Lemonade reaches $1 billion in premiums as 2025 kicks off strong

Israeli insurtech achieves major milestone with solid revenue growth despite challenges from California wildfires.

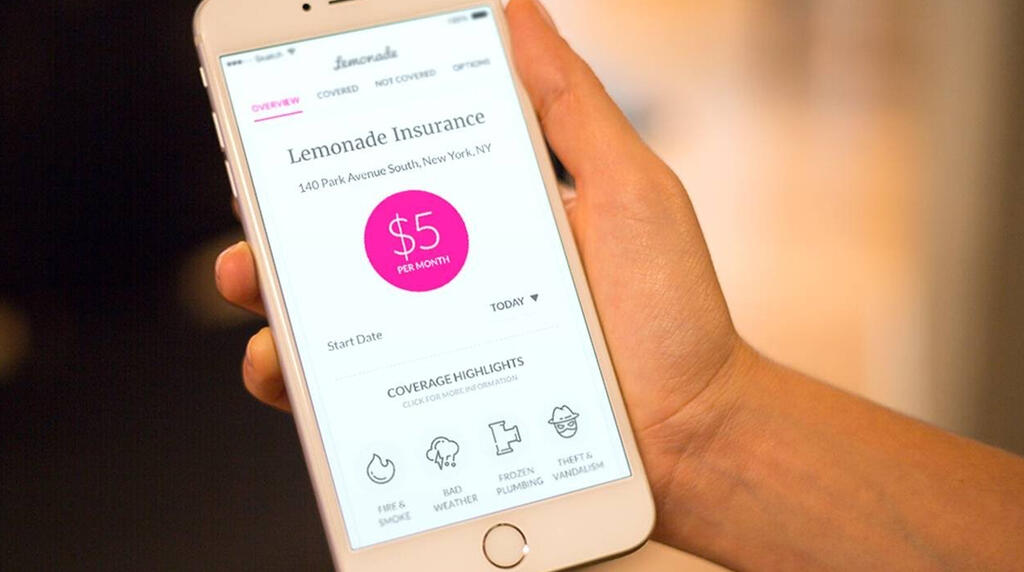

Israeli insurtech Lemonade is starting 2025 on a positive note. The company has surpassed the $1 billion mark in premiums, just eight and a half years after selling its first policy. The stock is up 4% in New York at the time of writing.

Following the increase in premiums, its revenues also grew by 27%, reaching $151.2 million in the first quarter. Despite the fires in California, where Lemonade insures some property owners, it maintained a 78% ratio between claims payments and revenues. Over the past 12 months, this ratio has been 73%.

However, the California fires did take a toll on Lemonade's results. They led to a loss of $62 million, with a negative impact of $22 million related to the fires.

As a result, Lemonade has returned to negative cash flow after managing to generate positive cash flow in the last quarter of 2024. Despite this, the loss is in line with the forecast the company provided to analysts and is even slightly lower than expectations—86 cents per share compared to the average analyst forecast of a loss of 94 cents per share.

Lemonade reiterates its forecast for 28% revenue growth in 2025, which will bring its total revenue to approximately $662 million. It also maintains its growth target of 30% for 2026.

The company expects to end the second quarter of 2025 with revenue between $157 million and $159 million. The bulk of Lemonade's revenue comes from building insurance policies, with additional sales from auto policies in select U.S. states and pet insurance policies.