Investors poured $1.3 billion into Benny Landa’s printing firm. How is it now running out of cash?

The Indigo founder’s next big idea has yet to make money, even after 15 years.

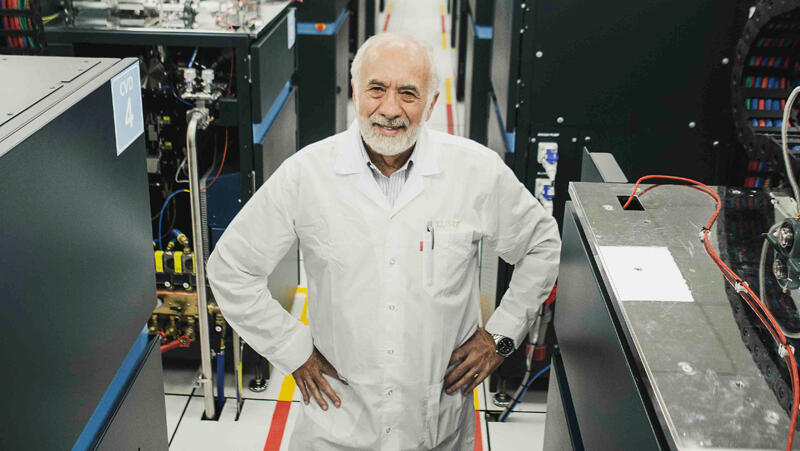

More than twenty years after selling Indigo to HP for $850 million and rewriting the rules of industrial printing, Benny Landa finds himself in a familiar but far more precarious position: at the cutting edge of digital print technology, and running out of cash to keep it alive.

Landa Digital Printing, the Israeli entrepreneur’s flagship venture since Indigo, is now under court protection as it seeks a debt settlement. Court documents show the company is burdened by debts totaling around $516 million (NIS 1.75 billion), dwarfing its remaining assets. Most of the debt, about NIS 1.4 billion (around $413 million), is owed to investors who are secured creditors. In addition, the company owes roughly NIS 300 million (about $88 million) to various unsecured creditors, including NIS 246 million (about $73 million) to suppliers. By contrast, the company’s assets stand at around NIS 429 million (about $127 million), excluding intellectual property.

For Landa, a legendary figure in the world of high-end print, the vision has always been bold: reinvent mass-market printing with proprietary water-based inkjet presses that could deliver vivid quality and faster runs, displacing traditional offset presses and transforming packaging, publishing, and commercial print. But fifteen years on, the dream has run aground on the stubborn economics of industrial hardware: the presses cost more to build than they sell for.

Despite more than $1.3 billion poured into Landa Digital Printing, including $220 million of Landa’s own capital, the company is still deeply loss-making at the gross margin level. Even before factoring in marketing, R&D or overhead, every machine it sells drags its finances deeper into the red. In the first five months of this year, the company’s revenue averaged just 12 million shekels per month, while its operating costs burned through nearly four times that amount.

Some of the world’s wealthiest investors have bet on Landa’s vision. Germany’s Susanne Klatten, heir to the BMW fortune and one of Europe’s richest women, is the largest backer: she holds nearly half of Landa Digital Printing through two vehicles, Altana Netherlands B.V. (28.9%) and Skion Digital Printing GmbH (16.4%). Foreign backers have poured $971 million into the venture, and also extended $353 million in interest-bearing loans that can convert to equity if the company survives.

Yet survival is far from certain. Landa began cutting back late last year, laying off 80 workers in Israel and reducing its global workforce to about 500. Now, another 250 employees, half the remaining team, have received layoff notices.

To stay afloat, the company is working with Deloitte to finalize a debt restructuring plan that might include bringing in a buyer from among the investors already at the table.

Two decades ago, Landa’s Indigo made him a star when HP snapped it up for nearly a billion dollars - a transformative exit that helped establish Israel’s reputation for world-class print and manufacturing technology. Whether history will repeat itself, or end as an expensive cautionary tale of a big bet that never paid off, now depends on whether the press that aimed to reinvent printing can reinvent its own balance sheet before it runs out of ink for good.