“Either defend your leader or consider making a change”: Pressure mounts on Intel leadership

Trump’s demand for CEO’s exit sparks boardroom dilemma.

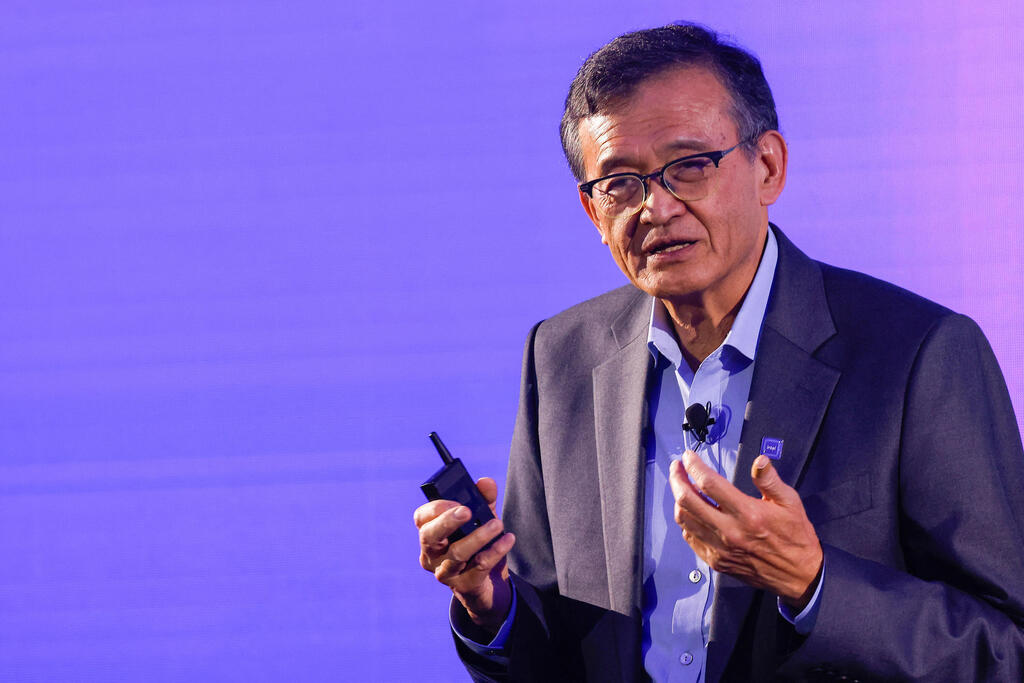

Intel CEO Lip-Bu Tan is already facing an uphill battle in turning around the struggling chipmaker. Now, U.S. President Donald Trump’s demand that Tan resign over his ties to Chinese firms may further distract him from that task.

Trump said on Thursday that Tan was “highly conflicted” due to his Chinese business connections. Reuters reported in April that Tan had invested in hundreds of Chinese companies, some of which were linked to the Chinese military.

Tan may now have to focus on convincing Trump that he is still the right person to revive the storied American semiconductor giant, potentially diverting his attention from the cost-cutting plan he is currently implementing.

“It is distracting,” Ryuta Makino, an analyst at Intel shareholder Gabelli Funds, which owns more than 200,000 Intel shares, told Reuters. “I think Trump will make goals for Intel to spend more, and I don't think Intel has the capabilities to spend more, like what Apple and Nvidia are doing.”

AI chip market leader Nvidia and iPhone-maker Apple have committed hundreds of billions of dollars to expanding domestic manufacturing, a strategy Trump says will bring jobs back to the U.S.

Until recently, Intel had been one of the biggest beneficiaries of the 2022 CHIPS Act, as former CEO Pat Gelsinger announced ambitious plans to build advanced chip factories in the U.S. But Tan has since scaled back those ambitions, as Intel’s goal of rivaling Taiwan’s TSMC in contract manufacturing has fallen short.

Last month, Tan said he would slow construction on new factories in Ohio, committing to build facilities only when there is clear demand for Intel’s chips. The move is likely to further strain his relationship with Trump.

Intel said in a statement Thursday that the company, its board, and Tan were making “significant investments” aligned with Trump’s America First agenda, but did not address Trump’s call for his resignation.

The statement was “bland,” David Wagner, portfolio manager at Intel shareholder Aptus Capital Advisors, told Reuters. “Either defend your leader, which will be the beginning of a difficult road ahead, or consider making a change," Wagner said. Having this play out over a few months is not something that Intel can afford, he said.

Tan himself released a statement late on Thursday. "The United States has been my home for more than 40 years. I love this country and am profoundly grateful for the opportunities it has given me. I also love this company," he said, adding that the board was "fully supportive of the work we are doing to transform our company."

Tan, a veteran of the semiconductor industry, took the helm at Intel about six months ago after the board ousted Gelsinger for years of missteps and mounting losses. Intel shares are flat this year after losing nearly two-thirds of their value in 2024.

Tan previously served as CEO of chip-design software firm Cadence Design Systems from 2008 to December 2021. Last month, Cadence agreed to plead guilty and pay over $140 million to settle charges it sold software to a Chinese military university involved in nuclear weapons simulation, sales that took place under Tan’s leadership, Reuters reported.

Reuters also reported on Wednesday that U.S. Senator Tom Cotton sent a letter to Intel’s board chair questioning Tan’s Chinese business ties and the Cadence case.

"There has been a lot of misinformation circulating about my past roles," Tan said in his statement on Thursday. "I have always operated within the highest legal and ethical standards. My reputation has been built on trust," he said.

It is not illegal for U.S. citizens to hold stakes in Chinese companies unless they are on the Treasury’s Chinese Military-Industrial Complex Companies List, which bans such investments. Reuters found no evidence that Tan held stakes in any company on that list.

Still, Trump’s remarks have put a spotlight on an issue that could hurt investor confidence.

"If you add in another layer of government scrutiny, and everybody looking into how the company is doing whatever it's doing ... that just makes it harder," a former senior Intel executive familiar with the company’s strategy under Gelsinger, told Reuters.

The source, who was laid off during Gelsinger’s workforce cuts last year, said Tan’s current strategy is to “get rid of all of the non-productive parts of the company and really focus on a key few products. If (Tan) leaves, it's going to just prolong whatever Intel has to do and needs to do really quickly."