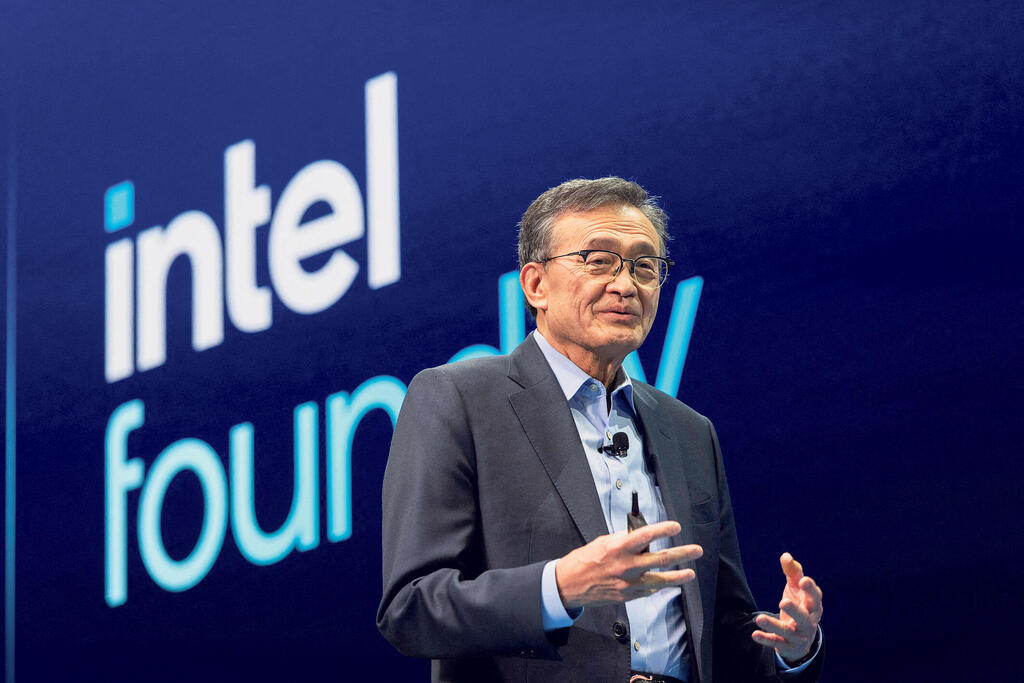

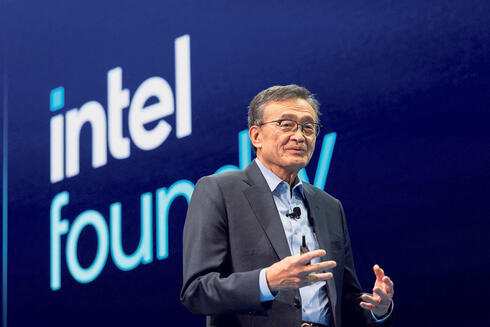

Defiant Intel CEO says "it’s a privilege" to lead Intel as Trump calls for resignation

Lip-Bu Tan pushes back against accusations over China ties amid pressure from Washington.

Intel CEO Lip-Bu Tan is fighting to steady both his company and his leadership after an extraordinary public rebuke from U.S. President Donald Trump, who on Thursday demanded Tan’s resignation over past business ties to Chinese tech firms, some reportedly connected to the Chinese military.

In a letter to employees circulated internally and later published on Intel’s website, Tan struck a defiant yet measured tone. “Leading Intel at this critical moment is not just a job – it’s a privilege,” he wrote. “My reputation has been built on trust – on doing what I say I’ll do, and doing it the right way. This is the same way I am leading Intel.”

Tan’s letter came just hours after Trump accused the Malaysian-born executive of being “highly conflicted” due to past investments through his venture capital firm, Walden International, and ties to Cadence Design Systems, where he previously served as CEO. “The CEO of INTEL is highly CONFLICTED and must resign, immediately,” Trump wrote on his Truth Social platform. “There is no other solution to this problem.”

The demand, reportedly made without warning to Intel’s board, marks a rare and highly charged instance of a U.S. president calling for the ouster of a public company CEO, and lands at a time when Intel is already battling existential questions about its relevance in the global chip race and its capacity to recover lost technological ground.

Tan’s position at Intel, one of the most proinent recipients of funding under the 2022 CHIPS Act, was always going to be closely watched. The company was awarded $8 billion in subsidies last year to build new semiconductor facilities in Ohio and other U.S. states, a cornerstone of Washington’s broader effort to secure domestic chip manufacturing.

But Tan’s appointment earlier this year, following the abrupt dismissal of former CEO Pat Gelsinger, quickly attracted scrutiny. A Reuters investigation in April reported that Tan and affiliated venture funds had invested over $200 million in Chinese tech firms, including suppliers to the People’s Liberation Army, between 2012 and 2024. Some of those holdings were still listed as current in Chinese corporate registries as of late last year.

Intel has said Tan has divested from those positions, though details remain unclear. On Thursday, the company reiterated its support for Tan and said it was working with the Administration to “ensure they have the facts.”

Trump’s remarks follow a letter from Senator Tom Cotton to Intel’s board, raising concerns about Tan’s connections and citing a criminal case against Cadence, which recently agreed to pay $140 million over sales to a Chinese military university during Tan’s tenure.

Tan, for his part, reaffirmed his alignment with national priorities: “I fully share the President’s commitment to advancing U.S. national and economic security,” he told employees. “We are engaging with the Administration to address the matters that have been raised.”

The leadership crisis comes at a moment of deep transition for Intel. Once the cornerstone of U.S. semiconductor dominance, the company has spent the past decade watching rivals like Taiwan’s TSMC and Nvidia take the technological and market lead.

Intel’s plan to reclaim its edge through a new chipmaking process known as “18A” has encountered quality issues, with internal data suggesting low production yields for next-generation Panther Lake chips. Reuters recently reported that only 10% of early chips met Intel’s specifications as of this summer.

Despite that, Tan has publicly maintained the company is on track to begin high-volume production later this year. “It will be a major milestone that’s a testament to your work and the important role Intel plays in the U.S. technology ecosystem,” he wrote in the letter.

Yet under Tan’s tenure, Intel has significantly scaled back Gelsinger-era ambitions. It has paused or delayed several factory projects, including pushing the completion date of its marquee Ohio facility to 2030 or 2031. The company has also implemented deep cost cuts, including layoffs, and moved away from Gelsinger’s sprawling “IDM 2.0” strategy.

Investors and analysts remain divided. Some view the administration’s pressure on Tan as a political overreach that could destabilize a strategically vital company. Others say the optics of Tan’s record, regardless of legal standing, may prove untenable in the current political climate.

Tan’s lack of a personal rapport with Trump, unlike other tech CEOs, may have worsened the fallout. “Unfortunately, Lip-Bu does not appear to have cultivated the kind of personal relationship with Trump that would help to assuage his ire,” Bernstein analyst Stacy Rasgon said.

Whether Tan can survive the storm may depend less on his résumé than on his ability to navigate an increasingly politicized semiconductor industry, where questions of national loyalty and strategic alignment now eclipse even technical competence.

“We are on a journey to restore Intel’s strength and create the innovations of the future,” Tan told employees. “Our mission is clear, and our opportunity is enormous.”

The board, for now, remains behind him.