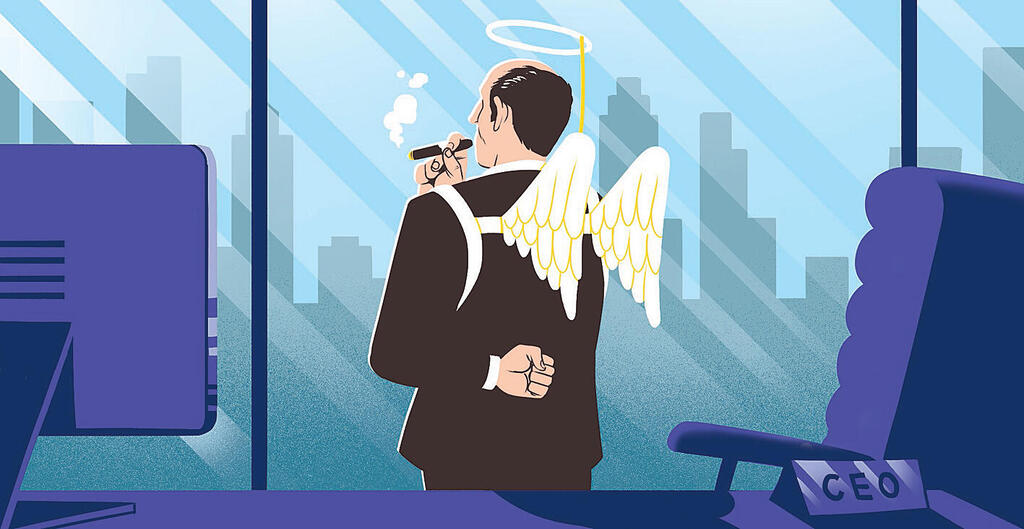

Can AI Public Benefit Corporations truly serve the public?

A “Public Benefit Corporation" is a nice branding idea, but the primary unanswered question remains: what benefit, and for whom?

If you thought for a moment that a recession, inflation, and the bursting of bubbles like crypto and web3 would bring about a renewed and healthy technological order, think again. Last week, an artificial intelligence company called Inflection AI raised a staggering $1.3 billion, valuing the company at $4 billion, only a year after its founding. How did they achieve such an impressive feat? The story encompasses all the necessary elements: a well-known founder who was a co-founder of DeepMind, Google's artificial intelligence division; the concept of generative artificial intelligence (a virtual assistant named Pi); a grandiose mission to care for the well-being of humanity; individual billionaire investors such as former Google CEO Eric Schmidt; and two star companies deeply engaged in the AI-of-everything race—Microsoft, the sole investor in OpenAI (the creator of ChatGPT), and Nvidia, the first trillion-dollar chip company.

This entire story is wrapped up in a unique structure: Inflection AI is not just a for-profit company, but also a Public Benefit Corporation (PBC), a niche form of association established a decade ago in Delaware, United States. The PBC aims to add a flavor of "public benefit" to the traditional structure of companies. Being part of this category adds an additional dimension of self-criticism. The company is required to publish a report to shareholders every two years, outlining its progress in fulfilling its goals for the "public benefit." Meeting these goals is part of the company's fiduciary duty to its shareholders, which in standard companies is narrow and financial in nature. The definition of "public benefit" is broad and non-binding, and in the case of Inflection AI, it encompasses the development of products to improve "human well-being and productivity... broadly for current and future generations."

According to a 2020 study conducted at the University of Berkeley, since the inception of the idea until 2020, just under 300 companies registered under this category. Almost all these companies are from the technology sector. This limited number is not coincidental. According to the same study, most venture capital investors who agreed to invest in these types of companies, which have additional goals beyond purely financial ones, did not consider this approach advantageous. From the investors' perspective, this structure was only "tolerable" but not desirable in any way. This perspective could also explain why investments in these companies were primarily made at the early stages, with significantly lower volumes and values compared to other companies in the industry.

1. "Limited" in generating huge profits

However, what held true for 2020 does not apply to 2023. Since the intense hype around generative artificial intelligence began, the idea of "public benefit" has become an effective branding tool, attributing potential future societal benefits and enhancing their power.

The most influential company in establishing these motives was OpenAI. Initially incorporated as a non-profit company in 2015, it transitioned into a for-profit company with an asterisk when it recognized the potential applications of its products and required significant investment from Microsoft in 2019. OpenAI established a wholly owned subsidiary that can generate "limited" profits for its shareholders, as its mission (according to them) remains focused on the public good. In this case, the limit was set at 100 times the initial investment. Microsoft, which invested over $10 billion, is "limited" in withdrawing a cumulative profit of "only" a trillion dollars. This means that Microsoft has no profit limit in the foreseeable future.

Following OpenAI, or more precisely, stemming from it, the second largest and highly talked-about star in the technology sector emerged—Anthropic. Founded less than two years ago by two brothers from OpenAI, Anthropic raised $1.5 billion in this short period. Their latest funding round in May included $450 million at a valuation of approximately $4.1 billion. Anthropic recruited from individual companies, not venture capital firms, including Google, Zoom, and Salesforce. Similar to Inflection AI, it is also incorporated as a PBC. By the end of 2022, Sama, an outsourcing company that hires contract workers in developing countries to sort and filter data for artificial intelligence models, joined the trend. Sama, founded in 2008, announced its transition to a PBC corporate structure. The list also includes smaller startups operating in the field of artificial intelligence, some of which changed their incorporation type this year or were initially established as PBCs.

2. A trend with a clear purpose

If it looks like a trend, behaves like a trend, and distributes festive announcements to the press to emphasize a transition to a niche corporate structure, then it is most likely a trend with a clear purpose. Although there are no significant differences between companies for the public benefit and for-profit companies, apart from the added "value" to the fiduciary duty, which is difficult to quantify, this category holds internal and external branding value. In recent months, almost all companies working in the field of artificial intelligence, especially the younger ones, emphasize the dimension of doing good or, alternatively, not doing harm in their activities. They highlight the potential benefits that this field could bring to society.

What was once considered "tolerable" by venture capital companies before ChatGPT is now a prestigious signal in the technology sector. Most companies in the field tend to overstate the importance of their work for the common good in the present and flood the discourse with grandiose future capabilities. Their missions are as ambitious as they are vague, encompassing ideas such as "increasing human well-being," "maintaining human supremacy over machines," or building "tools that will help humans flourish." Their self-perception is so elevated that some of them operate with the warning that the tools they develop may pose an "existential threat."

Despite the lack of scientific support for these far-reaching hypotheses, the branding strategy proves successful. The public's attention is diverted by the billionaires' fantasies about the end of the world and a potential singular moment, instead of focusing on how these companies' activities might harm well-being. We neglect to address the consequences for the environment resulting from the race to build larger and larger models, the indiscriminate harvesting of personal data without consent, and the exploitation of labor.

For instance, we fail to pay attention to the fact that in the same year Sama became a PBC, it was revealed that they employed hundreds of workers in Kenya for less than $2 per hour to sort disturbing and traumatizing content for OpenAI. The working conditions were appalling, leading to employee departures and documented mental crises until Sama announced a significant reduction in work with OpenAI. We don't address the outsourcing of this arduous human labor to OpenAI, a company that claims to build its products with only a handful of engineers, nor their active efforts to suppress regulations that would require consent for using internet users' personal data. Moreover, we fail to acknowledge that Anthropic's main financier is Sam Bankman-Fried, who invested half a billion dollars obtained through embezzlement from small clients. A “Public Benefit Corporation" is a nice branding idea, but the primary unanswered question remains: what benefit, and for whom?