"Cutting interest rates too early would be like stopping a course of antibiotics halfway through, it could backfire"

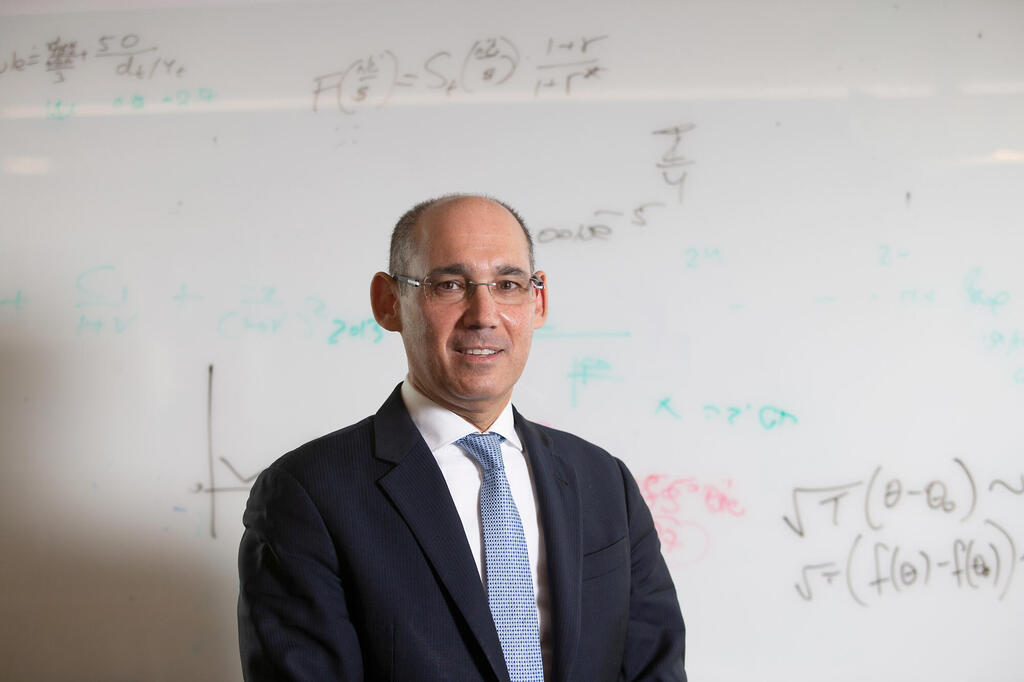

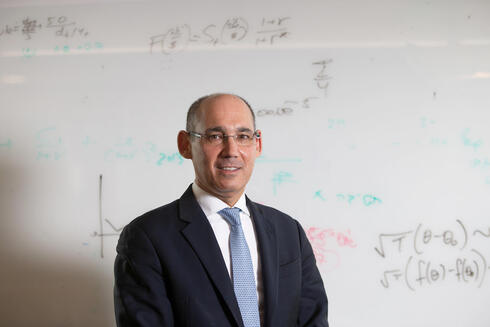

Bank of Israel Governor Prof. Amir Yaron warns of inflation risks and cautions against deficit complacency.

To the disappointment of many, the Bank of Israel’s Monetary Committee decided not to lower the interest rate, keeping it at the high level of 4.5% on Monday. After the decision, Bank of Israel Governor Prof. Amir Yaron conveyed three main messages: first, the risks of inflation persist; second, the Israeli economy is recovering well and can withstand the high interest rate in the coming weeks; and third, “We must be careful not to go too far with the deficit and debt, but there will be no disaster if the debt-to-GDP ratio rises in 2026.” The governor then clarified that his emphasis was on the need to reduce the debt-to-GDP ratio in 2027, and that this commitment should be announced as early as 2026.

As is customary for central bankers, these three messages were not stated plainly but emerge clearly from the overall picture the bank presents through its announcements. Regarding the first message, the Monetary Committee identified three risks to inflation: “geopolitical developments and their effects on economic activity,” “an increase in demand alongside supply constraints,” and “a deterioration in global trade conditions.” In the previous decision, another risk was mentioned: “shekel volatility.” But now, after the shekel has strengthened, this risk has diminished, in fact, the strong shekel should help push inflation down.

"We need to announce steps now that will lower the debt-to-GDP ratio in 2027. It’s not enough to just say we want to lower the ratio," the governor told Calcalist. “For a plan to be credible, decisions must be made now, as we did in 2024 when we announced that VAT would increase in 2025. We need to reassess security needs and determine the appropriate budget size. Some argue for a larger budget, others for a more modest one. We need a reassessment.”

There was a shift in the governor’s tone when discussing the government: This time, he avoided specifics about expected budget policy. He did not call on the government to include “growth-supporting components” or to “substantially reduce funds that do not support growth,” but instead spoke more generally about changing priorities, mainly targeting the defense budget. This more cautious wording may reflect his sense that the 2026 budget will not be passed by the current government, even though the Finance Ministry is already working on it.

According to your forecast, the debt-to-GDP ratio will rise to 71% in 2026. Are you comfortable with that?

"To the extent that conditions allow, we should spend less and ensure the debt-to-GDP ratio does not rise in 2026, or ideally, that it declines. We must maintain the market’s trust that we have earned over the past two years due to responsible fiscal frameworks, even though not every measure was perfect. We still don’t know what ‘degrees of freedom’ we’ll have with the budget. At minimum, the 2027 budget must reduce the debt ratio. If conditions permit, we should stabilize or even reduce it in 2026, alongside investments in growth engines and cuts to non-productive spending.”

The governor explained that Israel’s military success in Iran and a possible end to the war in Gaza could actually fuel inflation, as demand might surge faster than supply constraints ease. For example, many people will want to fly abroad, but it will take time for flights to return to normal capacity. He also noted that the war could push up rents in affected areas, slightly lifting the price index. “Wages are rising at an annual rate of 4.5%. In recent months, wage growth in the business sector has been relatively high, especially outside the high-tech sector, while public sector wage growth remains moderate.”

Many people thought inflation was behind us and that rates could be cut.

"Short-term inflation forecasts are extremely difficult. We’re in an environment of high uncertainty, there could be a ceasefire in Gaza, or fighting could intensify. We see an improvement in Israel’s risk premium, which reflects improved sentiment. This is likely to boost demand and consumption, but we probably won’t be able to bring in enough foreign workers to meet all the demand. So, precisely now, inflation could flare up again, and the cost of fixing that mistake would be severe. We must weigh the shekel’s strength against rising demand and rents.”

Powerful business leaders are calling for rate cuts because the shekel is strengthening, but they are not lowering prices. Do you have a message for them?

"There’s an economic process whereby a stronger shekel should translate into lower prices. But if the strong shekel meets strong demand, that effect is weaker than usual. We want to see the appreciation translate to lower prices and inflation return to target."

But you still expect inflation to fall. You predict 2.6% at year-end?

"Yes, that’s correct. It’s important to say this. Over the coming year, the easing of supply constraints should help bring inflation down. But cutting rates too early would be like stopping a course of antibiotics halfway through, it could backfire."

In its decision, the Monetary Committee wrote that “economic activity continues to recover at a moderate pace, and the labor market remains tight.” The governor also emphasized Israel’s declining risk premium, which supports stronger economic activity. He noted that the labor market remains tight, and that credit, which is highly sensitive to interest rates, is still expanding: “Household credit continues to grow, and we’re not seeing a significant rise in delinquency rates. The share of businesses reporting severe credit constraints remains low.”

Meanwhile, although the Research Department cut its growth forecast for 2025 to 3.3% (down 0.2 percentage points), it raised its 2026 forecast to 4.6%, up 0.6 percentage points. Credit card spending rebounded immediately after the operation in Iran ended, and capital raising in high-tech is sharply increasing, signs that justify keeping rates high for at least another eight weeks.

The Research Department now forecasts that debt will reach 70% of GDP in 2025 and 71% in 2026, up from a previous forecast of 68% in April. This change stems from higher spending and lower revenues in 2026: revenues will drop by about NIS 10 billion after it became clear that the Wiz deal would yield less than expected for the state treasury, while spending will rise by about NIS 16 billion due to the estimated cost of the war rolling into the 2026 budget. The Research Department also assumes that the Nagel Committee’s defense supplement (NIS 15 billion) will be added to the budget. Under this forecast, the deficit in 2026 will reach 4.2%, 1.3 percentage points higher than the previous estimate.