Closure of Azrieli.com may herald fall of other Israeli e-commerce sites

A loss of NIS 313 million ($85.7 million) has caused the Azrieli Group to close Azrieli.com. Due to a lack of experience in logistics and a conflict of interest with retailers, the real estate group's online site had no real chance of survival

The loss of approximately NIS 313 million ($85.7 million) over the last six years has led the Azrieli Group to close its online platform, Azrieli.com. Most of the site’s 70 employees will be laid off, with the site’s CEO Daniel Koren to remain along with a few other employees. The company says that all outstanding orders made on the site will be completed.

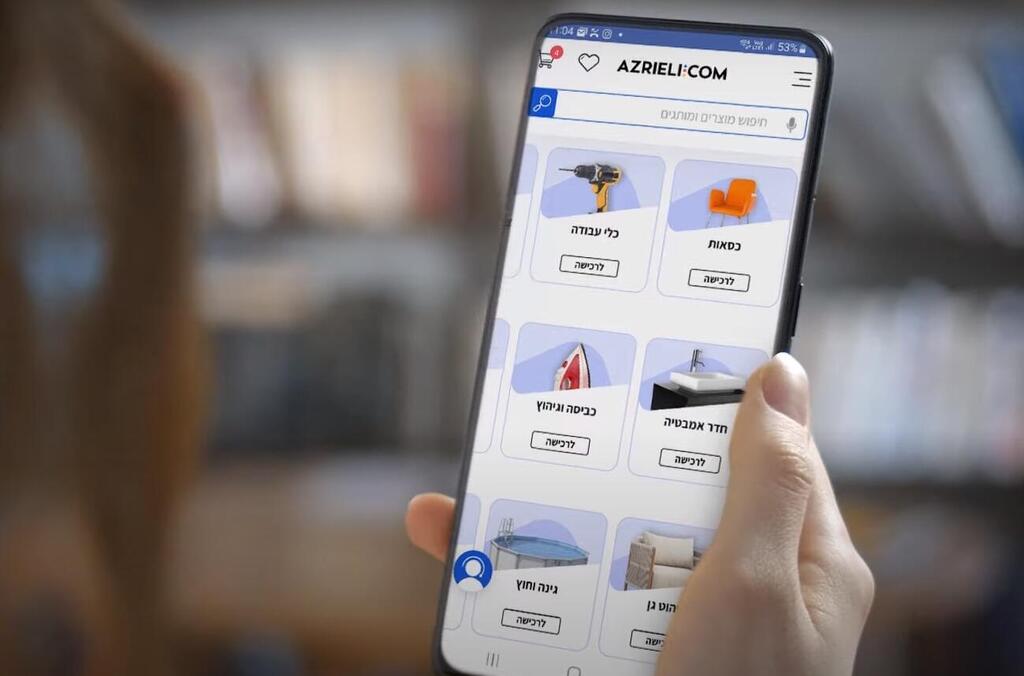

Azrieli entered the e-commerce market in 2016 with the acquisition of e-commerce platform buy2, founded by Aviv Refuah, for NIS 62 million ($16.9 million), which it then renamed Azrieli.com. At the time, the e-commerce sector was beginning to gain momentum in Israel, and Azrieli wanted to profit from the rising sector in addition to their profits from renting stores to tenants in shopping malls. The online activity of the group was Dana Azrieli's project, according to insiders. The site’s lack of success in recent years spurred efforts to revitalize it, but without success.

Azrieli.com incurred a loss of NIS 44 million ($12 million) in its first year, with rising losses each year except for 2020 when, due to the pandemic, the loss decreased slightly. A year later, the negative trend returned, and in 2022, they suffered a loss of NIS 60 million ($16.4 million). Although these losses are not substantial for the real estate company, which is valued at NIS 27 billion ($7.3 billion), the site was shut down when the group realized it could not make Azrieli.com profitable in the current model independently.

In its statement, Azrieli mentioned that competition from international e-commerce sites made it difficult to compete. The company also blamed the regulator for granting international sites an advantage for consumers through VAT exemption for purchases up to $75. “Over the years, Azrieli.com underwent a significant transformation, and changes were made to adapt the product offerings to the preferences of the Israeli consumer, and the entire technological infrastructure was rebuilt, but these efforts did not meet a large enough market to justify additional investments,” the company said.

However, the failure of Azrieli.com is somewhat more complex than stated. Azrieli lacked the fundamental pillars of e-commerce: retail, logistics, and trade. Firstly, not only is Azrieli not a retailer, but on the contrary, it has a conflict of interest with the retailers to whom it rents stores. Secondly, Azrieli isn’t a logistics company so it relies on the services of other logistics companies for distribution, which incurs additional costs. Thirdly, it lacks expertise in the trade sector, leading to purchase items from other importers, sometimes even from distributors who acquired the items from importers. This made Azrieli.com a third party in the product chain and forced it to sell at a non-competitive price or incur significant losses.

All of these challenges were compounded by aggressive resistance from major retail groups, including Castro, Fox, Renuar, Zara, and others, which flatly refused to sell their brands through Azrieli.com, considering it a competitor. Retailers were also unwilling to support the venture of the company who leased stores to them at what they felt was an unfair price.

The inherent challenge of a real estate company managing an e-commerce platform was demonstrated by competing websites. Five years ago, the Big Group decided to freeze its online venture a month before it was supposed to launch. After working on the project for two years and investing around NIS 15 million ($4 million), it was shelved after a bleak profit forecast.

Fox's Terminal X, launched in the summer of 2021, has not turned a profit yet and ended the first nine months of this year with a loss of NIS 1.8 million ($481,000). Last year, it incurred a loss of NIS 7.7 million ($2 million), and the year before it lost NIS 8.6 million ($2.3 million). Even the food retail giant, Shufersal, has downsized its online operations. About half of the employees for the online site were let go including the CEO, with operations integrated into other departments.

Additionally, The fashion website One Project, owned by the MGS group, is also experiencing cash flow problems. In fact, they have been trying to sell the site with no success. Industry insiders believe that the site is on the verge of closure due to a lack of bidders. In September, Calcalist revealed that the e-commerce site, Walla Shops, was bought by the HitechZone group. Walla Shops, previously owned by the Levant family, incurred losses of millions of shekels each year and was eventually bought for NIS 20 million ($5.4 million) by the Highbiz group, HitechZone’s operator.

The operational difficulties of running an e-commerce site characterize most industry actors. Small online trading sites have a turnover of NIS 50-100 million ($13.6-27 million) a year, and they lose money due to the cost of logistics, advertising on Google and Facebook, and in some cases, poor management. Those who manage to survive are trading sites that have physical stores compensating for the online losses. Many in the retail sector believe that the closure of Azrieli.com could lead to a series of closures of other e-commerce sites, as well as mergers and acquisitions. If retail giants like Shufersal and Azrieli are downsizing their online systems, it could serve as a signal for others who are struggling.