniv Bertele, Alon Lifshitz, and Alex Mashinsky.

(Credit: Benjamin Girette/Bloomberg, Damian Marhefka)

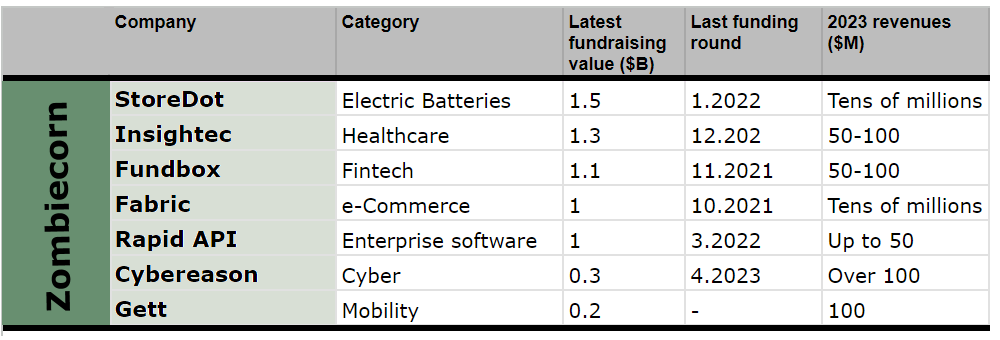

Another example is Gett Taxi, which pioneered ride-hailing apps, reaching a valuation of over a billion dollars. Dave Weiser, who led the company with co-founder Roi More, paved the way for the entire industry, but over the years they failed to dominate the market, leaving it to Uber, Lyft, and others. Today, the company is estimated to be worth no more than $200 million, with most of its business activity in Israel.

Failures like these are characterized by a charismatic entrepreneur with great charm, leading many investors to follow even if the business model is unclear, and the technology is not fully developed or proven. This was the case with RapidAPI, led by wonder kid Iddo Gino, who founded the company at 17. He managed to raise $275 million from prominent investors including Qumra Capital, Citi, Viola, Microsoft's M12, Dov Moran's Grove Ventures, and Andreessen Horowitz. A year after the company declared it had reached unicorn status, the management led by Gino was dismissed and most of the company's employees were fired after it was revealed that it had no real business activity, and its technology was not mature.

Gino is not the only one who charmed investors - Vesttoo CEO Yaniv Bertele and Gett’s Dave Weiser also succeeded in persuading major funds and investors.

Another case of a unicorn's downfall is Veev, founded in the U.S. by entrepreneurs Amit Haller and Ami Avrahami. Despite their lack of experience in real estate, they decided to change the way houses are built in the U.S. In 2022, the company reported to have raised a whopping $400 million, which a year later was revealed to have in fact been only $200 million. Unable to secure further funding, the company had to enter liquidation, and its major investor, Lennar, took over for an estimated $100 million at the most. Veev's case serves as a reminder that previous success in the tech industry does not guarantee future success, and that the rules of tech do not necessarily apply to other sectors.