Foodtech’s harsh reality check: From bold IPOs to preservation list

Investor hopes of robot chefs, vegan proteins, and lab-grown honey have given way to losses, layoffs, and near-worthless stocks.

About four and a half years after its IPO on the Tel Aviv Stock Exchange (TASE), and after losing 87% of its peak value, shares of NextFerm were last week transferred to the TASE preservation list, a holding area for companies on the verge of delisting. The move followed the company’s inability to secure financing for its continued operations and the effective suspension of its business activity, leading the Israel Securities Authority to classify it as a shell company.

Just six weeks earlier, another foodtech firm, SavorEat, had been sent to the same list, after the value of its public float fell below TASE requirements. The company’s market capitalization now stands at only NIS 5 million, down from a peak of NIS 386 million.

NextFerm and SavorEat are not alone. Both were part of a cohort of foodtech startups that went public in 2020–2021 with bold promises of alternative food solutions. Wilk and Beeio Honey also joined the exchange during that period, raising high hopes among investors. But the dream has since evaporated: from a combined peak valuation of over NIS 1 billion, only NIS 54 million remains today.

The wave extended beyond individual firms. Three R&D partnerships were also floated to channel capital into foodtech ventures. Of these, only BioMeat Foodtech has delivered for investors, with a 109% return. The other two, Millennium Foodtech and Feat Investments, lost 97% and 83% of their value, respectively.

This was part of the IPO boom of 2020–2021, when 121 companies listed in Tel Aviv, compared with only 19 over the next three years. Many of the new listings were “dream companies”, tech-heavy ventures with innovative concepts but no profits, and often no revenues. Cheap money in the pandemic era allowed such companies to raise funds at lofty valuations, but the end of low interest rates in 2022, coupled with political upheaval and war in Israel, drove investors back to safer assets and left these firms stranded.

By April 2024, NextFerm had suspended operations, citing its inability to raise capital. Former CEO Boaz Noy admitted: “The foodtech field requires much more investment and time than we can raise.” Attempts to raise money fell far short of targets, and in October the company laid off all employees. A temporary reprieve came when investor Yarin Ben Simhon injected NIS 3 million, becoming controlling shareholder, but controversy over his legal troubles and governance style soon drove the founders to resign.

SavorEat, for its part, entered the exchange in December 2020 with a market cap of NIS 251 million, briefly soaring to NIS 386 million on the promise of its “robot chef.” But revenues never materialized, losses accumulated to NIS 51 million, and in recent months it too announced layoffs and efficiency measures before being demoted to the preservation list.

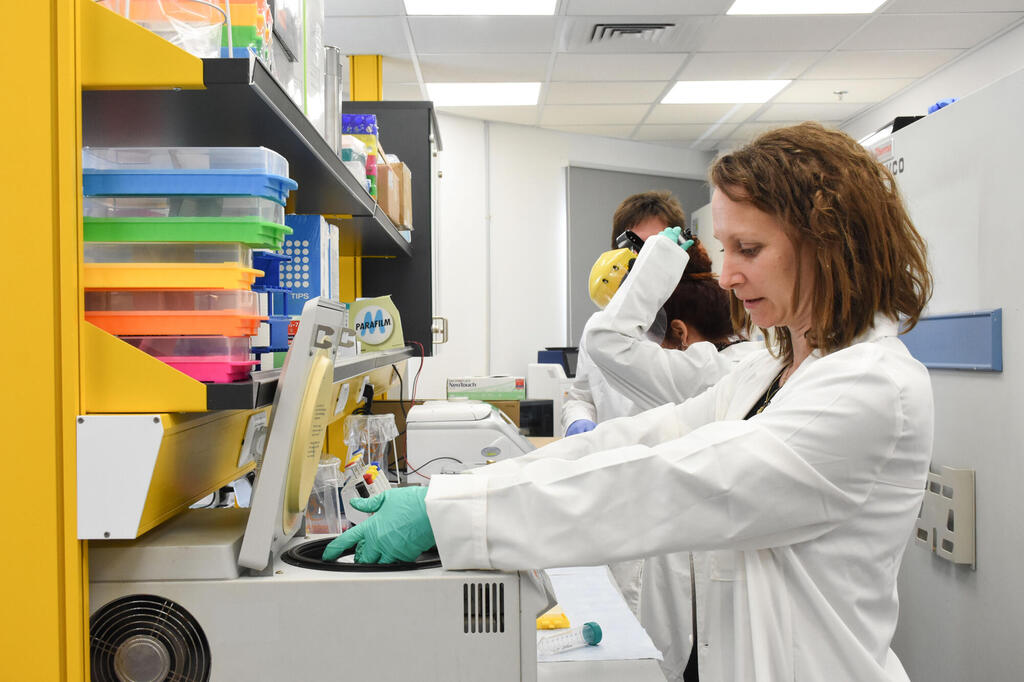

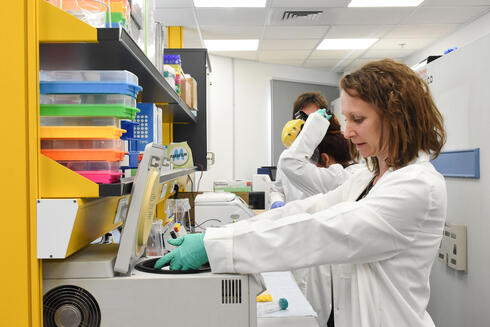

Wilk, which is developing cultured milk proteins, has also failed to generate revenues despite raising capital and replacing its CEO four times. Its value has collapsed from nearly NIS 300 million at listing to NIS 11 million today. Beeio Honey, which develops cultured honey, followed a similar path, losing 99% of its value and cycling through three CEOs and several controlling shareholders.

Together, the four firms exemplify the rise and fall of Israel’s foodtech “dream stocks”, launched in a boom of optimism, but left struggling to survive in today’s harsher financial climate.