"In 2023 many high-tech companies will significantly decrease in value"

After the layoffs, local high-tech is preparing for a wave of declines in company valuations, similar to the trend in the U.S. Israeli-American cyber unicorn Snyk revealed its value fell by 12% when it raised $196 million this week

The era of the decline in the value of high-tech companies has begun. American-Israeli cyber company Snyk announced earlier this week the raising of $196 million at a valuation of $7.4 billion, which is a 12% decrease compared to the value of the previous funding round, which was $8.6 billion. This comes on the back of the lay off of 198 of its employees in October, reducing its headcount by 14%. Snyk Series G was led by QIA (Qatar Investment Authority).

Snyk is not the first company to reveal it has raised funds at a declining value. It was preceded by the company Bizzabo, which had to raise at a reduced value of 30% earlier this year, while laying off about 120 employees.

Snyk CEO Peter McKay said the company raised the amount it needed regardless of the value. "The market says we are worth $7.4 billion today," he noted.

In the venture capital industry, Snyk’s fundraising is defined as a "down round" (funding at a decreasing value). "Investors were very patient with Snyk compared to similar companies which are publicly traded that suffered a significant decrease in value," a senior partner in the venture capital industry told Calcalist. "This is a relatively small decrease in value in a very good company, but this is only the beginning. In the coming year, we will see many companies that will show a significant decrease in value. So far, most of the down rounds have taken place in the United States, such as Klarna, which is a good company that suffered a severe decrease in value."

According to Lior Aviram, a partner at the Shibolet law firm, the actual drop in Snyk’s value is more significant than announced. "This is a 12% decrease in value only in appearance. In fact, the investors who have already invested in the company at the previous value will suffer a more significant decrease because their money has already been invested."

A down round means that a company is now forced to raise capital at a lower value than its previous fundraising value. This is the last and most painful solution for companies that usually prefer any other means before turning to this route. When there is a round at a decreasing value, all investors, both old and new, will ask for protection of their investments which will be expressed in larger percentages of equity at the expense of the company's founders. Also, the holdings belonging to the company's employees, some of whom received high-value options, will be significantly damaged and of course the company's name will take a hit.

Snyk had to absorb all the blows: it both recruited at a low value and fired hundreds of employees. However, CEO McKay announced that "In 2022, I’m proud that Snyk achieved a 100% year-over-year increase in revenue as well as net revenue retention of over 130%. In this challenging macroeconomic environment, it is more critical than ever for global enterprises to increase their developer productivity and be able to continue their pace of innovation securely.”

Despite the words of the CEO, it is not possible that a company that fired 200 of its employees and had to raise money at a value 12% lower than its previous round does not feel that the ground is burning beneath its feet.

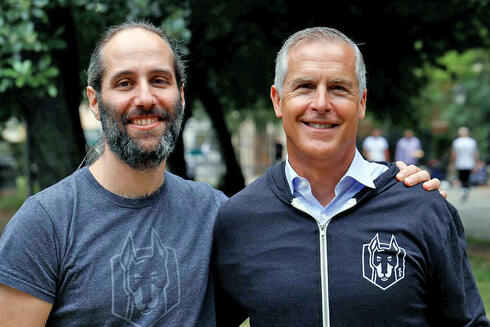

Snyk was founded in 2015 by a group of Unit 8200 graduates Assaf Hefetz, Danny Grander and Guy Podjarny. Most of the company’s employees are based in Boston and a small part in its offices in Israel. The company's security product is mainly aimed at developers, and its solution locates and fixes loopholes and weaknesses across open source platforms.

According to Lior Aviram: "There were several companies that closed down and reached the end of their money, and this is much more serious than a decrease in value. I believe that in 2023 many companies that raised during 2020 will be forced to raise at a significantly reduced value. These are companies that will reach the end of their cash and will be left with a choice of whether to raise or close. Smart entrepreneurs will choose to raise and swallow their pride and not wait for an increase in value.

"Companies that raised in 2021 can still wait and hope that in 2024 the situation will improve and they will be able to raise at a better value,” Aviram added. “But there is no way to predict that and it may be better for them to raise now. I believe that many companies will be forced to absorb a reduction in value or raise at a very similar value. Sometimes a real decrease in value is not visible on the ground because many times investors are given various benefits that compensate for the decrease in value."

Aviram estimates that the declines in value could be very large. "The Nasdaq index lost tens of percent of its value and companies should understand that they will suffer a similar decrease in value if not more. Even if the value of the company remains unchanged, it is already a detriment to the existing investors," he said. "It is important to remember that investors of funds do not want VCs to invest at a high value. Even if the funds have a lot of money, they will only invest when the value of the companies drops significantly."

According to a senior partner in the venture capital industry: "The interesting point in Snyk’s funding is the involvement of the Qatari government fund. It is important to consider the position of the Qatari investor in the company and whether it has an influence on the company. On the other hand, this is not a time to be picky and this is a very difficult decision for the company. Companies like Snyk do not have the option of giving up a deal. They need money and at a time like this it's hard to get $200 million."