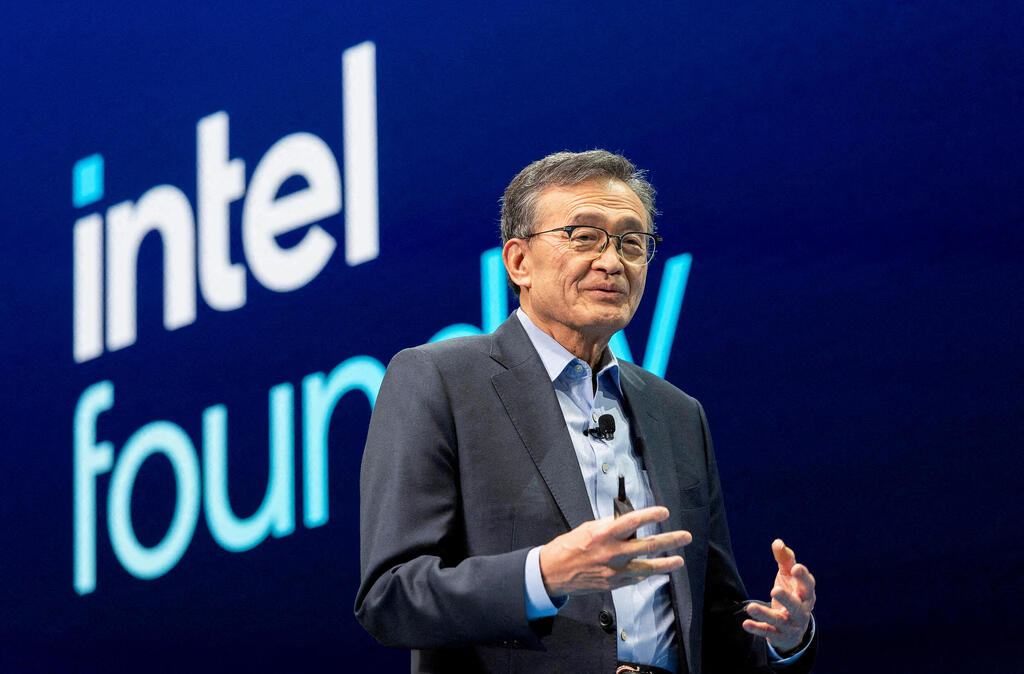

“We are on the journey to rebuild Intel,” CEO Lip-Bu Tan declares after breakthrough quarter

Shares jump nearly 10% as Tan’s austerity drive and $20 billion coalition deal begin to pay off.

Intel’s long-awaited recovery gathered pace on Friday as shares surged nearly 10% in Frankfurt, a day after the chipmaker posted third-quarter earnings that beat Wall Street expectations. The results marked the first since the company secured more than $20 billion in funding from Nvidia, Japan’s SoftBank, and the U.S. government, an extraordinary coalition reshaping one of Silicon Valley’s oldest institutions.

“This marks the fourth consecutive quarter of improved execution,” CEO Lip-Bu Tan told investors on Thursday, describing the results as evidence that Intel’s turnaround strategy “is taking hold.” The company’s adjusted profit reached 23 cents per share, far ahead of the 1 cent analysts had expected, while gross margins climbed to 40%.

Tan, who took the helm in March after Intel’s market value halved under his predecessor, has reversed the company’s trajectory through sweeping austerity and asset sales. Intel’s workforce is now 20% smaller, its once-expansive foundry ambitions pared back, and its capital spending sharply curtailed. The results have been swift: four consecutive quarters of improving revenue, earnings, and cash flow.

“I’ve focused on strengthening our balance sheet and liquidity,” Tan said. “The actions we took give us greater operational flexibility and position us well to continue executing with confidence.”

Those actions include $5.7 billion in accelerated U.S. government funding, $2 billion from SoftBank, and $5 billion from Nvidia, expected to close in the fourth quarter, alongside proceeds from partial sales of Mobileye and Altera. CFO David Zinsner said Intel exited the quarter with $30.9 billion in cash, its strongest position in years.

The turnaround is as political as it is financial. The U.S. government’s $8.9 billion stake, the first of its kind for a major technology company, underscores Washington’s commitment to reestablishing domestic chip production. Tan publicly thanked President Trump and Treasury Secretary Howard Lutnick for their “trust and confidence,” calling the partnership “essential to restoring semiconductor manufacturing leadership in America.”

Investors have responded enthusiastically. Intel’s shares rose 7% after hours on Thursday and 9.7% in Frankfurt on Friday, extending a 90% rally since January that has outpaced even Nvidia, the same company that once defined Intel’s decline.

Tan described the new partnership with Nvidia as emblematic of Intel’s new approach. The two companies, once fierce rivals, are now developing a hybrid computing platform that connects Intel’s x86 CPUs with Nvidia’s NVLink architecture to accelerate artificial intelligence workloads.

“It’s a new class of product,” Tan said, calling the effort “a multi-year engineering engagement” that could redefine AI data centers. Zinsner added that the partnership “doesn’t attack our existing TAM, it expands it.”

Artificial intelligence has become both a challenge and an opportunity for Intel. The company’s traditional CPUs are benefiting from the rapid build-out of AI infrastructure, which requires both training and inference computing power. Tan said Intel aims to make x86 “the compute platform of choice for AI inference,” with future generations of inference-optimized GPUs and AI-ready PCs.

“We are still in the early stage of the AI revolution,” Tan said. “Intel can and will play a much more significant role as we transform the company.”

Zinsner echoed the sentiment: “It’s increasingly clear that CPUs play a critical role within the AI data center. Some customers are even asking for long-term supply agreements as AI infrastructure expands.”

Under Tan, Intel’s once-grand plan to rival TSMC has been reined in but not abandoned. Its Intel 18A process node remains on track, with Fab 52 in Arizona now fully operational and yields improving predictably. “Building a world-class foundry is a long-term effort founded on trust,” Tan said. “We must learn to delight our customers.”

Zinsner confirmed that Intel Foundry’s $4.2 billion in quarterly revenue was slightly lower sequentially but improving operationally, with losses narrowing by $847 million.

Intel still faces intense competition and lingering doubts about whether its comeback is sustainable. Capacity constraints are expected to persist into 2026, and Tan acknowledged that “we are still a long way to go.” But for now, investors appear convinced.

“The culture is becoming more accountable, collaborative, and execution-oriented,” Tan said. “We are on the journey to rebuild Intel, and we’re making solid progress.”