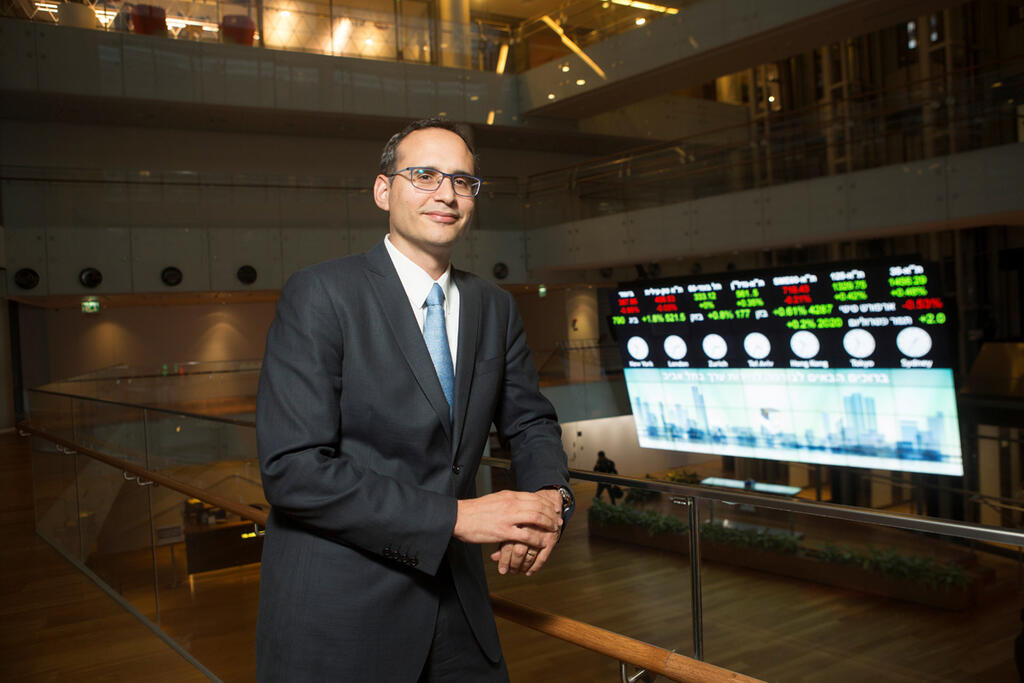

“If foreign investors lose confidence, they will just move on," says Tel Aviv Stock Exchange CEO

Tel Aviv Stock Exchange CEO Ittai Ben-Zeev says that foreign investments will return only if a political agreement is reached regarding the government’s judicial overhaul

The flow of foreign investment into the Israeli market has stopped due to the government’s attempt to pass legislation that would overhaul the Supreme Court and the subsequent widespread civil unrest, says Tel Aviv Stock Exchange CEO, Ittai Ben-Zeev.

Despite the Israeli economy’s strong international reputation, Ben-Zeev says that the current political situation has caused a halt to foreign investment. In an interview with Calcalist he noted the importance of resolving the current judicial conflict as quickly as possible, with certainty and consensus. “If foreign investors lose confidence, they won’t come back after a year or two. They will just move on - they have enough opportunities elsewhere," Ben-Zeev added.

Ben-Zeev pointed out that most recent price drops in the local market were due to Israeli investors, saying that “in the last two months, we’ve seen the Israeli investors voting with their hands.” He noted that many Israeli investors were moving their assets from the Israeli market to markets abroad.

Ben Zeev says that foreign investment accounted for a large amount of overall investment in the Israeli market in recent years. In 2021-2022 alone, foreign net investment in the Israeli market amounted to NIS 27 billion (approximately $7.5 billion). He says that “[foreign investors] have been waiting and trying to understand what is happening here. They are still buying, but in extremely small amounts compared to the last two years, and not because they have stopped believing in the Israeli economy and innovation, but rather due to the instability resulting from current political turmoil.” He emphasized that this has undoubtedly harmed the Israeli economy, and that foreign investment will only return when the judicial dispute is resolved.

Why didn't you join the Histadrut strike this week?

"The stock exchange is not an Israeli company. There is a profound difference between what happens inside the country and how we are viewed from the outside. Stock exchanges are open and it is very important to convey this to investors abroad."

But isn't the long term goal worth striking over?

"One of the arguments against the legal reform was that it would lead to people being unable to spend their money and everything closing. So, what would foreign investors think if that actually happened this week, and [the Stock Exchange] were suddenly closed? A step that may not seem dramatic to us here can have consequences for many years in the eyes of the world."

You seem optimistic that reaching a broad consensus will get us back to normal, but don't you think that the damage has already been done?

“When you look at what happened here in the last few weeks, you can see how people want to live in this country. There is an understanding that Jews have no other country in the world, and they care about what happens here. That's why we need to leverage what happened here not only in terms of individual rights and societal elements, but also to strengthen our economy. For example, all countries in the world, as a lesson from the period of the Coronavirus pandemic, want institutional money - which is the public pension - to be invested in the local economy. But here in Israel, institutions boast about investing more and more money in other economies - this is a paradox in my eyes."

A study published by the Bank of Israel this week showed that the stock returns of newly public companies are disappointingly lower than market returns. It doesn't really make you want to invest in public companies.

“There are pricing differences between [the Tel Aviv Stock Exchange] and the rest of the world, and this needs to be put in context. There are also a lot of IPOs that were in the US, including SPACs which didn’t yield amazing returns. In addition, the Israeli market is not a developed market in terms of distribution channels. Internationally, the general public is much more active in IPOs. In Israel, on the other hand, the institutions set the tone, and many times buy and remain with the shares, and then a liquidity problem arises. In addition, the topic of analysis is not developed in Israel for the general public, and this also affects liquidity and returns."

Related articles:

Although 2022 brought losses to investors, it was a good year for the Tel Aviv Stock Exchange due to an increase in trading volumes. According to the stock exchange, which is traded as a public company, in 2022 its revenues grew by 12%, compared to the previous year, to NIS 361 million (about $10 million), and the net profit increased by 11% to NIS 51.4 million (about $14.3 million). This was mainly due to a 22% increase in the average daily trading turnover in shares, and a 145% jump in the daily trading turnover of short-term loans to NIS 800 million (about $223 million). In the bond market, conversely, trading volumes fell by 12% last year.

A higher number of companies in the stock exchange, as well as higher fees charged by the stock exchange, also contributed to the increase in revenue. In the fourth quarter of 2022, the stock exchange recorded more lukewarm results, compared to the previous year, with an increase in revenues of only 1% at NIS 86.3 million (about $24 million). This stagnation in revenues is partly due to the lack of trading days in the fourth quarter due to the timing of the Jewish high holidays in the fall. The net profit in the quarter decreased by 6%, compared to the previous year, to NIS 13.2 million (about $3.6 million).