BiblioTech

CTech’s Book Review: The impact revolution and how we can change the world together.

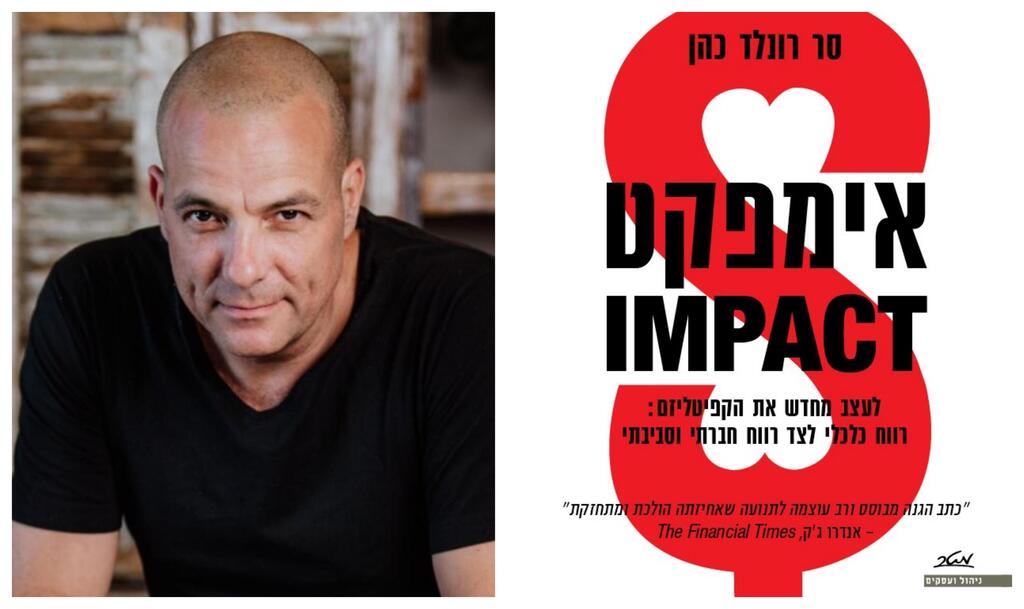

Yoel Cheshin, Founder of 2B and Co-Founder of Israel Round Table, shares insights from reading "Impact: Reshaping Capitalism to Drive Real Change" by Sir Ronald Cohen.

Yoel Cheshin is the Founder of 2B, a family-owned venture capital committed to Impact investing, and Co-Founder of Israel Round Table, an association of leading CEO’s working together on creating a social, economic, and environmental impact locally. He has joined CTech to share a review of "Impact: Reshaping Capitalism to Drive Real Change" by Sir Ronald Cohen. This is a new Hebrew translation of a book that was published in English.

Title: "Impact: Reshaping Capitalism to Drive Real Change"

Author: Sir Ronald Cohen

Format: Book

Where: Home

Summary:

Sir Ronald Cohen is the Eliezer Ben Yehuda of Investment, and like Eliezer Ben Yehuda in Yaron London’s song “Eliezer, when will you lie down to sleep?”, Cohen is working tirelessly on changing the current investment paradigm, dedicating the better part of the last 20 years to bringing Impact Investing to the forefront of investment, entrepreneurship, and business and calling for the Impact Revolution.

There is no doubt that a significant revolution is taking place. Much like Jean-Jacques Rousseau in “The Social Contract” that Cohen refers to, he reveals the many and diverse possibilities in which social and environmental rights can be protected through embracing the Impact Revolution through investment, business, governments (through legislation), and philanthropy.

He calls out greenwashing corporations (Adidas) and praises authentic impact endeavors (Ikea) and courageously does not ignore the difference between the two. As a true revolutionary, we can sense the spirit of Rousseau in his calling to embrace the new economic paradigm, as well as Ben Yehuda’s spirit in the practical implementing of it in his own endeavors over the past two decades.

Businesses, not governments or NGO’s, are to lead the revolution, taking on the responsibility of making this world a better place. Through Impact Investing, various creative models - Environmental, Social, and corporate Governance (ESG), Social Impact Bonds and other open-minded ideas - he calls everyone to join the revolution to eradicate the unbearable gaps in social, economic, and environmental issues our planet and species face.

Governments need to assist and support through regulation and other means. Philanthropy needs to adopt a more proactive, impact driven approach and consumers need to play their part in consciously selecting businesses and products that are in line with doing good socially or environmentally, thus starving businesses that have a negative impact on society or the environment, forcing them out of existence, or to adapt and embrace impact.

Important Themes:

Important themes to follow throughout the book are:

- The Impact Revolution – calling the investment and business communities globally to join the revolution that has begun (Cohen being a major contributor) and to create the change we desperately need to thrive, because the pursuit of profits has brought us to economic, social and environmental disaster.

- The Triple Helix: Risk-Return-Impact – a driving force of the new economy (revolution) where impact is measured as well as return and risk. A corporation’s success should no longer only be based on return, but also, in the same way that risk measurement is now factored into business, impact should be too and there are more and more tools for doing so today. Impact should be profitable first and foremost, not only benevolent.

- Philanthropy and Impact need to be intertwined. We can’t keep on throwing money at the problems we’re facing socially or environmentally. Philanthropy plays an important role in doing good, but the model needs to be changed and impact must be a measure considered in philanthropic initiatives.

- Measuring Impact is a must and tools are being created to do so, to quantify positive impact as well as negative impact that will hopefully become the gold standard for measuring success or factoring it into a company’s results in a way that risk and profit are reported.

What I’ve Learnt:

The book gives Cohen’s unique perspective from two decades of experience of taking impact investment from an idea to mainstream investment practices. This was fascinating to follow, both as an investor and a thought leader.

I received another body of knowledge, similar to the concepts of Conscious Capitalism (Mackey & Sisodia) and The Doing Good Model (Shari Arison) as well as others, referring to the idea of changing the way we do business for the greater good and the need to revolutionize corporations to include Impact in their DNA.

I learnt new perspectives on the importance of measuring impact. Measuring is the x ray companies need to embrace so that we can know we’re heading for a brighter future for ourselves and our children as well as the planet. In the same way we measure risk, which is now common practice in business, we need to apply tools to measure positive and negative impact and have them embraced and practiced globally.

I feel inspired by a truly genuine leader, who walks his talk and is leading the way to what will hopefully become a globally recognized economy, The Impact Economy, as he describes in the book. The challenge being to dismiss the practice of maximizing profits as the only criteria success is based on.

Critique:

The book doesn’t acknowledge the fact that impact is not a new concept, it is rather a remembrance or a return to what business’ true purpose has always been: benefiting people or communities and the planet by solving problems or fulfilling a need. In this respect Cohen is reviving a concept, and not creating one. Thus, he is more an Eliezer Ben Yehuda than a Jean-Jacques Rousseau.

Cohen doesn’t discuss in true depth how maximizing profits has brought us to the catastrophic situation we’re in now and how devastating it will be if we don’t change our ways. With devastating climate changes due to global warming, economic inequality that is growing deeper, hunger and food insecurity, the extinction of so many species, child labor and trafficking, monetizing on addictive products like cigarettes, cellphones, social media and much more. It’s important to know how we got here, so we know how to move forward.

The book doesn’t drive the message home that maximizing profit is the result of the impact one creates and not something done alongside profits as Cohen suggests. Profits are a means to an end, not an end in itself. I know it’s hard for us to understand this after being brainwashed for so many decades, but this is a fact. In a perfect world, profit will be a direct reflection of impact and the means to achieving it with the tools to measure it.

Who Should Read This Book:

First and foremost, investors, to absorb the spirit of Impact Investing, the way Cohen and myself are. Secondly, entrepreneurs so that impact is embedded into their DNA. Next should be philanthropists and regulators and finally, consumers who have the most power to effect change with their spending power.

No matter who you are, if you want to be a part of the change in making life better for everyone and our planet, you need to read this book and apply Impact into your life, whether you are a consumer, a business owner, an investor, a philanthropist or in government. The revolution is inevitable, the only question that remains is whether you are part of the problem or part of the solution.