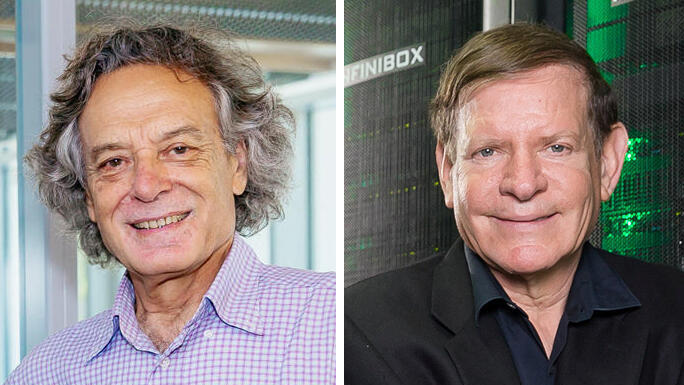

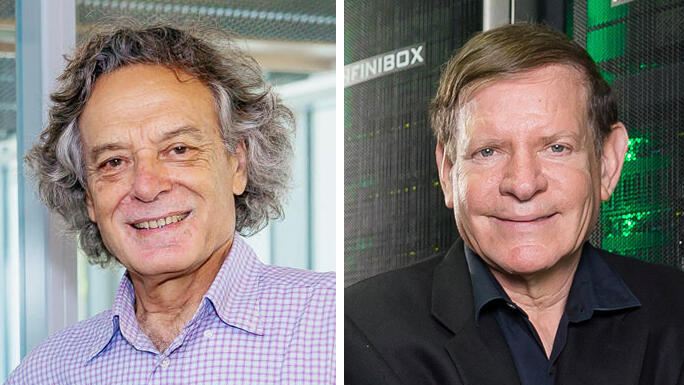

From tech titan to debtor: Moshe Yanai’s $100 million collapse

The Infinidat founder faces mounting personal debts, including $7.5 million owed to his longtime friend’s family.

After the court issued a bankruptcy order for high-tech entrepreneur Moshe Yanai, the full extent of his personal debts, initially estimated at around $100 million, is beginning to emerge.

According to Yanai’s testimony and other court documents, he owes between $10 million and $20 million to personal friends. Among his creditors are the four children of his longtime friend, Prof. Yair Tauman (77), a renowned economist and former director at Bank Hapoalim. The Tauman family, heirs of the academic who co-authored Game Theory with Nobel laureate Prof. Israel Aumann and Prof. Shmuel Zamir, has demanded immediate repayment of roughly $7.5 million.

The debt stems from loans Yanai took from the Tauman family over several years, based on expectations of future exits or profits from companies he founded or invested in. Since 2019, Yanai borrowed $6.1 million from members of the Tauman family through Michal International Investments (MII), a company he co-owned with his late wife, Rachel. MII, now controlled by its largest creditor, the Scintilla fund, to which Yanai owes about $42 million, served as his investment vehicle.

The loan carried 6% annual interest and was tied to the performance of Yanai’s storage startup Infinidat, with repayment triggered by a sale or IPO. If Infinidat was not sold, repayment was due by a set date with a minimum 6% interest.

“The entire negotiation was conducted directly with Yanai,” the Tauman family wrote in a court filing seeking to join the bankruptcy proceedings. “Yanai made it clear repeatedly that, despite the agreement being signed with MII, he was personally behind it. He even said explicitly, ‘The company is only for tax purposes, it’s actually me.’”

However, the family said Yanai never provided a written guarantee due to the personal trust between them. They now allege that Yanai “took advantage of the trust placed in him, defrauded them, and used their money for his own needs,” adding that “he appears to have deceived the family from the outset and has been rolling other people’s money for years.”

After reports surfaced of Infinidat’s sale to Chinese tech giant Lenovo, the Tauman family demanded repayment, but claim Yanai ignored them. Even if Yanai’s entire share of the Infinidat sale were transferred to the family, they estimate it would not fully cover the debt, as his proceeds total only about $3.5 million, according to Boaz Toshav, the court-appointed manager of MII on behalf of the Scintilla fund.

Yanai also testified that he owes roughly $25 million in loans from financial institutions, including $7.5 million to the Shaked Partners fund. Additional debts are owed to non-bank lenders, as well as to Executive Helicopters, which claims Yanai owes about 25 million shekels.

To finance his lifestyle, Yanai reportedly took a 70 million shekel mortgage from Bank Leumi, as well as a 10 million shekel loan from Ampa Capital and another 10 million shekel from Michman. The latter was intended for his helicopter company, but according to court testimony, portions of it were diverted to Yanai’s personal and family accounts.

Liens were filed on two luxury properties: a Tel Aviv penthouse on Antokolski Street, which Yanai tried to sell for 85 million shekels before the bankruptcy, and a villa on HaKidma Street in Herzliya Pituach. Yanai also owns two luxury cars, a 2024 Audi RS3 Sportback worth about 370,000 shekels, and a 2021 Tesla Model 3 Long Range, valued at about 150,000 shekels.

Court filings further show Yanai owns two properties in the U.S., one in Brooklyn, valued at roughly $7 million, and another in Boston, worth about $8 million. Bank Leumi’s foreclosure filings reveal an additional 135,000 shekel deposit and 53,000 shekel balance in his accounts. Yanai is also the sole heir of his late wife, though the estate’s value remains undisclosed.

According to Toshav, Yanai also holds shares worth $5 million in eToro, $8 million in Executive Helicopters, a stake in laser-sensor startup Maradin, and $10 million in biotech company Quris, which develops AI-based drug discovery models.

A representative for Yanai responded:

“Following the war in October 2023, a major deal involving one of Mr. Yanai’s portfolio companies was canceled, and additional transactions were delayed or frozen. To preserve these startups and their employees, loans were secured against private assets. All loans were used solely to fund company operations, as verified by an EY report submitted to the court. The financial difficulty is purely a cash-flow issue stemming from the security situation. With the realization of certain assets in the coming months, the matter is expected to be fully resolved.”