JP Morgan expands operations in Israel, enters high-tech commercial banking

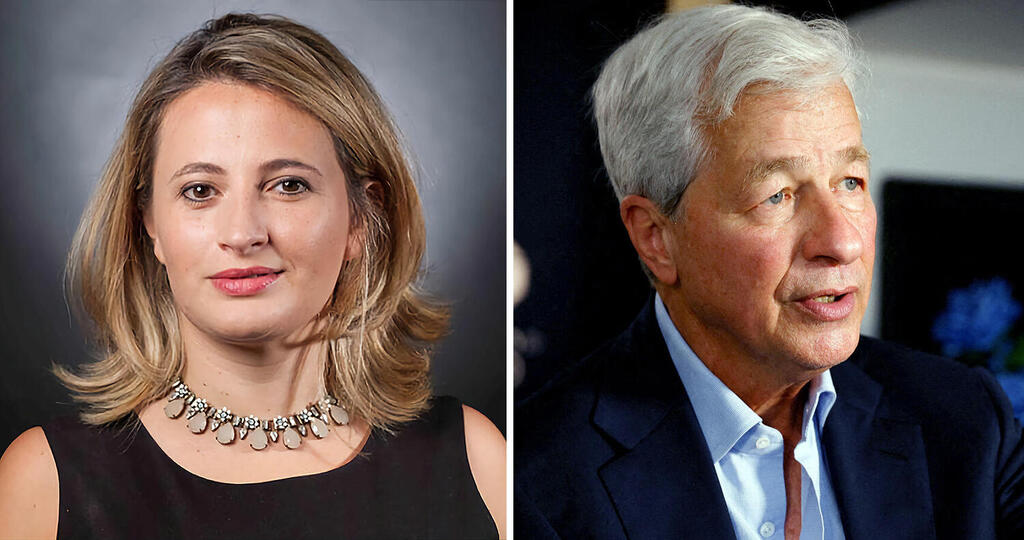

The global banking giant has recruited Darya Fuks to lead new venture, intensifying competition in high-tech financing

JP Morgan, one of the world's largest banks, is expanding its operations in Israel and entering the commercial banking sector for high-tech companies for the first time.

Calcalist has learned that the bank has already hired ten employees for this new venture, which will be led by Darya Fuks, former head of corporate development at Wix and a former employee of JP Morgan. Until now, JP Morgan's presence in Israel, managed by Roy Navon, was mainly focused on investment banking, private banking, and wealth management. The bank opened its first office in Israel in 2000.

This new initiative in Israel falls under JP Morgan's Innovation Economy banking division, which aims to cater to growth companies, founders, and the venture capital community. The move adds to the competition in account management and financing services for high-tech companies. Just last week, HSBC announced its entry into this sector in Israel with the acquisition of the European branch of the collapsed Silicon Valley Bank. Additionally, investment management giant BlackRock recently acquired Kreos Capital, which has plenty of activity in high-tech financing in Israel.

With the IPO market on Wall Street displaying little activity and venture capital funds facing resource limitations, the credit market for high-tech companies is becoming increasingly active. JP Morgan will focus primarily on late-stage high-tech companies, offering services such as capital raising support, liquidity solutions, and payment management. The bank will also provide strategic advice to venture capital funds and their portfolio companies. In this regard, JP Morgan will directly compete with UBS, which offers similar services and recently expanded its presence after acquiring Credit Suisse.

JP Morgan has been developing its innovation banking division over the past four years and recently acquired First Republic Bank (FRB) to further strengthen its presence in Silicon Valley and the technology sector overall.