State of the unicorns 2024: From breakout to bargain

Many unicorns are finding themselves in trouble, relying on whatever money they have left. But when the cash runs out this year and there is no possibility to continue paying the workers, we may see some go up for sale at ‘bargain’ prices

The sale of Perimeter 81 to Check Point for half a billion dollars in the summer of 2023 surprised many. How does a unicorn, especially one in the cyber field, drop by 50% in value from its previous funding round? But in reality, this is a dream deal. There will be few like it this year and many of those who today hold the title of "unicorn" on paper would be happy to sign off on a decrease of ‘only’ 50% of their value.

Why? A sale to a strategic buyer, which is also a public company, is often the best alternative for both investors and employees. Such a deal is not the end of the story as when the payment is received in cash, for example when a private investment fund makes an acquisition. In a sale to a public company there is still potential for an increase in value and future profit upon receiving the shares of the purchasing company. These "compromises" are rare and the statistics show that even in the good times, such as from 2015-2021, only 1% of all mergers and acquisitions in the U.S. were made at a value of more than half a billion dollars. In Israel, during the high tide of the last few years, only 20% of the acquisitions were made according to a value of more than $100 million.

Potential strategic buyers, who are not many, have endless options today. Almost every company that calls itself a unicorn is on the bargain shelf at one point or another, depending on how much money it has left. An average high-tech company that employs about 300-500 employees burns $30-50 million a year, so those who raised $100 million in 2021 are already seeing the bottom of the pot. The assumption was that 2023 would be the biggest year of M&As for Israeli companies, but the storm has passed and the need for cash has not gone away.

"This year there will no longer be any shame in a sale or even a down round," states Guy Preminger, senior partner and head of technology at the accounting firm PwC Israel. "The decision whether to sell or raise at a lower value is often the result of a compromise between entrepreneurs and investors. There are entrepreneurs who find it very important to maintain their independence. These are usually serial entrepreneurs who already have money and will insist on not selling. The investors who have been stuck for too long without an exit are ready to sell and will pressure the entrepreneurs."

Preminger points out that he is already seeing potential transactions accumulate, but estimates that the popping of the champagne bottles will be delayed, also because there are many entrepreneurs and investors in the IDF reserves and also due to the logistical difficulty of flying to and from Israel today as many airlines have not yet returned to operations here.

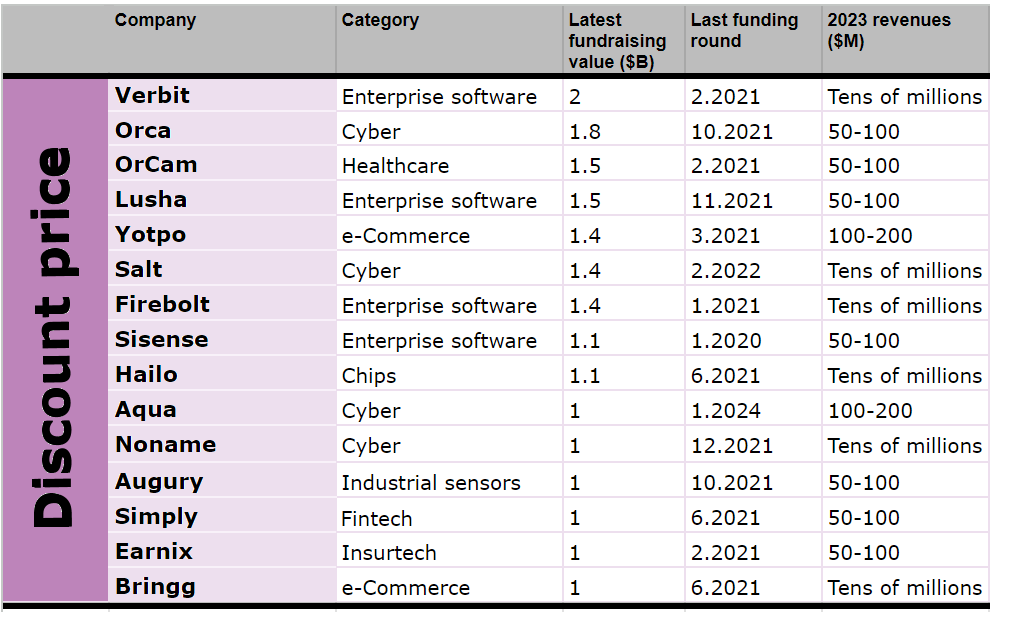

What are we expected to see? Most of the transactions will be based on a value of $300-700 million and these are the best-case scenarios, but there will also be sales known as "fire sales", meaning situations where the money runs out and there is nothing to pay salaries to employees and obligations to suppliers. Even the most glittering names of the past could easily find themselves on this side of the fence, especially those that are stuck at several tens of millions of dollars in sales or those that passed the coveted $100 million mark, but stopped growing.

The sad thing is that in most cases the growth stopped because the Israeli companies immersed themselves in becoming more efficient in order to postpone the next funding round and this goes against the DNA of a startup. In the U.S., where there are no sentiments, the rate of down rounds is immeasurably higher compared to Israel.

The Israeli companies, with the encouragement of local venture capital funds that are afraid to show negative returns on investments, have engaged in cutbacks in the last two years, some of them justified, but along the way marketing budgets were also cut, which slowed down growth. The unicorns that are in the most complex situation are those that sell to other high-tech companies or to small and medium-sized businesses. According to recent data, these have reached saturation in regards to another application or software tool, even if it's inexpensive.

But sale is not a dirty word, rather another door in the normal course of business of a company, especially if it is a sale to a private investment fund that allows the company to operate independently. According to Robin Gilthorpe, CEO of the fintech company Earnix, "When I look at the horizon of 3-5 years, an IPO is one option, but there is the world of investment funds. As someone who has been in IPOs, I can say that people underestimate the consequences of an IPO. Today we see many public companies that simply should not have gone down this road."