“We want to build the next Rafael”: Palantir veteran says Israel’s defense tech is moving faster than Washington realizes

After years at Palantir, Alex Moore, a partner in the venture capital fund 8VC, which was founded by other Palantir alumni and manages $8 billion, argues that Israel’s unique convergence of urgency, talent and battlefield data is creating a pace of innovation unfamiliar in the U.S.

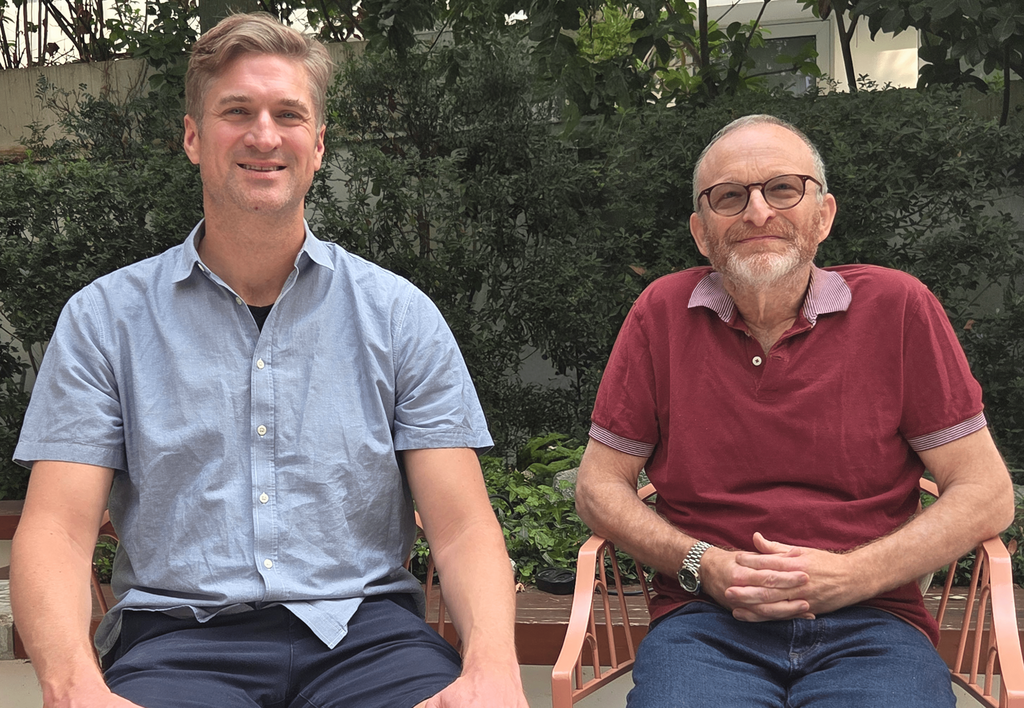

Alex Moore, the first employee at Palantir and now a leading investor in defense technology, arrived in Israel convinced that the industry is on the brink of a generational shift. After meeting more than a dozen companies, top defense officials and the country’s largest contractors, he says Israel is poised to produce a new kind of defense giant - one fast enough, innovative enough and AI-driven enough to disrupt a sector long dominated by U.S. primes.

You invest heavily in defense tech and AI, and you were among the first investors in Anduril, the largest defense startup today, valued at $30 billion in its latest round. You have only made one investment here to date, in Amnon Shashua's AI21. Why did you come to visit Israel and what are you looking for here?

"We think it is possible to establish a new defense technology giant here today, what is called a prime in professional language, not a startup, but a company on the order of Lockheed Martin in the U.S. or Elbit in Israel. The idea is to build the base here, leveraging the engineering talent that exists in Israel, and we will give this base access to the relevant markets. We have been looking at what is happening in Israel for a long time and see that in many categories in the defense world, Israel is much more advanced than the United States.

"This visit is my first time in Israel, and in just a few days I met with around 15 defense companies. I also met with President Isaac Herzog, with the Director General of the Ministry of Defense Amir Baram, and I also had dinner with the senior management of all the major defense companies in Israel. I visited the sites of the October 7 terrorist attack as well, and it was a powerful experience that only motivates me to do more here.

"In Israel, there are much more advanced versions of existing technologies, and everything was built here at a faster pace because of the war. The large defense companies here are also different from the American ones; they are much more innovative and actively seek out startups. The ecosystem is far more dynamic than parts of the American ecosystem. That's why we are very serious about our investments here and are actively seeking companies through a partnership with the Israeli venture capital fund Kinetica, which recently raised $150 million and is led by Yitz Applbaum, who was one of the founders of Lightspeed’s operations in Israel. Joe Lonsdale, one of the founders of Palantir and the founding partner of 8VC, is an advisor at Kinetica. We understand from Kinetica that they see 50 new defense tech companies every month, an explosion driven mainly by the connection between young engineers and IDF generals who bring deep combat experience."

Following geopolitical tensions around the world, there is a revival around new defense technologies. But is the situation today really different from before? For example, compared to your time at Palantir?

"At the beginning of Palantir, we had to sue the military, in other words, we filed a lawsuit against our own client because we provided the software but they did not pay. We discovered that the military echelon was using our software and saying, ‘Palantir saves lives and is important on the battlefield,’ but the Pentagon, influenced by the cartel of the old and large defense companies, tried to block us. Today, the situation is the opposite: the military wants to adopt new technologies, and the government also wants to break the cartel of prime contractors like Raytheon or Lockheed Martin.

"At the same time, there has been a significant shift among engineers and entrepreneurs. Twenty years ago, no one in the U.S. wanted to work in defense tech, and today it is considered ‘cool’ for engineers to work in this industry. After 15 years of building iPhone apps that have contributed to teenagers in the U.S. becoming depressed and antisocial, engineers want to do something ‘real,’ and the security field is exactly that.

"The geopolitical situation is of course also a huge driver, because the best entrepreneurs are naturally drawn to solving society’s biggest problems, and that is what is happening now. It's similar to when I started working at Palantir. It was shortly after the September 11 attacks. I was in the final stages of studying economics at Stanford University, and I, like many of my classmates, wanted to contribute to national security. September 11 exposed the failure of the U.S. intelligence system. We realized they needed software, so we decided to build software for the government, which was a completely wild idea at a time when everyone wanted to do consumer tech like Google or YouTube. When I heard there was a secret project to establish Palantir, I immediately reached out to Peter Thiel and Alex Karp to ask to join."

Still, there are many doubts about whether this enthusiasm can last. Is it just a temporary response to the wars in Israel and between Russia and Ukraine?

“I think what is happening now in defense tech is completely sustainable. Look at the numbers: Europe is going to add hundreds of billions of dollars to its defense budgets, real money, which must be invested in defense, innovation, and new systems. They are vulnerable to new technologies in the hands of adversaries, just like the U.S. The rise of drones and other cheap technologies capable of enormous damage has exposed the vulnerability of our old Cold War-era weapons systems. Today you can buy a drone in a store and do significant harm for very little money.

“In addition, we have concerns about China. We are worried about China, and that is not going away. Europe is also very afraid of Russia, and even if there is a ceasefire agreement, Europeans will not fully trust it. This geopolitical reality ensures that the demand for security innovation will continue.”

How are the giant American companies responding to everything happening in deep tech? Are they afraid of disruption? Are they trying to make it difficult, or is there already a willingness to adopt new things?

"I think they are not worried yet, but curious. We are moments before the real disruption. There are startups that are beginning to compete with the big companies and sometimes even win tenders. Therefore, there is now pressure from the CEOs of prime companies to build partnerships with startups. We are seeing more requests for collaborations, although sometimes I feel like their boss forced them to call me..."

But ultimately, 8VC’s exit strategy is very much based on selling startups to those giants, because it is difficult for defense companies to go public. Palantir itself took a very long time to go public on Wall Street, even though its stock has jumped 800% in five years and the company is now worth $400 billion. It’s hard to disclose the business activities of companies like these to the general public. Will most of them end up being sold to companies like Lockheed Martin or Raytheon?

"This is definitely a very common scenario. Acquisitions are healthy, but our main goal is to build the ‘next Rafael.’ We want to build a company as large as possible and also take it public. The path to an IPO requires patience, or as I like to tell investors in defense tech: ‘You have to be both patient and patriotic.’ If you want quick money, go into gaming or crypto, it’s still much easier than defense."

What are the chances of an Israeli startup breaking into the American market and becoming a large company? After all, even U.S. tech companies struggle to sell to the defense establishment.

"For Israeli startups, there is a playbook based on cyber companies that have built huge businesses, gone public or been acquired, and sometimes sold to the government. Now we want to apply this model to defense. The best way for an Israeli startup to gain access to the American market is to build products in the United States, especially in the current political climate. The U.S. is happy to buy superior technology invented abroad, but the companies need to establish manufacturing plants in America."

What categories would you recommend for startups today? Are the big prime companies more challenged by giant systems or by smaller technologies?

"The greatest opportunities are in new categories where the old companies are not dominant. Drones, for example, are a great example; startups excel there. We also see a lot of activity in electronic warfare and various types of missiles.

"We are seeing a real revolution across the board: both large and small missiles, and also in the computer, the brain of the missile. Obviously, startups will not build aircraft carriers or fighter jets, but they are building large drones that look like fighter jets, only without a pilot. The next stage in evolution will be around autonomy and artificial intelligence. If we can wage a war in which the soldier is not in danger because the plane flies itself, that is better.

"Startups are faster at identifying and implementing these trends. Although the vast majority of revenue still goes to large companies, as investors we see startups beginning to get a share of the revenue pie."

Looking back at Palantir’s early days, when you had to sue the government, what advice would you give to a founder starting a new defense company today?

"This is the best time ever to start. The walls have been broken, and they continue to fall every day. You have to be very patient, it will take time, but also move fast. Technology is moving fast thanks to artificial intelligence; the AI revolution is the ‘gas in the tank’ that forces the defense industry to accelerate."