BiblioTech

CTech’s Book Review: A cautionary tale for the tech scene

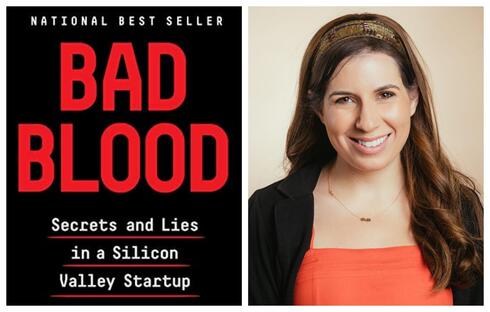

Esther Shatz, VP Consultancy and Product Marketing at Storemaven, shares insights after reading "Bad Blood: Secrets and Lies in a Silicon Valley Startup” by John Carreyrou

Esther Shatz is the VP of Consultancy and Product Marketing at Storemaven, a platform helping mobile apps and games make better marketing decisions with their data. She has joined CTech to share a review of "Bad Blood: Secrets and Lies in a Silicon Valley Startup” by John Carreyrou

Title: "Bad Blood: Secrets and Lies in a Silicon Valley Startup”

Author: John Carreyrou

Format: Book, Tablet, Audiobook

Where: Home

1 View gallery

Esther Shatz, VP Consultancy and Product Marketing at Storemaven

(Photo: Shai Shachar/Amazon)

Summary:

Elizabeth Holmes was once the darling of the tech world. At only 31 she was named the youngest self-made female billionaire thanks to her extraordinarily highly valued Biotech company, Theranos. The "next Steve Jobs," investors and the media were drawn to her like flies and she was expected to change the world.

A year later, her estimated net worth was $0, by 2018 her company was closed and she was indicted on multiple fraud allegations.

Carreyrou follows the rise and fall of Theranos but maybe more so of Elizabeth Holmes, and of the pitfalls of a startup culture built on dreams and winning over investors. Because there are real patients and consequences on the other side of the Theranos technology, the overpromising and under-delivering that permeates the startup world became more glaring, more provable, and honestly, more evil. While it's an expose of one specific company and founder, it's a wider cautionary tale for the tech scene.

Important Themes:

Trust & Transparency: Perhaps most obvious throughout the book is how paranoid and siloed Theranos and Holmes were. Non-disclosures were de rigueur, information was distributed on a "need to know" basis, such that those in charge of more business-related areas (finance, design, marketing, partnerships...) had no visibility into the tech and product development. Employees were discouraged from sharing with each other. Mistakes and failures were covered up or brushed over, rather than discussed and used for learning or brainstorming. Employee turnover was staggering. While this is how Holmes managed to keep Theranos above water for as long as she did, it could never lead to a stable, successful company long-term and prevented problems from being competently solved rather than patched up.

Objection Handling: Holmes repeatedly refused to accept objections or the word no. Any question or disagreement was met, in the best case, with hostility, and in the worst case with firings and litigation. It was impossible to create a company with sound policies and procedures because Elizabeth simply would not accept anything other than the answer she wanted to hear. As a young entrepreneur with little corporate experience, this meant she was overriding experts in their fields in order to achieve a vision in her head that had no basis in reality.

Elizabeth repeatedly ignored or flat-out rejected criticism, which is a fatal trap founders can often fall into. Instead of evolving, she fell back, year by year, until she went from inspiring founder to industry pariah.

Selling the Dream: Everything Elizabeth said, every decision made, was based on the Theranos vision. Vision is important in a company and lack of one can often be the reason a company fails. But a vision by itself is completely meaningless. The actual Theranos technology failed because of the repeated insistence that it worked on only a few drops of blood. The Theranos business failed because models were based on potential future deals with pharmaceutical companies that were nowhere near signed.

Sure, you want to present the rosy-colored version of your company when you're pitching to VCs and selling to clients, but rosy-colored isn't the same as imaginary. The image you're tinting has to exist.

What I’ve Learned:

It's quite sad because looking back post-Covid, if Theranos was a little less sexy and a little more modest, it really would have changed the world. Point-of-care blood testing became more of a necessity when immunocompromised individuals needed testing without exposing themselves during dangerous corona waves.

TS Eliot famously wrote, "the world will end not with a bang, but with a whimper" and “Bad Blood” to me makes the same case just in the glass-half-full way: a lasting, powerful new company and technology start with a gentler reality, a realistic promise that excites industry visionaries at first, rather than the whole world straight off the bat.

It also taught me to take valuations with a grain of salt. Only further strengthened by today's market conditions, I think it's important to remember that valuations are estimates, educated predictions, that shouldn't be taken as gospel.

Let's put aside the outright fraud for a moment, you can see where Theranos showed the weaknesses of the system:

- You had a charismatic founder surrounded by impressive people. Investors would not be wrong to believe that this team could achieve great things. They didn't know how resistant to objections or feedback Elizabeth was, which would ultimately lead to the resignations or dismissals of those competent people.

- Early investors and board members were of impeccable caliber (Rupert Murdoch, Tim Draper, Larry Elison, George Schultz, Henry Kissinger....) giving implicit credence to the company that makes you inherently more comfortable evaluating the company's potential. And yet - these early-stage names were not industry experts, making their ability to truly understand the company's tech and progress more limited

- The venture was exciting. A female CEO, a company making both money and positive global impact, the similarities to entities like Steve Jobs and Bill Gates...it's the kind of dream worth getting sucked into.

- Information was siloed. The teams in charge of tech and partnerships were not directly in touch with the teams in charge of forecasting. Inaccuracies and misrepresentations only became obvious internally after employees had spoken off the record.

Critiques:

Though backed up responsibly with data and sources, “Bad Blood” only covers one side of the story. Without hearing from Holmes, COO Sunny Balwati, staunch defender George Shultz, or any of the other players in Theranos's corner, we don't get a balanced view and might feel differently (at least a little) had we heard from the villains in this story.

Who Should Read This Book:

Anyone because it reads like a thriller and you're naturally pulled towards finishing it.

Investors: to remind themselves that everyone is responsible for their own rigorous due diligence.

Founders: as a cautionary tale.

Employees: for learning to trust their own instincts and knowledge even when it feels like everyone in the room is against them.