Law Gateways

Erdinast, Ben Nathan, Toledano & Co.: Personal connection key to building long term relationships

The firm is one of the top Israeli law firms participating in CTech’s Most Important Gateways to Israeli Tech series

"We believe the personal connection between the entrepreneur and the partner is key for building long term relationships of trust, so we would say that it is the feeling that you have just met your trusted advisor," explained the tech experts of Israeli law firm Erdinast, Ben Nathan, Toledano & Co. With Hamburger Evron.

Erdinast, Ben Nathan, Toledano & Co. With Hamburger Evron is one of the top Israeli law firms participating in CTech’s Most Important Gateways to Israeli Tech series. The heads of the firm's tech department answered a series of questions asked by CTech about their involvement in the Israeli ecosystem and how they expect the current crisis to effect the tech market.

Name of firm: Erdinast, Ben Nathan, Toledano & Co. With Hamburger Evron

Tech sectors of expertise: Cyber, Automotive, Food Tech, Ag-Tech, Big Data, IOT, AI, Enterprise Software, Prop-Tech, Travel-Tech

Number of lawyers in the tech and VC departments: 40 partners and lawyers

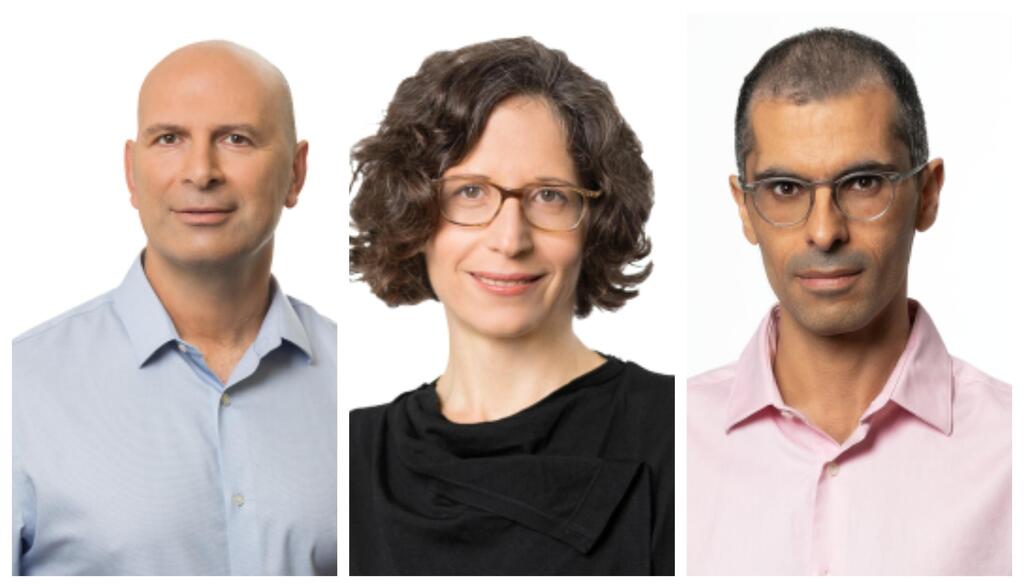

Heads of department: Roy Caner, Viva Gayer

Notable clients (startups, growth companies, VCs, angels): Among our notable clients we can mention: Vertex Ventures (both its Israeli and Singapore funds), Emerge, Magma Ventures, Hetz Ventures, Pitango, TLV Ventures, Viola, Amiti, Motorola Ventures, Hitachi Ventures, Tyson Foods' investment arm, S2G ventures, Horizons Ventures, 10D Ventures, IBI Tech, Trumpff Venture arm, Archer Daniels Midland' investment arm, Emerald Technology Ventures, Yariv Gilat, Debiopharm investment arm, Revaia, InCapital and many others.

Startups we represent include Guesty, Arbe, Bizaboo, DataGen, Fortellix, Anecdotes, DigitalOwl, BW Robotics, RecoLabs, Cymbio and many others. Global corporations include, Walmart, Motorola, Medtronic, and many others.

Notable deals in 2020-2022:

As part of our extended relationship with our clients, we can mention several deals during these past years:

- Representation of Guesty in its $50M financing by Apax (and 3 different acquisitions)

- Representation of Hitachi Ventures in a $75M financing of Weka.io and (together with vertex, Vertex Singapore and K-3) in the financing of Taranis

- Representation of Vertex, TLV and others in the $32M financing of ZenCity

- Representation of BW Robotics in its $35M financing from Insight Partners

- Representation of Guesty in its $50M financing by Apax (and 3 different acquisitions)

- Representation of Hitachi Ventures in a $75M financing of Weka.io and (together with vertex, Vertex Singapore and K-3) in the financing of Taranis

- Representation of Vertex, TLV and others in the $32M financing of ZenCity

- Representation of BW Robotics in its $35M financing from Insight Partners

- Representation of Red Dot in its $28M financing of Perception Point and in its investment in Supplant

- Representation of Altshuler in its $10M investment in Datos

- Representation of DataGen in its $60M financing led by Scale Ventures, with the participation of Viola, TLV and Spider

Below are examples of some M&A transactions in which we were involved:

- Representation of Walmart in the acquisitions of Aspectiva and Zeekit

- Reresentaion of DoorDash in its $8 billion acquisition of Wolt

- Representation of Surgical Science in its acquisition of Simbionix for $305M

- Representation of Hellman & Friedman in the acquisition of Checkmarx, a software security solutions company, for $1.15b

- Representation of Arbe in its financing rounds and recent de-SPAC transaction and listing on the NASDAQ

- Representation of AEA Investors LP in the sale of 1-800 Contacts, a contact lens retailer, and its Israeli subsidiary 6over6 to KKR for $3b

- Representation of Motorola in the sale of AgentVI to Irisity

Following the SPAC and IPO boom in 2021 - What trends are you expecting for the upcoming short and medium-term?

1. The very sizable rounds will continue to take place, as there is still a significant amount of funds available for investments, although we do expect valuations to decrease, following the recent market declines in the technology sector.

2. Short cycles between rounds will continue, but investors shall be more attuned to valuations.

3. As already becomes clear, SPAC boom will not continue and the number of IPOs will decrease, supplemented by an increased number of M&A transactions and as valuations will continue to decrease we expect to see towards the end of 2022 and early 2023 ‘going private’ transactions of Israeli tech companies as well as down-rounds as cash starts to run out.

4. Valuations at the growth-stage investments will be lower, as a direct consequence of lower valuations of public companies.

5. Growth players such as Insight and Tiger Global will be investing also in earlier stages.

6. Secondary investments will accompany almost all growth stage investments and shall even occur as stand-alone transactions.

7. Israeli mature startups and public tech companies will grow through local and global M&A acquisitions, using the fundings they got and do not need to use.

8. More investments will be made by the corporate ventures of global corporations.

9. Institutional investors will continue to invest in Israeli startups at a higher rate.

10. Early stage venture capital funds are creating more and more "opportunity funds" that allow them to double down on their investments or are creating SPVs with institutional investors to invest in later stages.

Will we continue to see funding rounds at the fantastic valuations we saw last year? Why? We will continue to see funding rounds at very high valuations, but only with respect to companies with sales and revenue that justify this, where there will still be competition by investors with very deep pockets. Multiples will be reduced though, even in these companies, and the public tech companies will be used as a benchmark to push valuations and multiples down. Reduced valuations of public companies (most of the Israeli companies that became public are now traded below their IPO price and investors are therefore much more cautious) creates a ripple effect on growth investments, and in particular where there is small or no revenue.

What is the most important process Israeli high-tech has experienced over the past two years and where does it leave the industry?

The most important process Israeli high-tech companies have experienced over the past two years is the fact that they received a tremendous amount of funding that allowed them to continue to grow rather than to be sold to global corporations and PE funds that will take them to the next level. This created a few additional phenomena as follows:

1. It forced them to strengthen and master their marketing abilities (in the past it was known that once an Israeli company needs to shift to sizable global marketing it has to be sold to a global/US corporation with such capabilities).

2. As the fundings were at high valuations, their potential acquisition price became higher. This and the sizable amount of funding they got shifted them from the M&A route to the IPO/SPAC route.

3. The significant amount of funding allowed the start-ups to grow non-organically through acquisitions. All these leave the industry much stronger, with Israeli startups reaching the unicorn level at an amazing number and paste; this also resulted in a "race" to recruit employees (including by way of "equity-hire" acquisitions), which increased the salaries and compensation granted to the high-tech employees and strong competition on the real estate.

Why aren’t there enough Israeli institutional investors in tech? How should they be encouraged?

In the past, Israeli institutional investors almost did not invest at all in Israeli start-ups. This is no longer the case. We are working with many Israeli institutional investors that are now joining and even leading rounds and also investing in local and foreign venture capital funds. This is the result of both incentivized governmental plans and the realization by the institutional investors (in particular in a low interest environment) that they are missing out. In addition, early-stage venture capital funds are now creating many SPVs with institutional investors that allow the early stage venture capital funds to use their pro-rata investment rights in a later stages by apportioning some of it to institutional investors and thus increasing the involvement of the institutional investors in the tech market.

What is the most important thing an entrepreneur should focus on when selecting a law firm?

We believe the personal connection between the entrepreneur and the partner is key for building long term relationships of trust, so we would say that it is the feeling that you have just met your trusted advisor. This should come at minimum with a law firm that is highly experienced in the high-tech field and is capable of providing full support to the start-up's various legal needs. An important thing to check (and referrals from other founders of start-up companies that work with the relevant partner can be very helpful to this) is that the partner is very involved, that the partner can provide business advice and not only legal and that the partner is a deal maker, putting ego on the side.

What are some basic mistakes made by entrepreneurs?

A big mistake would be to involve your advisors later in the process rather than sooner. Your advisors are here to support you, so use them in any brainstorming. They have a lot of experience and can help you avoid many mistakes. Making mistakes that are the result of not consulting, at an early stage, are not easy to remedy and fix later.

Another mistake is to assume that a funding process will take place quicker than it actually does, and as a result starting the funding process too late when the existing funds are drying. This puts the company in a lesser bargaining position in the process.

What are the most important parameters for a law firm when deciding to represent an entrepreneur in a deal (product, paying customers, entrepreneur’s previous experience), and what would be a reason to turn down an entrepreneur (if any at all)?

Believing in the entrepreneur as a person with execution capabilities on the one hand and personal skills on the other is key. The product may change, a prior experience may be improved, but the personal abilities are hard to change. You need to understand and trust that you can work with the person for a long term.

What are the most crucial stages of a deal?

Most of the important terms of the deal are agreed at the term-sheet stage. we would point out that stage as the most crucial.