Fintech startup Pontera raises $60 million at $550 million valuation

The Israeli company, which makes money by charging a percentage fee to financial advisors who use its platform, said that its annual revenue has quadrupled since 2021

Israeli fintech company Pontera, formerly known as FeeX, has successfully secured $60 million in a fundraising round from ICONIQ Growth, which was completed last month amidst the war in Gaza. Investment firm ICONIQ Growth is affiliated with ICONIQ Capital, which is according to past publications, renowned for managing portfolios of major Silicon Valley figures such as Mark Zuckerberg, Jack Dorsey, and Reid Hoffman and has $80 billion under management. ICONIQ Growth has invested previously in the likes of Zoom, Wolt, and Uber, as well as Israeli startups such as Orca, Axonius, and Fireblocks.

Pontera didn't disclose its valuation, but it is estimated to be valued at over $550 million. The company has raised a total of $160 million including the latest round of funding. It also counts Blumberg Capital and Lightspeed Venture Partners as backers.

The Founders Kitchen, Hanaco Ventures, and Blumberg Capital also participated in the round. The Founders Kitchen investment fund is led by Uri Levine, founder of Waze, with Levine also being one of FeeX’s co-founders.

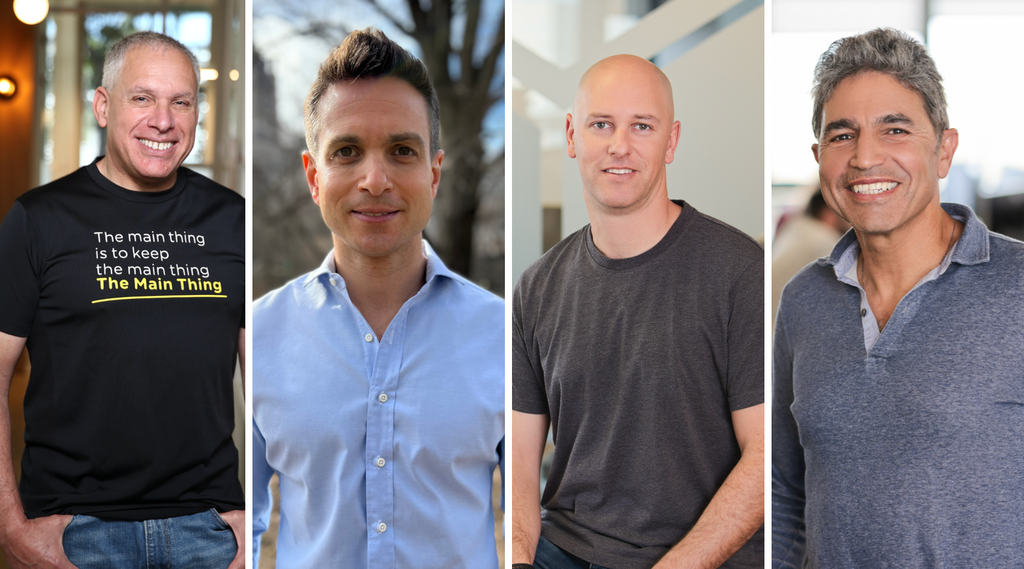

FeeX started out as a company that enabled the comparison of commissions and management fees in pension funds. Its new name Pontera comes from the Latin “pont,” meaning “bridge,” and reflects the company’s aspirations to create a bridge between individuals and secure retirement. Under this new model Pontera has increased its workforce to 220 employees, 65% of which are based in Israel. Pontera's CEO Yoav Zurel oversees operations from New York.

The recent funds will support hiring 50 additional employees in Israel, following the recruitment of 100 worldwide in the past year. Zurel said the company's annual revenue has quadrupled since 2021, but did not give any financial details. It makes money by charging a percentage fee to financial advisors who use the platform.

Financial advisers like Dynasty Financial Partners and SageView Advisory Group use Pontera's platform to analyze, rebalance and monitor various government issued retirement funds and other accounts across financial institutions.

"We have teams in the U.S. and in Israel and our focus is serving the U.S. retirement saver," said Zurel.

By June 2021, 401(k) plans in the United States held an estimated $7.3 trillion in assets and represented nearly one-fifth of the $37.2 trillion U.S. retirement market, according to Investment Company Institute.

"401(k)'s can be very meaningful portions of people's overall portfolios and assets and it's really important to make the best decisions with them. There was no real way or alternative for advisers to compliantly securely manage held away assets in the past, like they can with Pontera," said Yoonkee Sull, partner at ICONIQ Growth.

Reuters contributed to this report