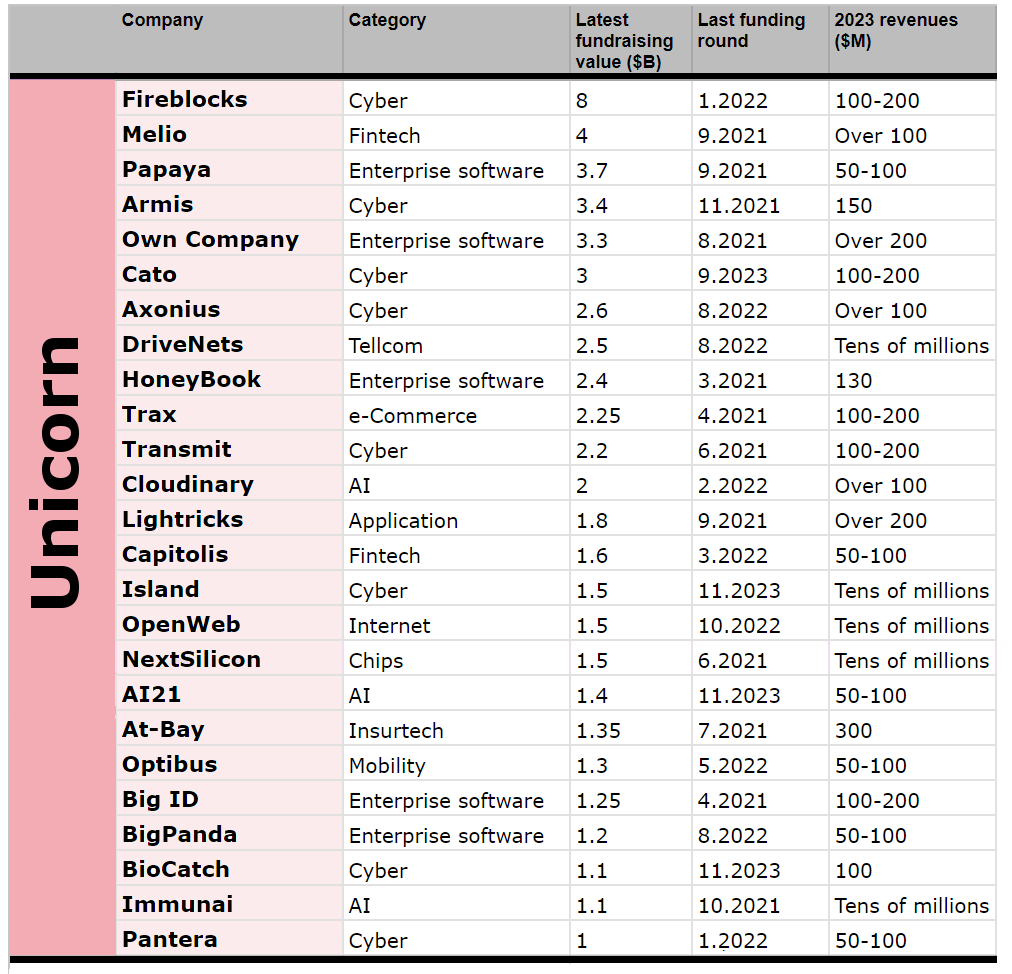

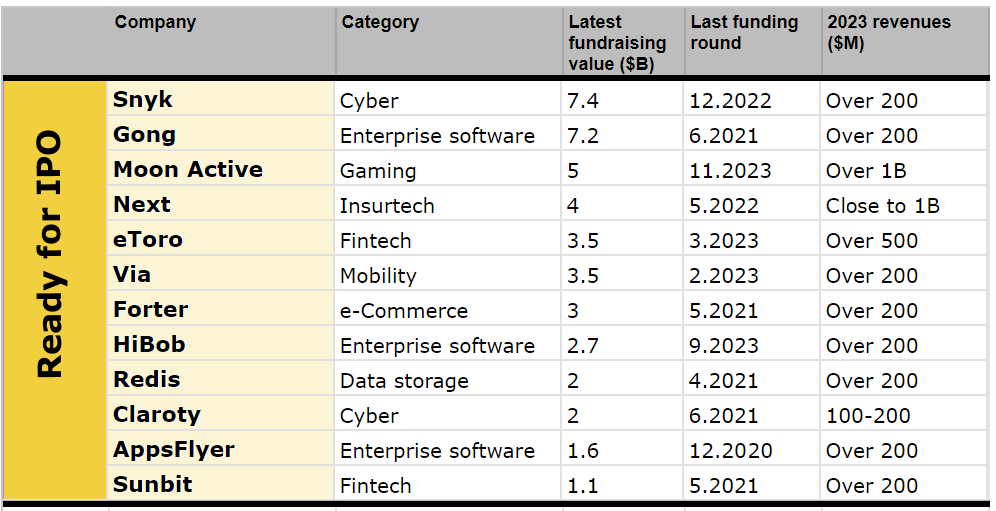

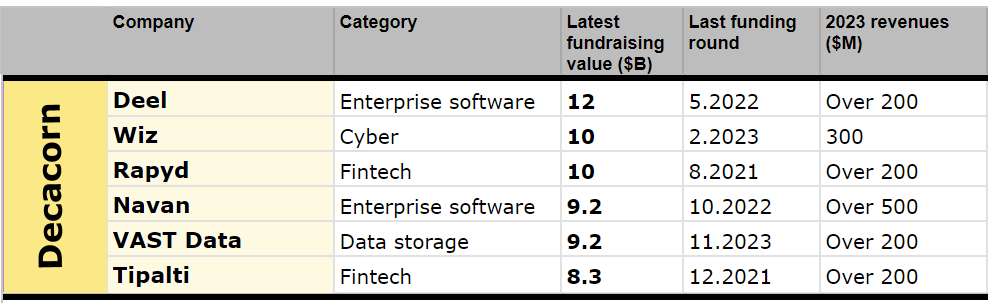

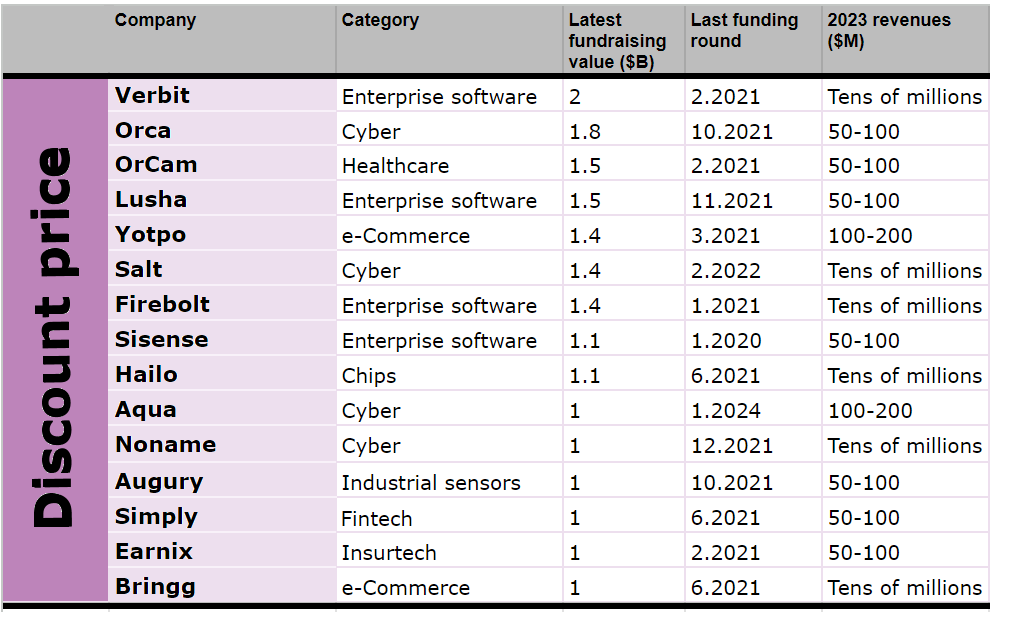

State of the unicorns 2024: The full and updated list

Many Israeli unicorns, startups valued at a billion dollars or more, did not survive the flock of black swans that hit the local tech ecosystem over the past couple of years. However, those that managed to remain afloat, are entering 2024 in a much stronger position, ready to capitalize on the difficult lessons they have learned

Israel’s herd of unicorns finds themselves at a crossroads at the start of 2024. Everything that private high-tech companies worth a billion dollars and more managed to avoid in 2022-2023 will come back to haunt them this year. How much are they really worth? Which of them is still a unicorn and which of them has lost their status, and what's more - which of them never actually held the title in the real world of the post-bubble? The money raised in 2021, even if it was managed responsibly, is likely to run out towards the end of 2024.

Many of the Israeli unicorns avoided fundraisings in the last two years in order not to admit the decrease in their real value. Managements invested efforts mainly on the operational side, trying to reduce expenses without harming growth too much. For some, it worked, for others less so. Now the better companies will be able to raise follow-on rounds with a value similar to or slightly lower than the previous round, and the not-so-good ones will probably say goodbye to the dream and choose the route of selling to a private investment fund or a larger company.

These are of course two decent alternatives, but for many companies, a sale is also out of reach. A deal of the type closed in 2023 by the cyber company Perimeter 81, which was sold to Check Point for about $500 million, half of its value in its previous round, is the kind of dream deal that many would like to repeat this year and will not be able to. Long-term statistics, both in Israel and in the world, show that the vast majority of mergers and acquisitions are made at a value of less than half a billion dollars. Transactions of billions are extremely rare, as the list of potential buyers is limited.

This is one of the biggest barriers and challenges facing the Israeli unicorn herd: their high value. It is an unrealistic anchor not only for the smaller companies but also for the top segment of the Israeli list: the Decacorns. This club, which can be called the "top decile" of Israeli startups, is also stuck in its own trap. Even when the IPO market opens, these companies, even though they are bigger and growing and more mature, will probably not be able to issue at a higher value than their last round.

There were plenty of reasons to celebrate the $50 billion that flowed into Israeli tech in just a few years, but not all of the startups were up to the task because, in the end, the real measure of a company is not its value but its revenue. The value should be a reflection of actual performance and future expectations. In 2021, value was largely determined according to expectations, which was reflected in imaginary revenue multipliers. Today the pendulum returned towards the middle and the multipliers are more sane, between six and 12 on income.

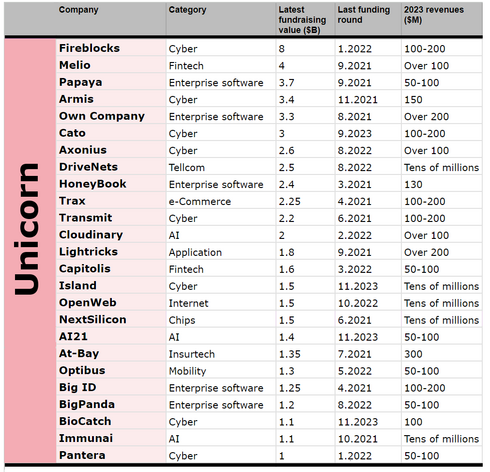

The main meaning of this is that to be a unicorn today, it is not enough to show revenues of several tens of millions of dollars or even $100 million a year.

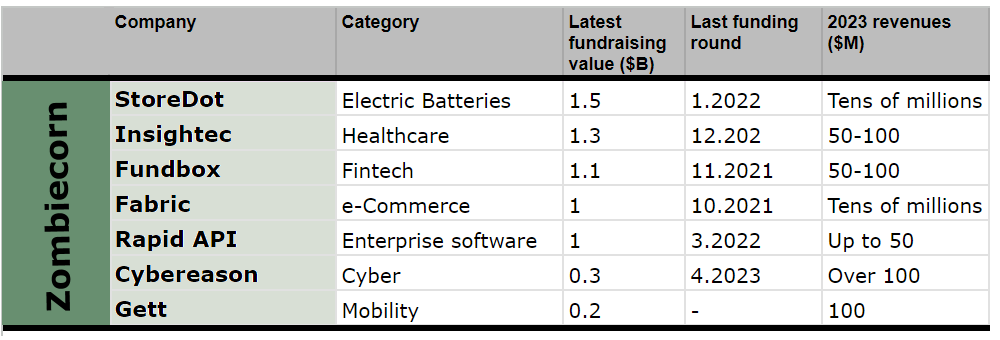

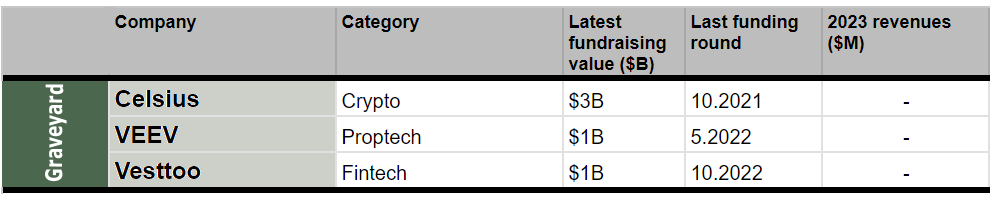

To identify who still meets the definition, who has already progressed and is ready for an IPO, who must look for a buyer, and who is already a complete zombie, we collected the real figures behind the companies. We examined the financial performance of the companies, their growth rate, the rate of cash burn, changes in their workforce, changes in the business models, and of course, also how close they are to profitability or positive cash flow.

After this thorough examination, it became clear that many of the unicorns had lost their title in the last two years: some of them were not deserving of it in the first place, and some were even frauds in the simplest sense of the word. Nevertheless, a considerable and even surprisingly large number are still real unicorns. These are companies that have streamlined where necessary and at the same time managed to grow at an impressive double-digit rate in the last two years and reach sales volumes of $200 million or more.

The current high-tech crisis, which may end this year at least in the U.S., was different from its predecessors. On the one hand, it was longer and lasted two years, but on the other hand, it was less violent. Despite the apocalyptic fears and predictions, in the long quarters of the crisis, there were no mass layoffs and deep unemployment similar to the crisis of 2000. On the other hand, this time, beyond the general global crisis that came with a series of rapid interest rate increases that shocked the generation that grew up in a world of zero interest, Israel has incomparably more complex internal challenges.

2024 will be a year of difficult decisions. But it also has the potential to be a good year for Israeli high-tech, of course, given that the security situation and the war do not escalate to the northern front and the reservists return to the offices. The high-tech companies enter 2024 more mature and experienced, because of what their management went through, from the interest rate increases and the suspension of funding, to the judicial coup, the protests, and now the war.

Those who survived the last two years learned a great deal about proper management and also saw the other and less pleasant side of investors and customers. From here, the only way is up.

How did we analyze the companies?

In recent weeks, we have had conversations with high-tech managers and investors to understand the real situation of the companies that became unicorns over recent years, that is, those that raised at a value of one billion dollars or more. The parameters examined were: annual revenues in 2023, the rate of growth, the number of employees today compared to the past, amount of funding, and runway, i.e. how long the remaining cash in the company's coffers will last.