VC Survey 2026

“One of the most undervalued opportunities is next-gen HR and talent intelligence”

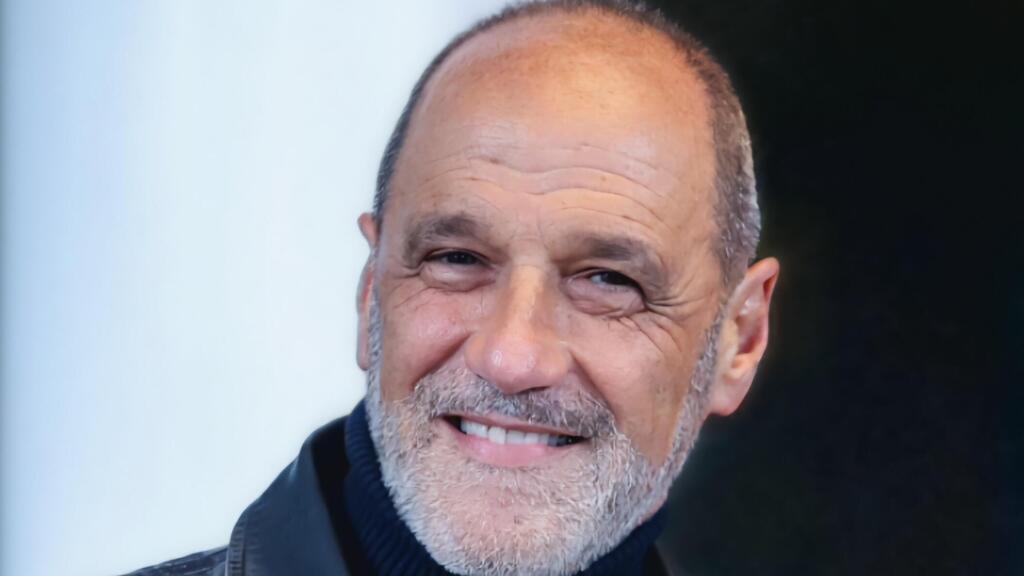

SYN Ventures Operating Partner Marcio Lempert joins CTech to give his outlook for the 2026 market, from the civilian sectors set to benefit most from defense-derived tech to the untapped opportunities overlooked by the market, as part of CTech's VC Survey 2026: The Next Leap.

“One of the most undervalued opportunities is next-generation HR and talent intelligence platforms that move beyond workflow and compliance tools toward objective, data-driven assessment of role fit, capability, and potential,” says Marcio Lempert, operating partner at SYN Ventures. Lempert argues that while the market has historically prioritized process over decision quality, “as hiring costs rise, labor markets tighten, and performance scrutiny increases, organizations are increasingly seeking more rigorous, transparent, and defensible ways to evaluate talent.”

Following the turbulence of recent years and the stabilization of 2025, the Israeli tech ecosystem is entering a new era: The Next Leap. Lempert joined CTech to share insights for its VC Survey 2026, which invites prominent investors to discuss the topics, trends, and “leaps” expected in the year ahead.

Lempert believes that premium valuations in 2026 “will be driven by a combination of gross revenue retention and capital efficiency.” Companies that can demonstrate strong retention alongside disciplined capital deployment, says Lempert, “demonstrate both product-market fit and operational maturity, positioning them to command premium outcomes in a selective valuation environment.”

You can read the entire interview below:

Fund ID

Name of Fund: SYN Ventures

Total Assets Under Management (AUM): ~900M ($890M)

Partners/Managers: Jay Leek (founder and managing partner), Art Coviello, Marcio Lempert, Dan Burns, Ryan Permeh, Glenn Chisholm, Adam Cecil

Notable Portfolio Companies (Active): Terra Security, Halcyon, Cranium, RegScale, Miggo, BreachRX, Conifers, Reveal Security

Notable Exits: Talon, Pangea, Adlumin

The Liquidity Leap: After a period defined by cash preservation, will 2026 see the reopening of the IPO window for Israeli tech, or will M&A remain the sole viable liquidity event?

In our view, the IPO window is likely to reopen in 2026, but only for a very small subset of Israeli technology companies. The bar for going public has risen materially and now requires clear category leadership, meaningful scale, predictable revenue, and a credible path to sustained profitability.

We believe that for companies that meet these criteria, public markets may again offer an attractive liquidity path. However, for the vast majority of the ecosystem, M&A will remain the more realistic and prevalent exit route, as strategic acquirers continue to seek differentiated technology and defensible market positions. In this environment, IPOs are best viewed as an outcome reserved for the most mature businesses rather than a broadly accessible option.

The Valuation Leap: Moving past the market correction, what is the single most critical metric (e.g. EBITDA, NRR) that will drive premium valuations in 2026?

In our opinion, premium valuations in 2026 will be driven by a combination of gross revenue retention and capital efficiency.

We believe gross retention has become a central indicator of product necessity and durability. In a more disciplined market, the ability to retain customers — particularly without relying on aggressive expansion — signals that a product has become embedded in customer operations.

At the same time, we expect capital efficiency, often measured through burn multiple, to remain critical. Companies that pair strong retention with disciplined capital deployment demonstrate both product-market fit and operational maturity, positioning them to command premium outcomes in a selective valuation environment.

The Agentic Leap: As we transition from 'Copilots' to autonomous 'Agents,' which specific vertical will be the first to fully trust AI with independent decision-making?

In our view, the first vertical to meaningfully trust autonomous AI agents will not be security, but internal business operations — particularly finance, procurement, and back-office functions.

We expect adoption to begin by uplifting human operators — automating reconciliations, approvals, exception handling, and routine decision paths — before progressing toward independent execution within predefined guardrails.

By contrast, in our opinion, mission-critical domains such as security or safety-of-life systems will remain hybrid for longer, as organizations are slower to delegate irreversible decisions where failure modes are asymmetric.

Related articles:

- “Israeli tech is increasingly positioned to lead the next wave of value creation across AI-driven verticals”

- “2026 will no longer be a one-way street toward forced consolidation”

- “Almost anything proven under battlefield conditions can become a commercial product once it’s translated into civilian workflows”

The Dual-Use Leap: Israel has mastered Defense Tech. Which civilian industry (e.g., Construction, Agri, Logistics) will see the biggest disruption from adapting these battle-tested technologies?

In our view, the civilian sector most likely to see meaningful disruption from defense-derived technologies is critical infrastructure and civil resilience, including energy, transportation, water systems, and emergency response.

We believe capabilities developed in military environments — such as real-time sensing, command-and-control systems, anomaly detection, and secure communications — translate directly to civilian infrastructure that is increasingly digitized and exposed to both physical and cyber risk. As governments and operators place greater emphasis on resilience alongside efficiency, we expect this convergence to accelerate.

The Contrarian Leap: What is one sector or trend currently ignored by the herd that you believe represents the most undervalued opportunity for the coming year?

In our opinion, one of the most undervalued opportunities is next-generation HR and talent intelligence platforms that move beyond workflow and compliance tools toward objective, data-driven assessment of role fit, capability, and potential.

We believe that despite the strategic importance of human capital, HR technology has historically prioritized process over decision quality. As hiring costs rise, labor markets tighten, and performance scrutiny increases, organizations are increasingly seeking more rigorous, transparent, and defensible ways to evaluate talent. In our view, this transition — from subjective judgment to evidence-based assessment — remains underappreciated by the market, making it a contrarian but compelling opportunity.

Finally, what are 2-3 startups that, in your opinion, are likely to make a leap forward in 2026?

From SYN Ventures’ portfolio:

Terra Security – Terra is an agentic AI platform for continuous web application pentesting, compressing testing cycles from weeks to hours/days with a human-in-the-loop approach. We’re excited because it augments security teams and turns offensive security into a continuous, scalable capability.

Mitiga – Mitiga enables investigation to containment in one workflow across cloud, SaaS, and identity, where incident evidence is otherwise fragmented and slow to piece together. We like it because it’s built for cloud response at scale, with an AI-assisted approach that’s expanding into identity and emerging AI attack surfaces.

Miggo – Miggo delivers AI-powered runtime defense through Application Detection & Response (ADR), helping teams understand what’s happening inside their applications and respond quickly. We’re excited by its ability to generate actionable protections to block exploit paths – driving prevention and response, not just alerting.

All three companies are gaining significant traction in the market with significant customers and growing ARR.