State of the unicorns 2024: Who's ready for an IPO?

Following the upheaval in high-tech, entrepreneurs are going to be forced to issue decacorns at a value lower than their last funding round. Besides the blow to the ego, the move hurts the employees' options. The market is currently flooded with unicorns and the competition for investors is intense

“The concrete has dried and you can start stepping on the floor," is how Aaron Mankovski, a partner in the Pitango venture capital fund and one of the oldest players in the sector, describes the current situation in the high-tech industry. Mankovski is pointing to the great upheaval that the industry went through in 2022 and 2023 and that it is now possible to start making more strategic plans, beyond cutbacks and layoffs.

"The word unicorn no longer expresses anything and has no meaning. It was very much related to certain market conditions at the time, but what is important today is revenue, growth and a horizon of profitability. Only those who have the real DNA of a successful company that can grow over time will also be able to reach an IPO."

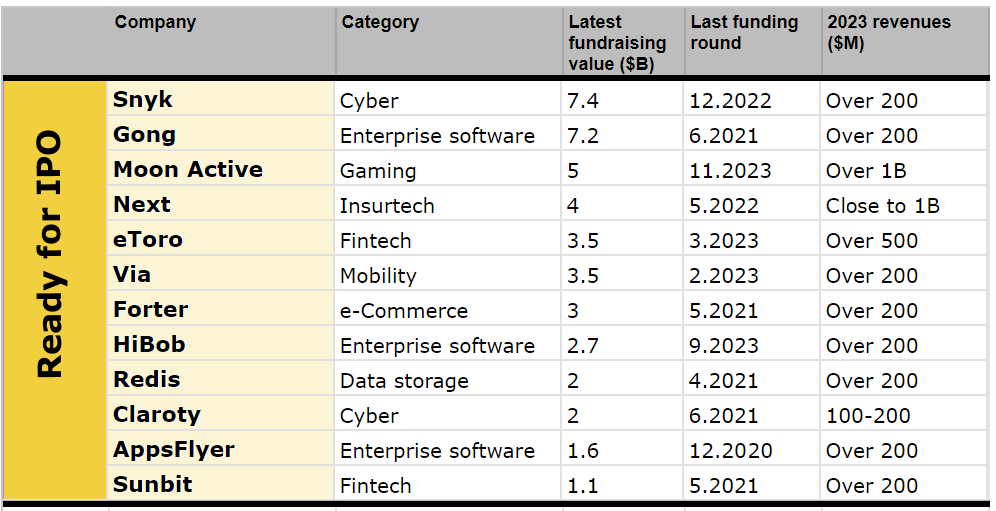

So who are the companies that could go public in 2024? In order to complete an IPO in the near future - and it is being forecast that the IPO window could open soon - it is no longer enough to have a nice presentation with graphs showing exponential growth. This time, investors are saying "show me the money" and send home the ponies pretending to be unicorns. The consensus today is that the minimum revenue threshold for an IPO is $200 million per year, but it is desirable that it be closer to $500 million, combined with a growth rate of at least 20% and being close to profitability.

"A legitimate public company today has revenues of at least half a billion dollars and the Americans expect even a billion dollars. All the companies left from the previous wave of 2021 with a value of $20-50 million have no place in the public market," says Ilan Paz, Barclays Israel CEO. "2024 begins on a much more optimistic note. In the U.S. the expectation is for a return to the average number of IPOs seen in recent years."

In fact, the IPO window was already supposed to open after 2023 ended with a jump in the leading indices on Wall Street. The Nasdaq stood out, jumping 44%, the sharpest increase since 1999. Except that for some reason the lights are not on day and night in the accountants' offices, and the lawyers and the U.S. Securities and Exchange Commission are not flooded with prospectuses.

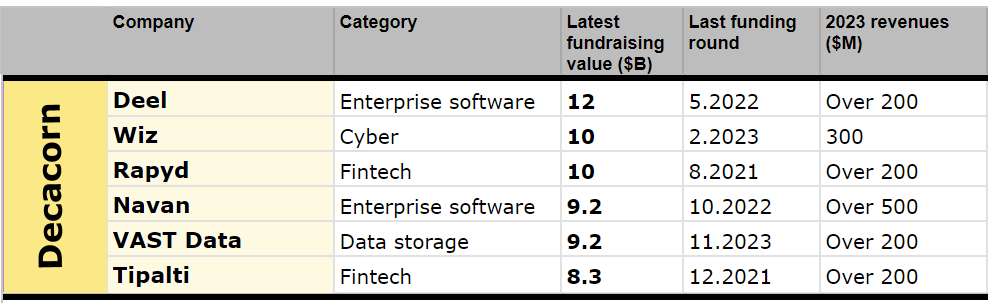

The reason for this is that the 2020-2023 vintage arrives trapped within its historical value trap. The levels of multipliers in the unicorn industry have changed and returned to 2019, meaning between 5 and 12 at most on revenues. This means that a company with a revenue rate of $300 million will not receive a value of more than $2-3 billion, which leaves most of Israel's decacorns as well as the most mature companies such as Tipalti, Rapyd or Snyk far from the value at which they raised in their last rounds.

In the U.S., this has already happened to companies that are considered to be the top of the top, such as Instacart or Klaviyo, which went public at the end of 2023 at a value that was lower than their last private round and since they went public have seen their shares fall even more. For example, Instacart was issued for $10 billion compared to a value of $39 billion in the last round and today it is trading at a market cap of $6.5 billion. Klaviyo, which is closer to the value levels of Israeli companies, was issued at $9.2 billion, slightly less than the last round, and has since fallen to $7 billion.

Among the Israeli companies, Next Insurance, one of the mature companies in Israel, which already generates revenues of more than $800 million a year, can be seen as a prominent example. Last November, it completed a large private capital raising of $265 million, but the value remained the same as in the previous round: $4 billion. Respectable, but far from the multiples of 2021.

Beyond the symbolism of admitting the decline in value, an IPO at a lower value than in the last fundraising round means employees have a smaller change of making a big profit from their options.

Moreover, the competition for the attention of investors on Wall Street will be higher than ever. A recent analysis by the investment bank Goldman Sachs shows that given the number of 600 suitable unicorns in the software field and given an average exit rate of about 25 IPOs and about 30 M&A transactions per year, it will take 12 years to "empty" the existing stable, even before new ones join it. "The first IPOs we will see this year will be of companies with revenues of more than a billion and they will be issued according to the value of $7-8 billion. There will be no Israeli companies among them. The turn of the Israeli companies will only come towards 2025," says Mankovski.

The most mature of the Israeli companies that, according to estimates, has already submitted a draft prospectus to the SEC is Navan (formerly TripActions). It is growing rapidly, with an annual revenue rate exceeding half a billion dollars. However, based on previous reports, it is aspiring to issue at a value of $12 billion, and this remains challenging in the market conditions of 2024. Apparently, the best option, reserved for growing companies approaching profitability or even already generating cash, is to wait another year or even two.

"I still believe that Gong can reach a value of $100 billion, as I mentioned in 2021; none of the basic assumptions has changed. The question today is only how long it will take," said Amit Ben-Dov, founder and CEO of Gong, which conducted its last funding round in 2021 at a value of $7.2 billion. Currently, it is still far from the half-billion-dollar revenue mark, but it has funds for more than two years, according to Ben Dov, so there's no rush: "The IPO is something we will think about in the future, but only when the market fully recovers."