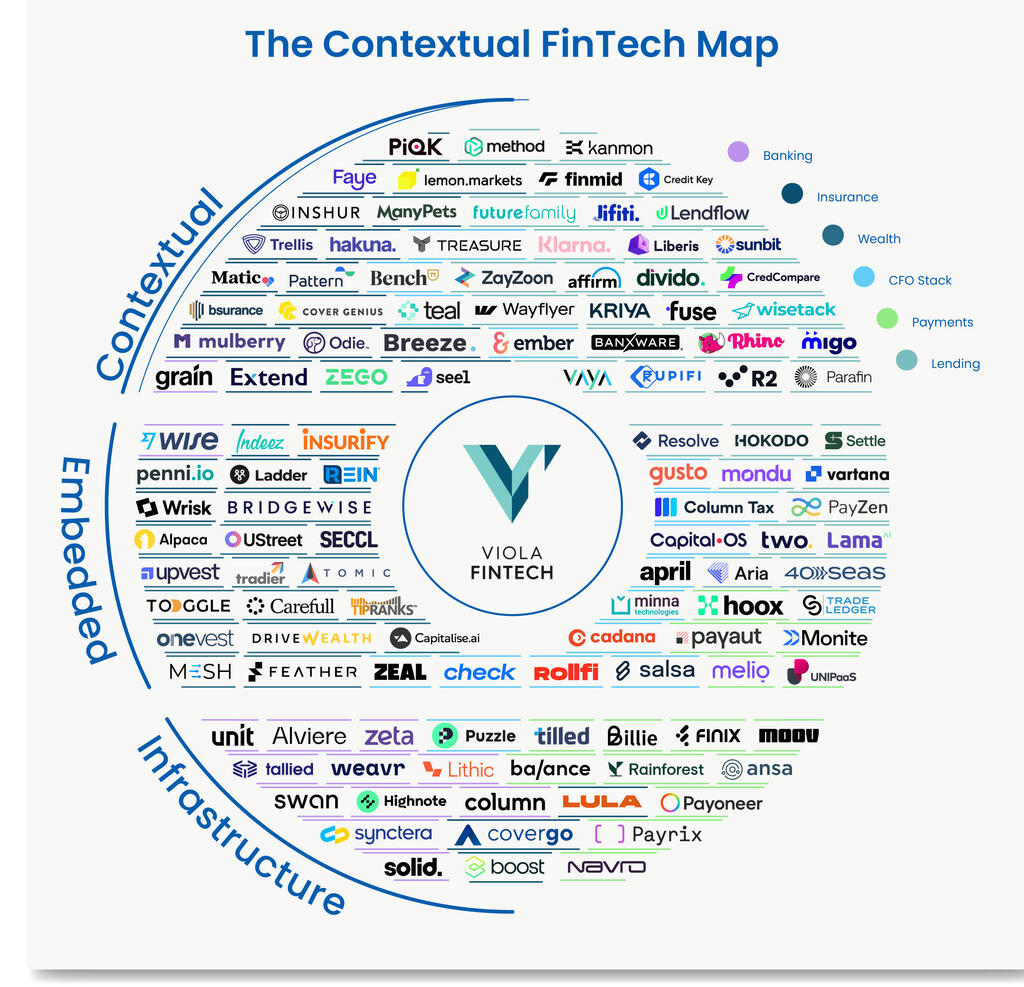

Mapping the contextual fintech evolution

“With the rise of Gen AI and the commoditization of models, tailoring personalized products and experiences for specific audiences is becoming more achievable than ever. But the key to unlocking potential is leveraging technology to architect smart and thoughtful customer experiences backed by effective business models,” writes Noam Inbar, Partner at Viola FinTech

Embedded finance is undoubtedly a hot topic in the Fintech industry and offers an incredible opportunity, with predictions that it will reach a market size of $588 billion by 2032. The concept of integrating financial services into non-financial offerings can provide value to all stakeholders involved. Consumers can benefit from a frictionless and optimized experience, brands can create an additional revenue stream, and Fintechs can gain an effective distribution channel.

Embedded finance, if correctly executed, can enable fintechs to reduce their distribution costs down to practically zero. However, despite the hype surrounding embedded finance, it has yet to deliver on its game-changing potential, at least in its current form. Most existing use cases focus on the basic concept of distribution - incorporating one product within another product. While this approach does provide some value, the overall experience remains limited.

With the rise of Gen AI and the commoditization of models, tailoring personalized products and experiences for specific audiences is becoming more achievable than ever. But the key to unlocking potential is leveraging technology to architect smart and thoughtful customer experiences backed by effective business models.

The First Generation: An Offer Without a Cause

The first generation of embedded finance has primarily centered around banking and payment applications. Many of these use cases do not result in significant value for the customer. In Payments, for example, though merchants may profit from embedding payment capabilities within their products, customers remain indifferent as there is no added value or improvement in their experience.

Finance in Transition - From Embedded to Contextual

There are some great examples of embedded finance, in which integrating a new product that introduces fresh functionality within an existing product while staying within the same framework or domain. But the holy grail to creating the ultimate experience is in the intersection of embedded, personalized, and on-time. Or, in a word - contextual.

Contextual Finance can be best understood through the lens of intent. Often, purchasing a financial product is not the main objective of the customer but rather a secondary outcome that arises from another goal. For instance, someone doesn't wake up in the morning with the desire to obtain a mortgage, but they might wake up with the desire to buy a home. This primary intent of purchasing a home drives their actions while getting a mortgage is a complementary intent that helps them achieve that goal. By considering the context and offering a financial product as part of the customer's journey toward achieving his primary goal, Contextual Finance can deliver an embedded, personalized, and on-time experience.

Let’s take a look at several interesting use cases of Contextual Finance by Israeli companies:

Insurance

Insurance is one of the most exciting areas in terms of contextual finance. There are many use cases whereby customers can purchase additional protection for the product they initially intended to buy. For example, Faye enables consumers planning a trip and purchasing flight tickets to add travel insurance as part of that journey.

Financing

The lending space holds a myriad of opportunities for contextual finance. Rhino is an interesting example of a financing opportunity at the point of sale: they help consumers who are purchasing a solar panel system select the most suitable deal terms for their needs while interacting with the solar panel installer at their own home.

Banking

Most banking used cases in embedded finance fall under the category of infrastructure, simply connecting one financial institution to another relevant one. Grain is a great example of a contextual use case in banking - they provide a currency hedging solution embedded within corporate platforms such as travel booking, supply chain, shipping, marketplaces, etc., enabling companies to reduce FX exposure by hedging through their bank as part of the transaction flow.

Noam Inbar is a Partner at Viola FinTech