The gig is up: Customers paying the price for the sharing economy

From Uber, to Airbnb, to Wolt. The "disruptive technology" companies promised an easy and shiny new life using cheap money. However, once interest rates rose, services that were once efficient, cheap and aesthetic have become complicated, expensive and unattractive

Once upon a time, Uber and Lyft cabs used to be black and shiny, competing with each other on availability, speed and price. Streaming services competed for quality content libraries at affordable prices and food ordering apps used to provide service for free.

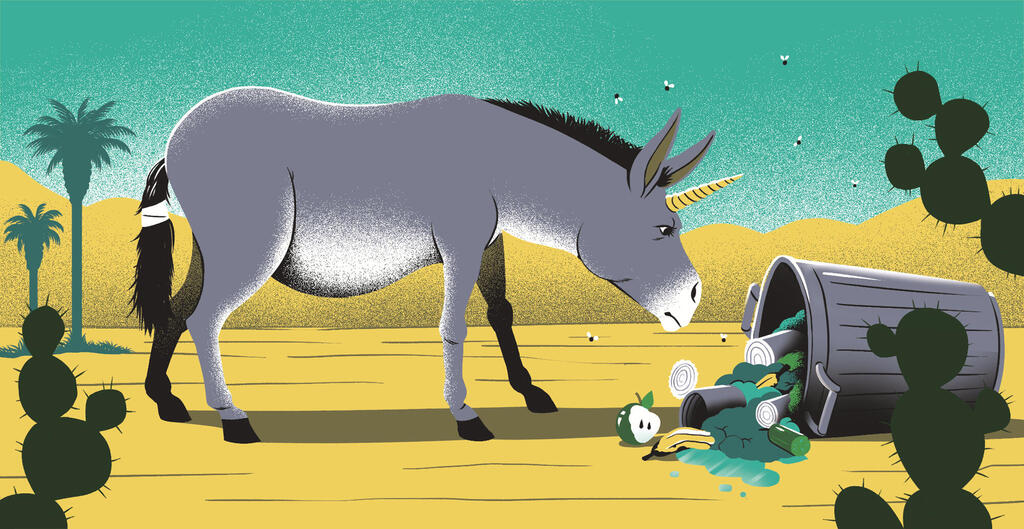

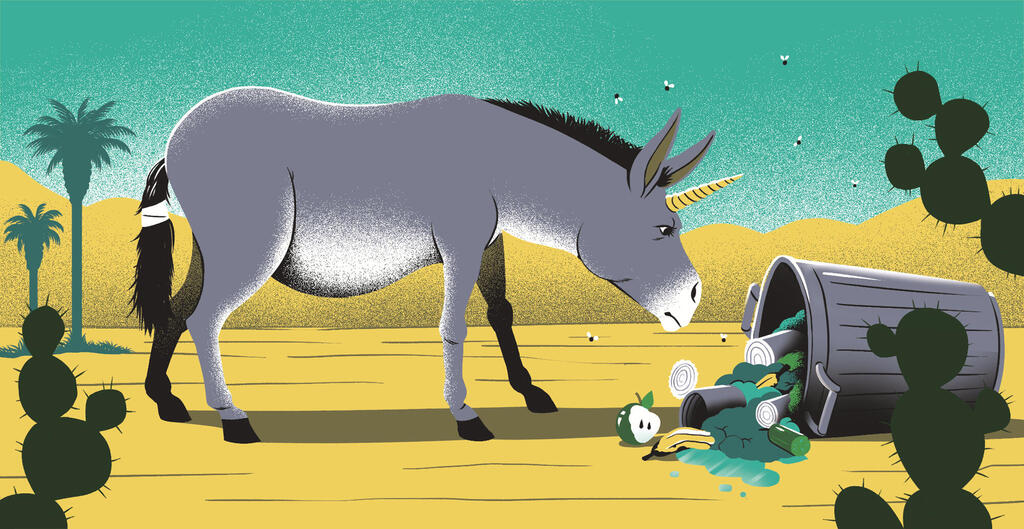

That has all changed. Today Uber and Lyft taxis are old and beat up. There are three mobile devices on the driver's dashboard, one for each app the driver uses so that they can take a ride in one app while still completing another ride. A similar trick is used by the food couriers. It is not rare to see a delivery person wearing Wolt’s jacket, while the food comes in Uber Eats’ boxes, all while you ordered it from a third app. What about the shared scooters and bikes? They are dirty, and scarred from many accidents and too many trips.

1. Responsibility for the destruction of the urban fabric

Along with the deterioration, prices are also rising, here is a partial list: The streaming service Netflix, which once heralded the end of the cable era and the beginning of the era of abundance, announced that it would raise prices (again), because otherwise how would it be able to show a net profit? The basic price offered will be twice as high as it was when the service was launched.

At least Netflix has done it over a decade of operation. Hulu doubled its price in five years, Disney Plus did it in two and a half during what the Wall Street Journal called "streamflation". Amazon not only doubled the prices of its Prime services, but also increased the minimum order required for free shipping services by tens of percent, and from this month subscribers are also forced to watch advertisements on the streaming service.

Uber, Lyft and others, the darlings of venture capital until five years ago, have in recent years raised prices by dozens of percent and significantly increased the fees they charge drivers. The numbers look particularly bad. According to the research company YipitData, Uber, the most dominant player of all, has raised its fares by about 17% every year for the past four years (since it started trading and stopped being supported by venture capitalists), four times compared to the consumer price index. Global transportation researcher Hubert Horan recently estimated that Uber "offers higher prices and worse service than the traditional taxi industry offered a decade ago." The food service companies completely broke the market (in every bad sense), and created a unique price inflation that includes a price increase of about 50% in recent years on the delivery menu (on which restaurants will quote higher prices than in the actual restaurant). To these, of course, a service fee, shipping fees and then tips must be added.

And what about Airbnb? In places where its activity was not restricted by regulators as in Berlin and London, no market was broken. We were left with prices similar to hotels, a mediocre IKEA experience and high fees, and most importantly - the company broke the local housing markets and led to a collective price increase. One study found that New Yorkers paid $616 million more annually in rent payments as a result of long-term rental apartments becoming Airbnb apartments. Another study found that just last summer, 17,000 housing units were lost to short-term rental platforms in British Columbia, Canada. In Tel Aviv, over 8,500 apartments were lost that moved to the platform and further suffocated the stressed local market.

This is how we reached 2024 and the reality where in quite a few cases the traditional services look better. The companies that excelled in fast, reliable, cheap service and were proud of their high standard, no longer set the standard at what they are supposed to be best at. A taxi is nicer than Uber, a hotel is nicer than an Airbnb apartment, and delivery people from a restaurant come with hot food (and less service fees); Amazon has heaps of fake products, and it's really better sometimes to just go to the store.

It was almost possible to forget that throughout the past decade we talked about these companies in glowing terms. They are framed as incredibly innovative, smart and successful companies that will catapult the housing, trade, transportation, tourism and shipping markets into the future. Their activities are designed to fix bad and expensive industries through disruptive and creative technology.

And they really did change the public space and existence beyond recognition: the rental housing market is going crazy, the neighbors change every week, wages have eroded, social benefits are taken in exchange for "flexibility in working hours", the streets and roads become more dangerous due to the flooding of unsupervised means of transport, and more taxis that wait more time to work creates more traffic jams and air pollution.

2 View gallery

The damage of the "old" world is already taking its toll

(Illustration: Yonatan Popper)

2. They destroyed the old world and were destroyed in the process

What happened to these companies? The ride-sharing companies stopped subsidizing the trips and took more profits from the drivers, who bear the maintenance costs anyway. The food delivery companies bought each other to death; Scooters have no business model; The costs of creating original content are high and the competition in streaming services is expanding. But the main reason for the current situation is that these are post-hype days, when there is not even a vapor left from the investment fire of the previous decade. The mountain of money that fueled the market to establish a new digital economy is gone; This is a time when aggressive growth is no longer supported, and instead all energy and money are invested in new worlds (artificial intelligence).

About a decade ago, the "retail apocalypse" was announced. The term was meant to describe the decline of malls across the United States, which became abandoned, broken and irrelevant following the e-commerce revolution and the rise of companies like Amazon that offered fast deliveries and low prices. The Internet was defined as responsible for a tectonic change in the American shopping culture, which led to the closing of hundreds of thousands of stores in the U.S., mass layoffs and finally literally destroyed entire communities built around the malls. Apocalypse is a dramatic term and there were spectacular images to justify it - huge neglected buildings, huge empty parking lots and boarded up shops.

While technology companies, startups, venture capital investors and some financial analysis companies are investing efforts to create a better future through artificial intelligence, the damage of the "old" world is still taking its toll. Old is a relative term and in this sense refers to the last two decades characterized by "cheap" money, and aggressive investments in technology companies that also promised to change the future for the better. Today it becomes clear that what destroyed the old world was created in such a way that it had no other option but to be destroyed. The subsidizing of the services of the disruptive startups has also ended, and among the ruins of the abandoned and ugly shopping malls, the tragedy of cheap prices is revealed, which includes a show of battered Uber and Lyft cars, sticky scooters and smelly Airbnb apartments. Today there is no free shipping, no free travel, no movies without ads. This is the cheap money apocalypse.