Mental health tech investment soars 150% to $352 million as market consolidates

A new report by Startup Nation Central and partners reveals a dramatic shift in the sector: capital is doubling while deal count drops, signaling a move toward deep-tech and clinical solutions in the wake of the war.

Investment in mental health technology has recorded a sharp quantitative increase over the past year, characterized by a consolidation of capital into fewer, larger funding rounds. According to new data covering the 2024-2025 period, the sector raised a total of $352 million in 2025, marking a 150% increase compared to the $138 million raised in 2024.

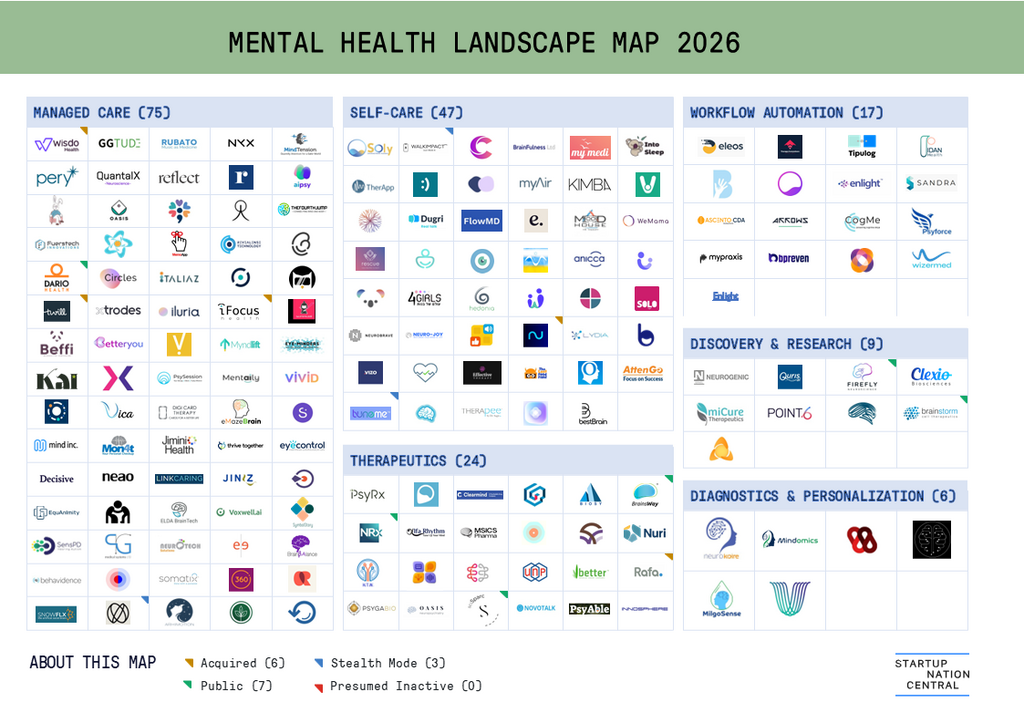

These figures were released as part of the "2026 Mental Health Technology Map," a comprehensive industry report produced by Startup Nation Central in collaboration with the ICAR Collective, the 8400 Health Network, and Bezyl. The map currently tracks the activity of 178 companies operating in the field.

The data reveals a tightening of the market structure. While total capital more than doubled, the number of investment rounds decreased from 20 in 2024 to 13 in 2025. This indicates a trend toward larger investments in maturing companies rather than a wide spray of Seed funding.

The sector's dominance within the broader health-tech industry is statistically significant. In 2025, three of the top five investment rounds in the entire health technology ecosystem were secured by mental health companies. These three deals alone accounted for 297 million NIS out of the 532 million NIS total raised by the top five health-tech performers. Despite this influx of capital into top-tier players, the ecosystem retains a strong pipeline of new innovation, with 80% of mental health startups currently classified as being in early-stage development.

The report identifies a distinct transition in the types of technologies being developed. The market is moving away from general "Wellbeing" applications toward deep-tech, clinical, and system-integrated solutions:

- Managed Care: Now the largest sub-sector with 75 companies, reflecting a demand for infrastructure solutions that integrate with insurers and health systems.

- Self-Care: The second-largest category with 47 companies, signaling a maturing market less reliant on generic wellness platforms.

- Workflow Automation: This category has grown to 17 companies, highlighting an industry-wide focus on improving provider efficiency.

R&D activity is increasingly segmented into specific clinical stages. For the projection year 2026, the report categorizes companies as follows:

- Therapeutics: 24 companies focused on evidence-based treatment.

- Discovery & Research: 9 companies.

- Diagnostics & Personalization: 6 companies.

While the data is global in relevance, the drivers are local. The report describes the Israeli market as a "living lab" due to the complex trauma resulting from the ongoing conflict. The Ministry of Health has responded by advancing policies to integrate these technologies into the public health system, including funding tracks for Digital Therapeutics (DTx).

Adi Ostri Matalon, a lead investor in the sector, explains the dynamic: "Israel has become, following the war, a living lab containing thousands of people dealing with personal and national trauma... creating a need for solutions that will simplify the treatment process and assist it in an optimal way".

However, experts warn that private capital alone is insufficient for long-term sustainability. Yariv Lotan, VP of Product and Data at Startup Nation Central, states: "Alongside private investment in the field, national investment in health policy is required to leverage digital innovation... and support for research and development".

Addressing the balance between digital tools and traditional therapy, Gila Tolub, CEO of the ICAR Collective, notes: "In trauma healing, the core will always be human - relationships, trust, and accompaniment. But without technology, this response remains limited in scope.”