Can a new CEO reignite Amdocs’ growth engine?

The software group is leaning on long contracts and a new AI platform for the next phase after announcing that Shuky Sheffer, who has led the company for seven years, will retire and be succeeded by Shimie Hortig, currently president of the Americas Business Group.

Amdocs is changing its CEO at a moment when the telecom industry is suspended between two eras, with legacy IT systems still generating most revenue while generative AI promises a transformation that has yet to translate into meaningful growth. The company’s steady quarterly results, released alongside the leadership transition on Tuesday, highlight both the durability of its core business and the strategic challenge awaiting incoming CEO Shimie Hortig as he seeks to reaccelerate momentum.

The Israeli company, which currently has a market cap of around $8 billion, announced that Shuky Sheffer, who has led the company for seven years, will retire and be succeeded by Hortig, currently president of Amdocs’ Americas Business Group. The leadership transition comes after Amdocs reported fiscal first-quarter revenue of $1.16 billion, up 4.1% year on year as reported and 3.5% in constant currency, figures that were slightly above the midpoint of its guidance but still reflective of a telecom market marked by cautious spending.

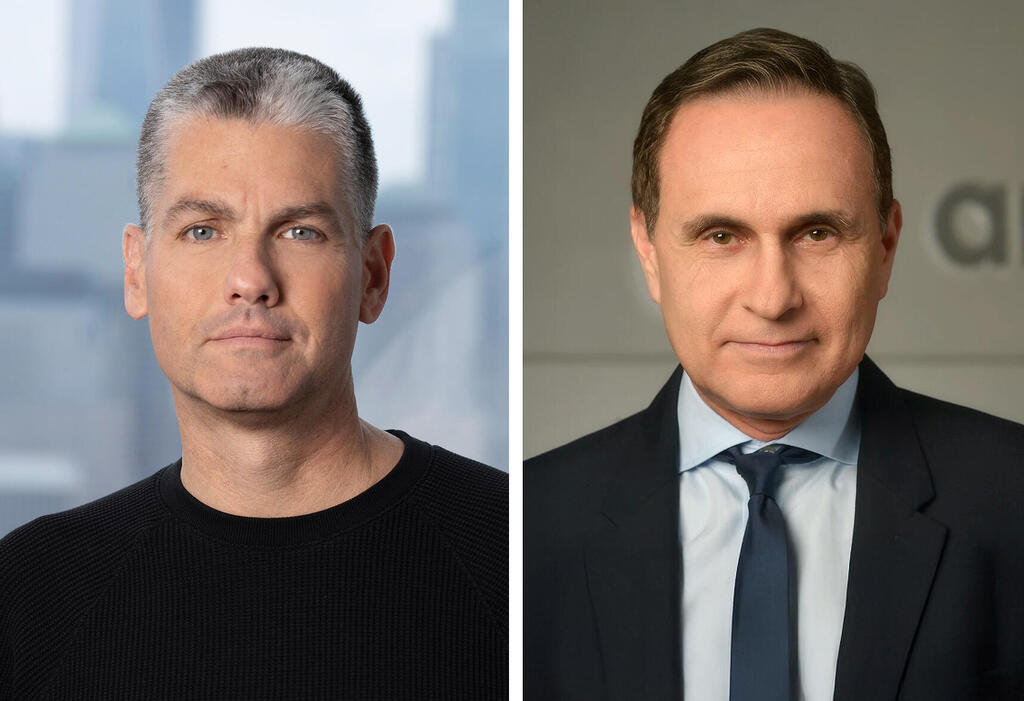

1 View gallery

Shuky Sheffer (right), who has led Amdocs for seven years, will retire and be succeeded by Shimie Hortig (left), currently president of the Americas Business Group.

For a company that derives roughly two-thirds of its revenue from long-term managed services contracts with mobile operators, continuity matters. Amdocs said its managed services revenue reached $746 million, or about 65% of total sales, while its 12-month backlog rose to $4.25 billion, up 2.7% from a year earlier. Profitability also improved: non-GAAP operating margin reached 21.6%, and free cash flow totaled $188 million for the quarter.

“Our first quarter profitability improved significantly from a year ago and was unchanged sequentially as we balanced internal efficiency gains with accelerated generative AI investments,” said Tamar Rapaport-Dagim, chief financial officer and chief operating officer of Amdocs.

Last August, Amdocs unveiled its new GenAI & Data division tasked with integrating AI into every corner of the company. The announcement came alongside preparations for a fresh round of layoffs that affected hundreds of employees in Israel and abroad.

On Tuesday, the company reiterated its outlook for fiscal 2026 revenue growth of 1%-5% in constant currency, a range that suggests telecom operators remain deliberate in their investment cycles even as they explore artificial intelligence, cloud migration, and fiber rollouts.

Sheffer’s departure marks the end of a long chapter. He joined Amdocs more than three decades ago and steered the company through the pandemic and the industry’s shift toward cloud-based platforms. Board chairman Eli Gelman credited him with transforming Amdocs into a “cloud-native, AI-enabled powerhouse” while preserving its reputation as a dependable partner for large carriers.

His successor, Hortig, is an internal appointment aimed at preserving that continuity. A graduate of Tel Aviv University with more than 20 years in the telecom technology sector, Hortig has overseen Amdocs’ largest region and many of its most strategic customer relationships. The board described him as “the clear and natural choice” to lead the company in what it called the “GenAI era.”

In a statement, Hortig said his priority would be to convert technological leadership into “durable growth and shareholder value,” emphasizing deep customer partnerships and disciplined delivery.

The management change coincides with Amdocs’ effort to reposition itself as more than a traditional billing and operations vendor. The company used its earnings announcement to unveil aOS, an “agentic operating system” designed for telecommunications. Executives framed the platform as a potential long-term growth engine that could help carriers automate customer service, network operations, and software development.

Sheffer pointed to a series of contract wins as evidence that the strategy is gaining traction, including a multi-year agreement with T-Mobile covering managed services, software development, and AI innovation, as well as an expanded engagement with Vodafone Germany. Amdocs also completed the acquisition of Matrixx Software, a move intended to strengthen its position with operators such as Verizon, Telus, and Telefónica.

Still, the company struck a cautious tone about the macroeconomic environment. While telecom groups are investing in AI and digital transformation, they are doing so selectively, and Amdocs said it continues to monitor customer spending behavior closely.