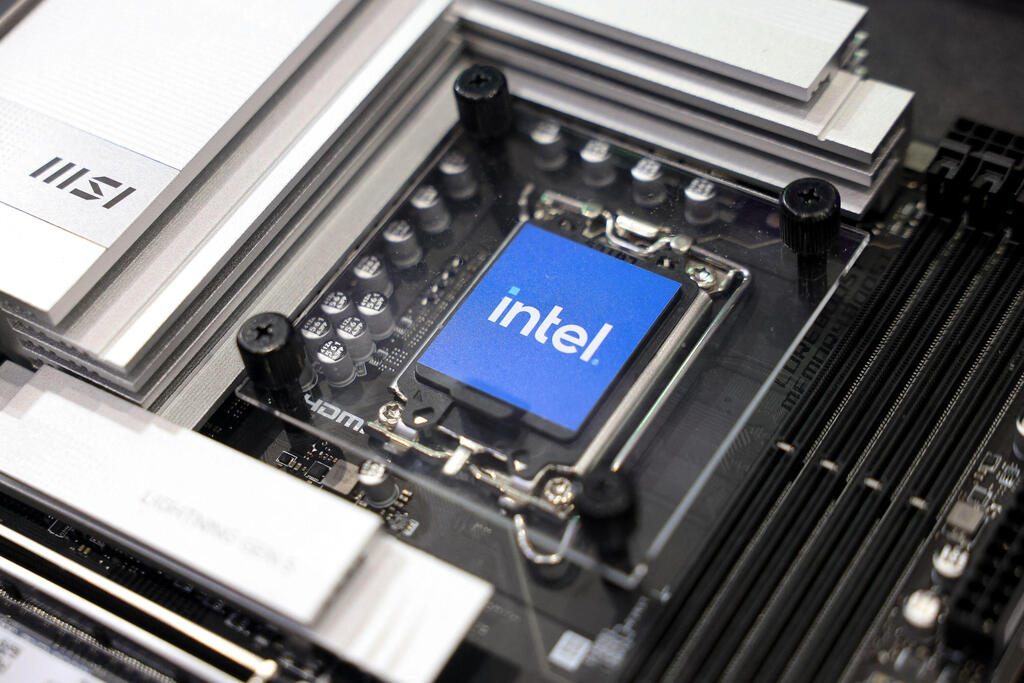

Intel gets boost from U.S. stake rumors despite deep struggles

Proposed federal stake sparks debate over industrial policy and corporate rescue.

Intel shares rose more than 20% last week on hopes of additional financial aid for the struggling chipmaker, following a report that the U.S. government may buy a stake in the company.

The Bloomberg News report came after a Monday meeting between CEO Lip-Bu Tan and President Donald Trump. The meeting followed Trump’s demand for Tan’s resignation over what he called the executive’s “highly conflicted” ties to Chinese firms. Trump later described the meeting as “very interesting.”

The administration’s consideration of an equity stake in Intel marks the latest in a series of unprecedented corporate interventions. Trump has previously backed a deal that would make the Department of Defense the largest shareholder in rare-earth producer MP Materials.

According to Bloomberg, the government is weighing the use of funds from the 2022 CHIPS Act, signed into law by then-President Joe Biden, to acquire a stake in Intel. Last year, Intel secured nearly $8 billion in subsidies under the act, the largest award to date, to support new factories in Ohio and other states. Those plans were championed by former CEO Pat Gelsinger, who staked Intel’s recovery on reviving its manufacturing dominance.

Tan, however, has scaled back those ambitions, slowing construction in Ohio. His approach ties factory development to actual demand for services, an outlook that analysts say could clash with Trump’s push to strengthen domestic semiconductor production.

Neither Intel nor the White House immediately responded to requests for comment.

Analysts said additional federal backing could give Intel more breathing room to revive its loss-making foundry business. But challenges remain: the company faces a weak product roadmap, difficulty attracting customers, and growing doubts about its ability to compete in advanced chipmaking.

“This could be a game-changer,” said Matt Britzman, senior equity analyst at Hargreaves Lansdown. “But government support might help shore up confidence, it doesn’t fix the underlying competitiveness gap in advanced nodes.”

Intel has long since ceded leadership in manufacturing to Taiwan’s TSMC. It has almost no foothold in the booming AI chip market dominated by Nvidia, and continues to lose share in PCs and data centers to AMD.

Its most advanced 18A manufacturing process has also run into trouble. Reuters has reported quality issues, with only a small percentage of chips meeting customer standards. Intel still relies partly on TSMC to manufacture some of its own designs.

“Intel also needs capability; can the U.S. government do anything to help here?” Bernstein analysts asked. “Without a solid process roadmap, the entire exercise would be economically equivalent to setting tens of billions of dollars on fire.”

First published: 11:38, 17.08.25