Once a $2 billion hope, Landa Digital Printing files for court protection

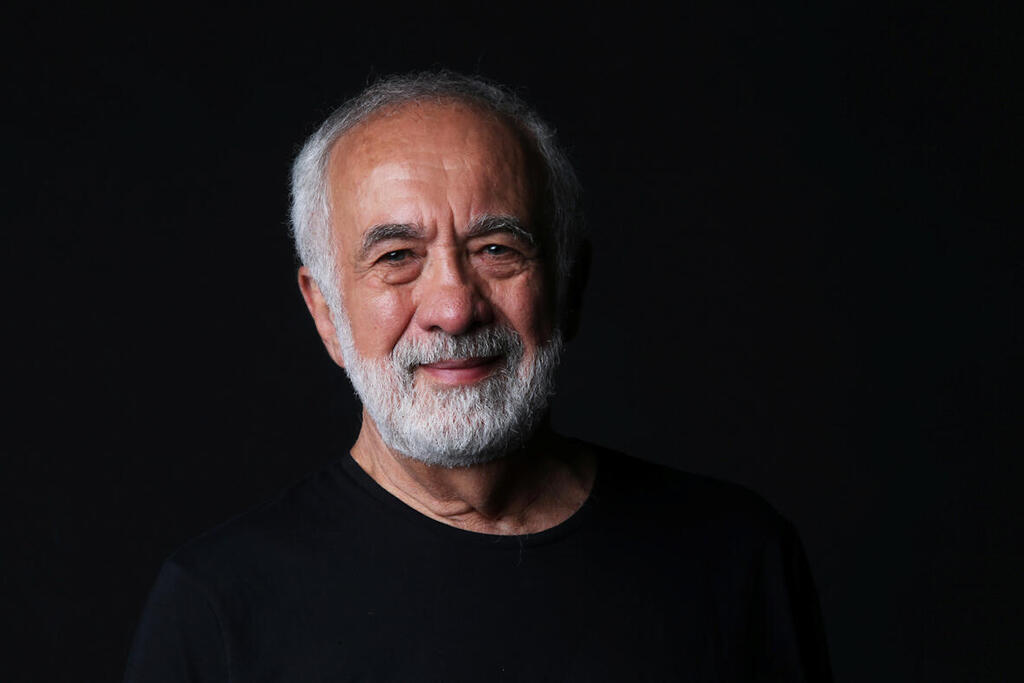

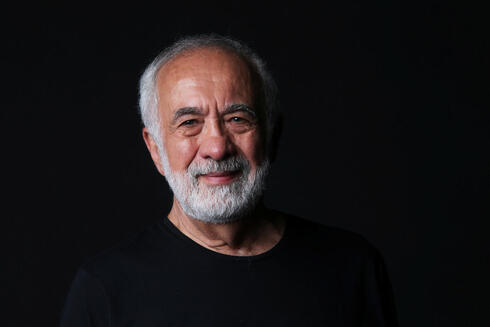

Benny Landa’s ambitious digital press venture hopes to reach a deal with creditors and potential buyers after massive investments and global setbacks.

Entrepreneur Benny Landa’s digital printing company, Landa Digital Printing, has filed a request for a stay of proceedings to formulate a debt settlement. As of the filing date, the company’s total debts amount to approximately NIS 1.75 billion (about $516 million).

Most of the debt, about NIS 1.4 billion (around $413 million), is owed to investors who are secured creditors. In addition, the company owes roughly NIS 300 million (about $88 million) to various unsecured creditors, including NIS 246 million (about $73 million) to suppliers. According to the company, it also owes Bank Mizrahi Tefahot approximately NIS 25 million (about $7.4 million). By contrast, the company’s assets stand at around NIS 429 million (about $127 million), excluding intellectual property.

Landa develops and manufactures digital printing presses for the commercial printing, packaging, and publishing markets and is considered a pioneer at the frontier of traditional printing. Its technology is based on a unique water-based inkjet process, developed in-house and protected by numerous patents.

The company hopes to reach a debt settlement during the stay of proceedings, likely through agreements with a buyer from among the interested parties currently in discussions.

Landa Digital Printing is a private company founded by Benny Landa, a renowned entrepreneur and innovator in digital printing.

The company and its subsidiaries once employed about 500 people, mostly in Israel, but the workforce has been significantly reduced in the past year due to a restructuring plan.

The secured and financing creditors include Altana Netherlands B.V. and Skion Digital Printing GmbH, and Winter Pte Corporation.

To date, over $1.3 billion has been invested in the company, initially by Benny Landa himself, who contributed more than $220 million of his own capital, and in recent years by secured creditors. After 15 years of development, the company has completed its breakthrough industrial digital printing technology and has begun commercial sales to customers worldwide.

However, the company has faced financial difficulties due to global economic challenges, the war in Israel, rising international shipping costs, delays in customer payments, and the direct impact of these factors on its performance.

Landa’s goal is to find a solution that avoids insolvency, which could have severe consequences for the company and its creditors. The company cites supply chain disruptions, including maritime shipping delays due to Houthi attacks and difficulties using the Suez Canal, as major challenges. Additionally, more than 25% of the company’s Israeli workforce has been called up for extended reserve duty since the war began.

The company notes that because its machines are high-cost items, customers typically pay in installments rather than upfront, a standard practice in the printing industry. The recovery plan has been prepared with the help of Deloitte, which has provided an experienced team to assist in developing the strategy.

In 2021, Calcalist reported that Landa is in the process of merging his digital printing company with a Nasdaq-traded SPAC. Landa Digital Printing (LDP) had hired Bank of America to lead the move and Landa was believed to be targeting a $2 billion valuation.