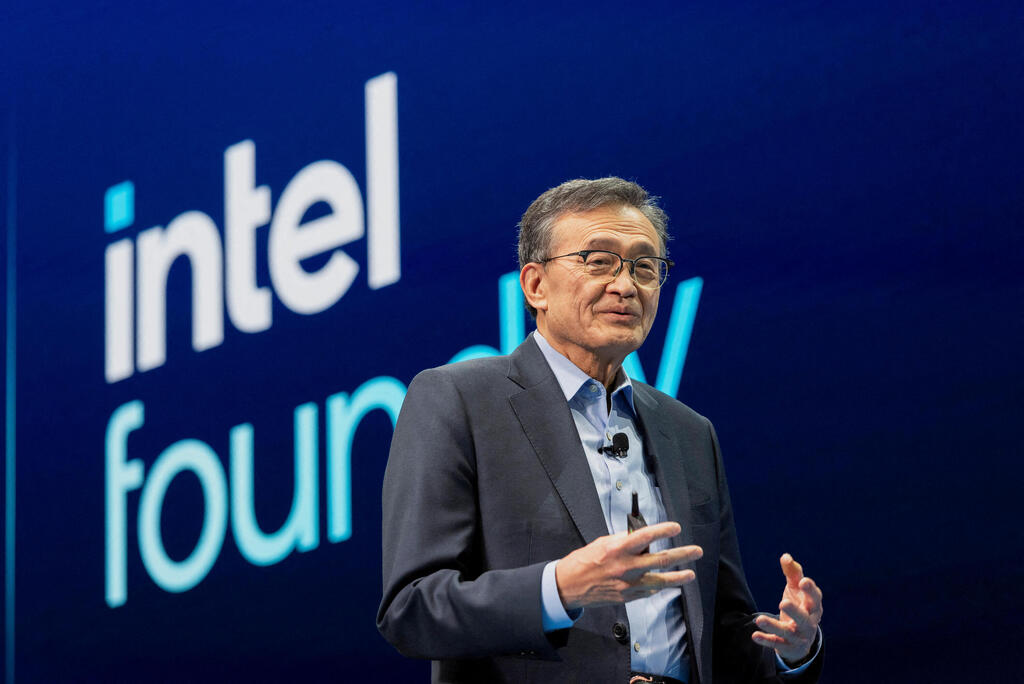

Intel Products CEO: “Employees are very optimistic about the fact that Lip-Bu can help us”

Michelle Johnston-Holthaus said new leadership under CEO Lip-Bu Tan is driving transparency, urgency, and a strategic turnaround amid Intel’s battle for relevance in the AI era.

Eight weeks into Lip-Bu Tan’s tenure as CEO of Intel, a new tone is taking hold inside the world’s once-dominant chipmaker: urgency, transparency, and a willingness to admit hard truths.

In a wide-ranging conversation at Bank of America’s Global Technology Conference, Michelle Johnston-Holthaus, CEO of Intel Products and one of top executives at the company, laid bare the depth of the challenges facing Intel. She also offered an unvarnished glimpse into how Tan is pushing to reclaim relevance in the AI era.

“We absolutely know where our shortcomings are,” Johnston-Holthaus said. “But I think sometimes it’s easy to see the shortcomings and not always easy to figure out how to fix them.”

The stakes are existential. Intel, long the bedrock of PC and server computing, has been outpaced in recent years by rivals more attuned to the explosion of artificial intelligence workloads, custom silicon, and geopolitically charged supply chains. But under Tan, a storied semiconductor investor and former head of Cadence Design Systems, the company is refocusing its efforts on four fronts: rebuilding its technology roadmap, proving its relevance in AI, winning back customers for its foundry business, and repairing its balance sheet.

“He came in with a very strong point of view,” Johnston-Holthaus said. “He’s flattened the organization, brought engineering to him, [and] is doing deep dives.”

The internal culture appears to be shifting as well. Tan, according to Johnston-Holthaus, “wants to hear the bad news first.” The new leadership’s directness marks a sharp contrast with years of top-down optimism that often papered over operational and financial strain.

Johnston-Holthaus acknowledged that Intel is making hard choices on pricing and product prioritization, especially in 2025. After years of pursuing market share, the company is now “trying to be a bit more pragmatic,” she said, noting that Intel’s customer deal pipeline in Q1 was “significantly lower” than in previous quarters.

That’s no accident. Tan is focused on rebuilding profitability, especially restoring gross margins above 50%. That will mean fewer low-margin deals, and more discipline in how Intel prices its products, and positions its engineering strengths.

“We need to be building products that allow us to do that because they fit the right competitive landscape,” Johnston-Holthaus said. But “we also have the right cost structure in place. And it really requires us to do both.”

That push comes as the AI transition accelerates. Tan and CTO Sachin Katti are leading what Johnston-Holthaus described as an “enormous” internal effort to define Intel’s role in AI, and make that strategy legible to investors, partners, and customers. “Where we’re going to win, how do we use the IP portfolio that we have inside, and who do we need to partner with, you’ll hear more about that externally,” she said.

Complicating everything is the looming threat of new U.S. tariffs. “We have a whole team that’s doing a variety of scenario planning,” Johnston-Holthaus said. “Nobody’s going to get it perfectly right, but I think we have enough scenario planning that we can pull pieces out.”

She also emphasized the company’s flexibility in manufacturing. Intel’s newest nodes can be fabricated at multiple sites inside and outside the U.S., and it maintains volume relationships with TSMC. With the advanced 18A node being developed in the U.S. and EUV capabilities abroad, Intel has some strategic room to maneuver, and to match customers’ shifting geographic priorities.

“What’s probably most important to me is really understanding what customers want,” she added. “Where do they want to build?”

Ultimately, the most compelling takeaway from Johnston-Holthaus’s remarks is not just Intel’s strategic redirection, but the speed and intensity with which it’s unfolding.

“He’s done a lot in his first eight weeks,” she said of Tan. “He’s hyper focused, he knows exactly where the problems are, which is very good to see. But he’s willing to listen, he’s willing to learn, and he’s willing to roll up his sleeves.”

That energy, she said, is being felt across Intel’s workforce. “Employees are very optimistic about the fact that he can help us.”