Analysis

From ashes to orbit: How Israel rebuilt its satellite program

Nine years after the Amos 6 explosion, IAI’s Dror 1 carries the weight of lost deals, political bargaining, and a quest for technological self-reliance.

Apart from being dramatic and breathtaking, launching a satellite into space is a major scientific feat that demands countless calculations and meticulous planning over many months. It is the absolute domain of scientists in white coats and seasoned engineers, yet this unique status, which carries enormous potential risks of malfunctions and disruptions, also invites superstition and silent prayers.

On Sunday morning, long minutes after SpaceX’s Falcon 9 rocket, owned by American billionaire Elon Musk, carried Israel’s new communications satellite Dror 1 to its intended orbit 36,000 kilometers above Earth, did the heads of Israel Aerospace Industries (IAI) feel ready to talk about it. Over the tense weekend leading up to the launch, they kept silent, “because no one wants to cast an evil eye.”

Dror 1 is the first communications satellite that IAI has designed and built since its predecessor, Amos 6, which was intended for a commercial communications company, was destroyed during a wet rehearsal before it could be launched almost nine years ago. Two days before its planned launch, it was already secured inside the capsule atop the Falcon 9 rocket at Cape Canaveral Space Force Station in Florida.

A malfunction during rocket refueling caused an explosion that turned the $200 million, 5.5-ton satellite into ashes, along with broken hearts and a failed business plan for Spacecom. At the time, Spacecom was about to be sold to the Chinese media group Xinwei for about $285 million in a deal contingent on the successful launch of Amos 6. A major payment from Facebook, which intended to use the satellite to connect parts of Africa to the internet, also evaporated. Less than a year earlier, Spacecom had lost Amos 5 after it unexpectedly lost contact with Earth.

The trauma of that explosion remains vivid. The image of the fireball that engulfed the Florida launch pad is seared into the memories of IAI’s project managers. Back then, Boaz Levy, then head of IAI’s Missile and Space Division, was on a flight to Cape Canaveral to witness the launch up close. When he arrived, there was nothing left to see: neither rocket nor satellite. On Sunday morning, after the successful launch of Dror 1 from the same base and using the same rocket, Levy, now IAI’s CEO, reported with relief that “the corrective experience has been achieved.”

Beyond the financial blow to Spacecom, the Amos 6 failure exposed Israel’s lack of strategy for its communications satellite industry. Spacecom was IAI’s sole customer for such satellites. After the explosion, the company scrambled to reduce losses, leasing a satellite from Canada’s Loral and later ordering Amos 17 from the American giant Boeing.

IAI’s production rate for communications satellites is about one every four to five years, while Boeing and other major global players can produce up to six annually. IAI has struggled to offer a competitive solution for the rapidly evolving communications sector, both in delivery time and cost. Its future in this field remains uncertain: without new orders, it risks losing the skilled workforce essential for building such satellites.

A special committee led by then–Director General of the Ministry of Science, Peretz Vazan, concluded that Israel’s capabilities in this area fulfill vital national needs and preserve the country’s independence in information and data flow. Following his recommendations, in mid-2018 the Ministry of Science announced it would commission a communications satellite from IAI.

The work order arrived at IAI about five years ago, at a cost of around $200 million. Development faced multiple hurdles: the COVID-19 pandemic, global flight shutdowns, supply chain disruptions, domestic political instability, the recent judicial overhaul, the October 7 war, and the pivot to emergency operations to support the IDF and Israel’s defense needs.

The government’s commitment to the committee’s recommendations is expected to support the launch of a new Dror-series satellite every five years for the next two decades. After IAI engineers position Dror 1 in its final orbit and it begins operations in about a month, the company will turn to the state to plan and fund Dror 2. Although the government defined this as a “strategic need,” it has yet to hold a single discussion about it.

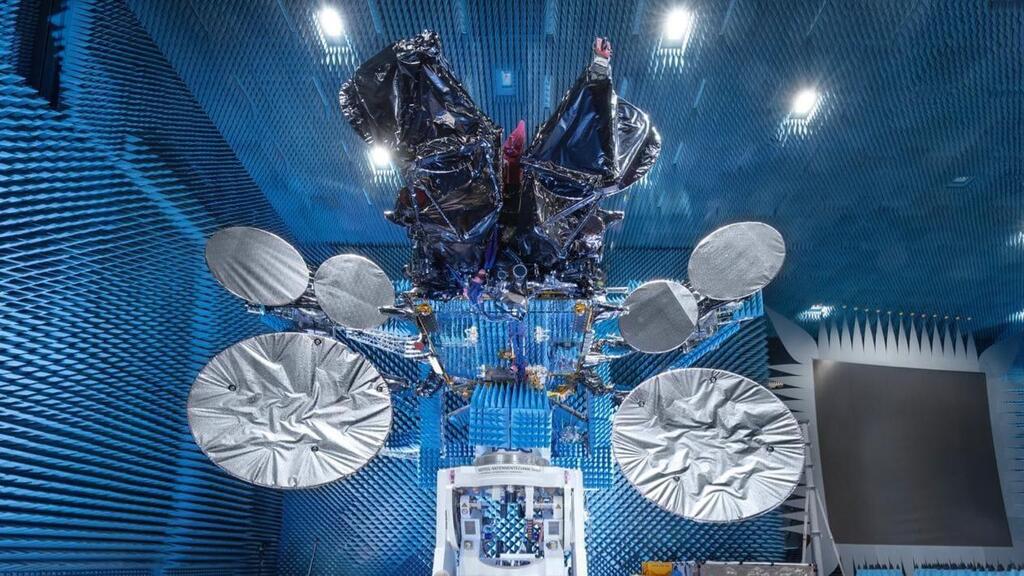

Dror 1 was built entirely with local production and, according to IAI, is the most advanced communications satellite it has ever developed. It will deliver secure, always-available communications for government bodies with complete Israeli operational independence, in contrast to the state’s partial reliance on the earlier Amos series sold to Spacecom. “We’ve managed to retain the best minds and capabilities in this field and haven’t compromised on anything. We have an excellent, advanced satellite, and so far, every stage of the launch has gone smoothly,” IAI CEO Boaz Levy told Calcalist.

The planned operational lifespan of Dror 1 is 15 years. IAI says that expanding the Dror series with a new satellite every five years will ensure Israel’s redundancy and resilience in this critical area. While the government must soon make decisions about the future of communications satellites, the defense establishment has already drawn its own lessons from the recent 12-day war with Iran, emphasizing the need to strengthen its intelligence satellite capabilities.

Today, Israel’s defense forces operate several intelligence satellites from the Ofek series, also built by IAI. Unlike a communications satellite that remains fixed high above Earth, these orbit every 90 minutes at altitudes of a few hundred kilometers.

The Defense Ministry’s plans now include developing and deploying constellations of dozens of “nano-satellites” capable of coordinated maneuvers over multiple points of interest at high frequency. Operating satellites in this way should deliver continuous, high-resolution coverage of any area of interest and provide improved tracking and “area dominance” for intelligence operations.