Nvidia surge powers $180M donation, but leaves recipients with tough choice

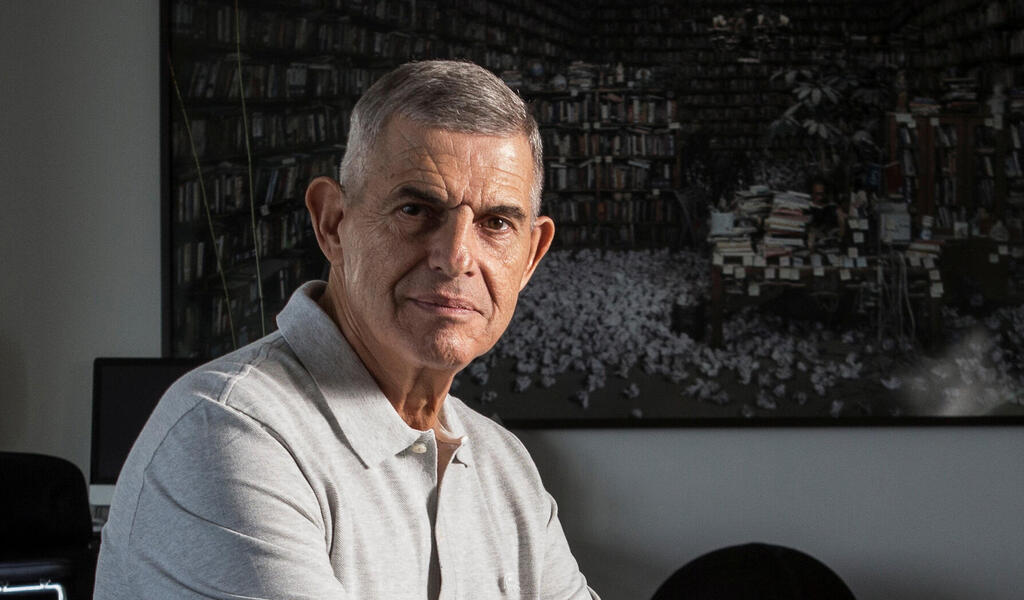

Shmuel Harlap’s gifts to Beilinson Hospital and the Weizmann Institute, partially made in Nvidia stock, highlights both the extraordinary returns of the tech giant and the dilemma of whether to sell or hold.

Shmuel Harlap’s massive donation of 600 million shekels (approximately $180M) to Beilinson Hospital, alongside a contribution of tens of millions of shekels to the Weizmann Institute in August, drew significant attention and headlines, as befits gifts of unprecedented scale. However, Calcalist has learned an undisclosed detail about these donations: they were not made in cash, but at least partially in shares of technology giant Nvidia.

Harlap, a veteran investor with deep familiarity in high-tech, previously invested in Mellanox, which was acquired by Nvidia in 2019 for $7 billion. As part of that deal, Mellanox shareholders, led by founder Eyal Waldman, received $125 for each Mellanox share they owned. According to estimates, Harlap used that money to acquire Nvidia shares almost immediately. Nvidia stock was valued at just $93 billion in total market capitalization when the acquisition closed in 2020.

Since then, Nvidia’s stock has skyrocketed, becoming the key, and almost sole, supplier of chips capable of powering large language models (LLMs) at the core of the AI revolution. Today, Nvidia is the world’s most valuable company, trading at a market capitalization of $4.5 trillion.

For perspective: when Nvidia finalized the Mellanox deal, its share price stood at $6. As of Tuesday’s close, it exceeded $168, a surge of 2,261% in just four and a half years. Harlap, who held onto his Nvidia stock, benefited from this extraordinary return, though the exact size of his Mellanox holdings at the time of the sale is unknown.

Now, his donations to Beilinson and the Weizmann Institute also carry upside potential, and risk, since they were made in stock rather than cash. Nvidia’s shares, for example, have been volatile in recent weeks amid investor concerns that rivals such as Broadcom could begin chipping away at its dominance.

A statement from Harlap said: “We do not provide details on donations.”

Anat and Dr. Shmuel Harlap’s $180 million donation to Beilinson Hospital is the largest ever to an Israeli public hospital. The funds will go toward constructing Hope Tower, a new facility dedicated to treating heart and brain diseases. Scheduled to open in early 2027, the 15-floor, 70,000-square-meter tower will house 300 inpatient and intensive care beds, as well as advanced cardiology and neurology units.

The gift adds to the family’s approximately $10 million contribution to the Weizmann Institute, earmarked for restoring a building damaged in last June’s Iranian missile attack.

Beyond philanthropy, Harlap, directly and through his company Colmobil, has long been an active investor in Israeli startups. His portfolio includes Mobileye, whose 2017 sale to Intel brought Harlap and Colmobil over $1 billion. He has also invested in medical device firm Orcam Technologies, founded by Mobileye’s Amnon Shashua and Ziv Aviram. Nvidia’s acquisition of Mellanox has since proven crucial in bolstering its AI and data center leadership by integrating Mellanox’s advanced networking technologies into AI systems for global customers.