National Economic Conference

"Clal's entry into the TA-35 is the result of our strategic moves"

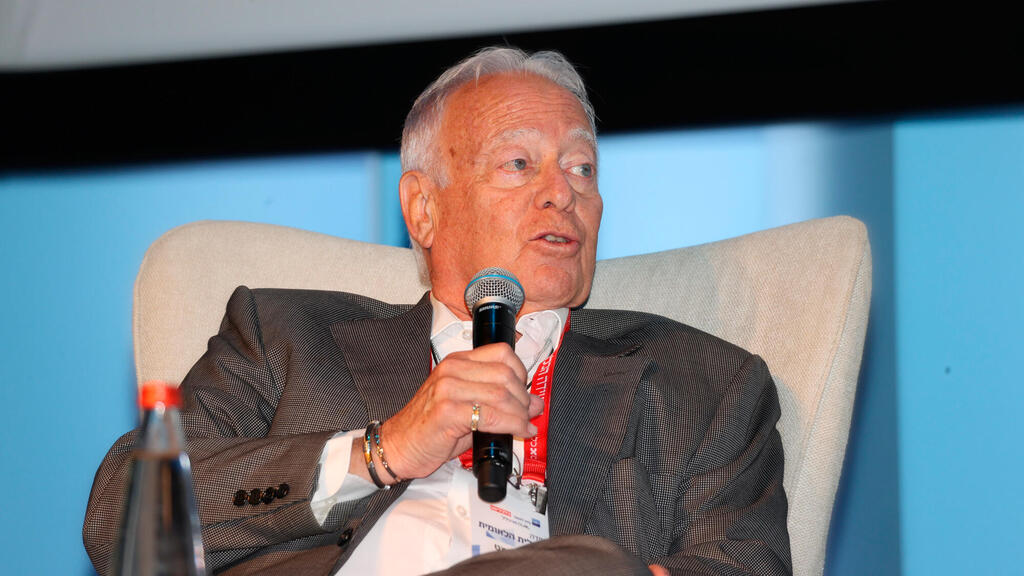

Haim Samet, chairman of Clal Insurance, was speaking at the National Economic Conference.

"Even during the coronavirus pandemic, we continued to find investment opportunities in Israel, and surprisingly, these have increased since the war began. We invest first and foremost because it is the right thing to do for our members. But beyond that, your heart should lead you to do what is in the best interest of the State of Israel, and there is no doubt that increasing investments in Israel is something that strengthens the Israeli economy during this period,” said Haim Samet, Chairman of Clal Insurance, speaking at the National Economic Conference of Calcalist and Bank Leumi.

After all, you’re not a philanthropic organization, you have to think about the returns for your members.

"When you manage 380 billion shekels, the responsibility for our members’ money is carried with a sacred sense of duty. It’s not just about protecting members’ money, we also operate in a competitive environment, and everyone wants to deliver a solid return. In the end, the investments we made have proven themselves in terms of results. The Max deal alone accounts for a quarter of Clal’s profit and enabled us to distribute a dividend for the first time in ten years. And even now, we’re not standing still, we’re evaluating the right strategy for Max and Clal, with an eye on what we will do over the next three to five years."

Let’s pause for a moment on how you see the role of institutional investors, how much weight should social considerations have?

"Returns must be there, but they are not everything. Clal’s investment in ESG issues and environmental protection has earned us incredible ratings, Platinum on the Ma’ala index, Triple A on other indices. We keep our hands firmly on the wheel steering us in that direction. Since the war began, we have launched many initiatives: we established a fund to help insured people who were injured in the Gaza Envelope area, even in cases where insurance clauses do not always allow for full compensation. We donated to the police and the IDF. We also awarded 50 scholarships to female business administration students who fought in the war, these scholarships are handed out by families who themselves were affected. In addition, 60 of our managers have ‘adopted’ wounded IDF personnel to help support their rehabilitation after the war."

Clal Insurance recently entered the Tel Aviv 35 index. How do you feel about that? Was it all thanks to the Max deal?

"It’s a great honor to enter the Tel Aviv 35 index, you could say that ‘all the stars aligned,’ but this did not happen by chance. The Max deal was groundbreaking. When I became chairman of Clal, I quickly realized we needed to build an additional economic pillar for the insurance company. Our excellent CEO, Yoram Naveh, came up with the idea of acquiring a credit card company. The acquisition took a year and a half, what delayed it was our insistence on excellent corporate governance and our desire to strengthen the insurance side. There’s no doubt that today, in light of the results, the Max deal was not only bold but truly outstanding."

You talk about the test of results, but at the time the controlling shareholder (Alfred Akirov) objected strongly, and there was plenty of criticism.

"That’s true. Actually, when you’re a company without a controlling shareholder, the decisions made by the board of directors carry more weight than in a company with a controlling core. At the time, a derivative lawsuit was filed, and the stock price fell by 40%. But at the end of the day, you ask yourself: What should I do? Should I do what’s right for the company? Or just sleep well at night? I think we should always do what’s right for the company."

Is the recent rally in insurance stocks sustainable?

"This surge took everyone by surprise, it was phenomenal. Will there be corrections later? Yes. But is there room for continued growth? I believe so. We are in the midst of a war that has lasted nearly two years. The rise in the stock market reflects a belief that good things are waiting for us in the future."