Bankrupt tech entrepreneur faces new pressure in $120M collapse as creditors chase eToro holdings

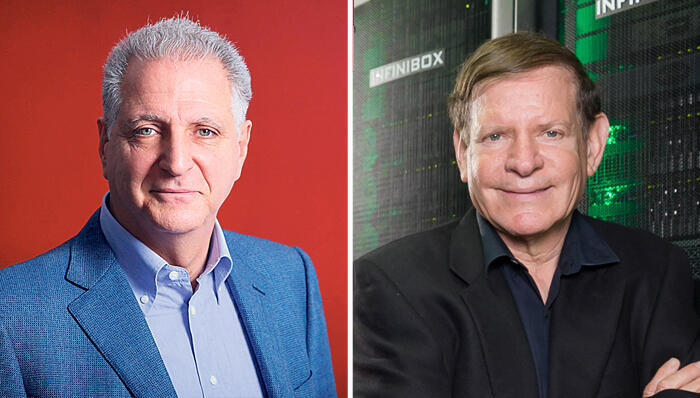

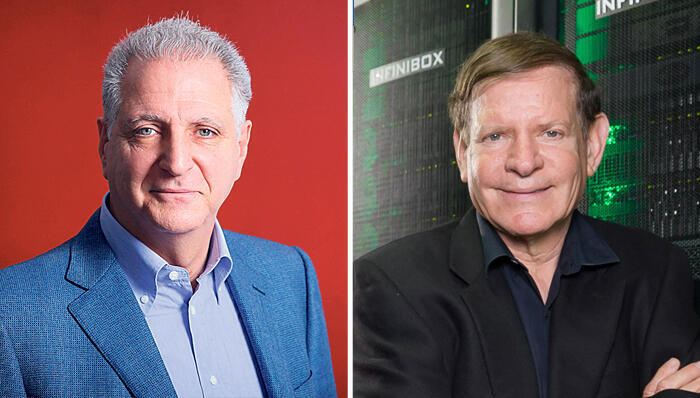

Shavit Capital and NY24 seek control of shares tied to Moshe Yanai.

The Shavit Capital investment fund, in which businessman Leon Recanati is a partner and serves as chairman, according to the fund’s website, is claiming a debt of approximately $7.5 million from the holding company MII, owned by bankrupt high-tech entrepreneur Moshe Yanai, Calcalist has learned.

Shavit and another high-interest, non-bank lender, NY24 of New York, which alleges a debt of about $5 million from Yanai, are now seeking to seize shares in the trading platform eToro valued at an estimated $13.7 million. The shares are registered under Yanai’s name and under companies he controls. The creditors are attempting to take control of the assets to recover the debts, according to a request filed last week by Yanai’s bankruptcy trustee, attorney Shuli Goldblatt. According to Shavit Capital’s website, eToro is among the portfolio companies in which it invests.

Attorney Goldblatt wrote: “The trustee has learned that several parties - Yanai’s creditors, directly and indirectly - have contacted him asserting rights to the shares owned by MII or ETR (another company owned by Yanai). These claims are based on various agreements they say MII and Yanai signed, either personally or through guarantors, at different times.”

Following the trustee’s request, Tel Aviv Magistrate’s Court Judge Lior Gelbard issued a freezing order prohibiting the transfer or disposition of the eToro shares registered in Yanai’s name or under companies he owns.

The alleged debts to Shavit and NY24 add to a long list of liabilities attributed to Yanai, estimated at $120 million, owed to banks, investment funds, non-bank credit companies, and personal acquaintances. On the asset side, according to estimates, Yanai owns shares in technology startups, four houses, four vehicles, and additional property valued at $60–70 million.