Israel’s mega-Seed era: The 10 biggest Seed rounds of 2025

Repeat founders and cybersecurity dominate a reshaped early-stage funding market.

Seed funding in Israeli high-tech has traditionally meant modest checks, small teams, and limited expectations. In 2025, that model is increasingly giving way to something very different.

According to data from venture capital firm Viola, roughly 5% of Seed transactions in Israel now qualify as “mega-seed” rounds, typically in the $20-50 million range. These deals are overwhelmingly concentrated among second-time founders, often in cybersecurity, whose prior exits, global networks, and operational credibility resonate immediately with U.S. investors.

The following list highlights the 10 largest Israeli high-tech Seed funding rounds of 2025, offering a snapshot of how experience and capital are reshaping the earliest stage of company building.

Sector: Cybersecurity (AI-driven penetration testing)

Founders: Pavel Gurvich, Ariel Zeitlin, Ofri Ziv, Itamar Tal, Aner Mazur

Founded in May 2025, Tenzai raised an exceptional $75 million Seed round led by Battery Ventures, Greylock Partners, and Lux Capital. The company is targeting the penetration-testing market by using AI to replicate and scale the work traditionally performed by elite human hackers.

Most of the founding team previously built Guardicore, which was acquired by Akamai for $600 million in 2021, while Mazur served as founding CPO at Snyk.

Sector: Cybersecurity (autonomous security investigations)

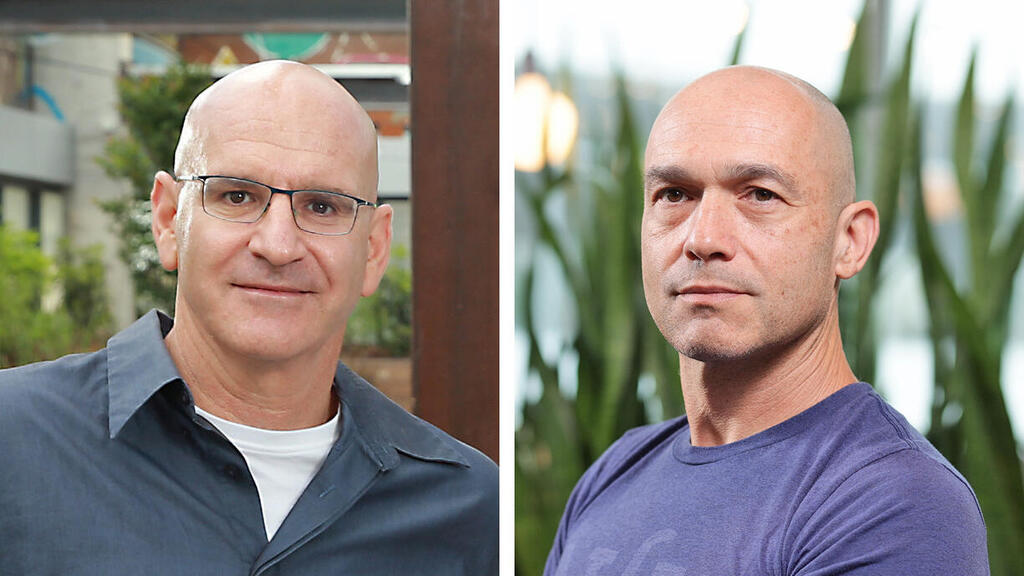

Founders: Lior Div, Yonatan Striem-Amit

7AI’s rise has been unusually fast. The company raised a $36 million Seed round in February 2025 and followed it just ten months later with a record $130 million Series A.

Founded by Cybereason’s former CEO and CTO, 7AI develops autonomous AI agents that conduct security investigations at scale, processing millions of alerts and sharply reducing false positives for large enterprise customers.

Sector: Identity security

Founders: Roy Katmor, Robert Wiseman, Ido Kelson

Orchid Security raised a $36 million Seed round co-led by Team8 and Intel Capital to tackle the growing complexity of enterprise identity environments.

Katmor and Kelson previously co-founded enSilo, which was acquired by Fortinet, while Wiseman led identity initiatives at Team8 and Claroty. The company is building an AI-driven orchestration platform to unify identity security across cloud and on-prem systems.

Sector: AI agents for call centers

Founders: Bar Winkler, Roey Lalazar

Founded in early 2025, Wonderful raised $34 million in Seed funding led by Index Ventures to build multilingual AI agents for call centers, with a focus on non-English markets.

Winkler previously founded Approve.com, which was sold to Tipalti, while Lalazar founded the localization startup Kaps. Just four months after its Seed round, Wonderful raised a $100 million Series A.

Sector: Cybersecurity platform

Founders: Guy Flechter, Ron Peled

Sola Security emerged from stealth with a Seed round of roughly $30 million, aiming to democratize the creation of cybersecurity tools.

Flechter previously led Cider Security until its acquisition by Palo Alto Networks, while Peled served as Global CISO of LivePerson. The platform allows security professionals to build tailored tools without deep engineering resources.

Sector: Enterprise AI platforms

Founder: Shay Levi

Unframe raised an undisclosed $20 million Seed round before emerging publicly with a $30 million Series A. The company was founded by Shay Levi, co-founder of Noname Security.

Unframe is positioning itself as an all-in-one AI platform designed to replace legacy enterprise software with rapidly deployed, customized AI solutions.

Sector: Identity and access intelligence

Founders: Barak Perelman, Mille Gandelsman, Ido Trivizki

Following their exit to Tenable, the founders of Indegy raised $20 million in Seed funding for Opti, a startup focused on automating and clarifying complex relationships between users, systems, and permissions in large organizations.

Investors are backing the company’s attempt to create an intelligence layer for access sprawl in enterprise environments.

Sector: AI-driven sales intelligence

Founders: Tal Peretz and partners

Onfire AI raised $20 million in Seed funding across two phases to apply military-grade intelligence methodologies to SaaS sales.

The company analyzes open online data to identify real-time demand signals, helping sales teams target prospects with greater precision.

Sector: Cloud security

Founders: Jonathan Langer, Itay Kirshenbaum, Stephen Goldberg, Ilai Fallach

Founded by the team behind Medigate, which was sold to Claroty for about $400 million, Act Security raised a $20 million Seed round from Team8 and Bessemer.

The company aims to move beyond cloud visibility toward enabling concrete, actionable risk reduction. Act raised a $40 million Series A just four months later.

Sector: Defense technology

Founders: Gigi Levy-Weiss, Yiftach Shoolman, Sari Brosh Rechav, Matan Melamed

Line 5 completed the largest defense-tech Seed round of 2025. The company was founded by NFX founder Gigi Levy-Weiss and Redis co-founder Yiftach Shoolman, alongside executives with deep experience in space, defense, and counter-drone systems.

The startup remains largely in stealth, with its founders emphasizing battlefield innovation aimed at reducing risk to soldiers.