These are Israel's five most valuable tech companies entering 2024

Mobileye, Check Point, Nice, monday.com, and CyberArk head the list of the Israeli tech firms with the highest market cap after weathering a stormy 2023, reaching a total value of $83.5 billion

The past year was a roller coaster for the global high-tech landscape. However, with 2024 around the corner, it is clear that the giants of the Israeli tech ecosystem managed to weather the storm and will be entering the new year in a better position than they started in. This is reflected in the stock price of the companies, which in many cases rose significantly over the last 12 months.

Below is a list of the five most valuable Israeli tech companies entering 2024 (Figures updated for December 25. List does not include pharma and defense companies):

Mobileye - Market cap: $34.62 billion

Mobileye’s valuation of $16.7 billion when it went public in October 2022 was considered to be disappointing by many onlookers. After all, the Israeli self-driving company was dreaming of a valuation of around $50 billion when Intel began looking into taking its Israeli unit public a year earlier before the economic downturn gutted public markets. There is little doubt that anyone who invested in Mobileye’s IPO is currently feeling good about it, with the company’s shares more than doubling in valuation since going public. In fact, the lowest point for Mobileye shares this year was on January 2, with the price rising over 35% since.

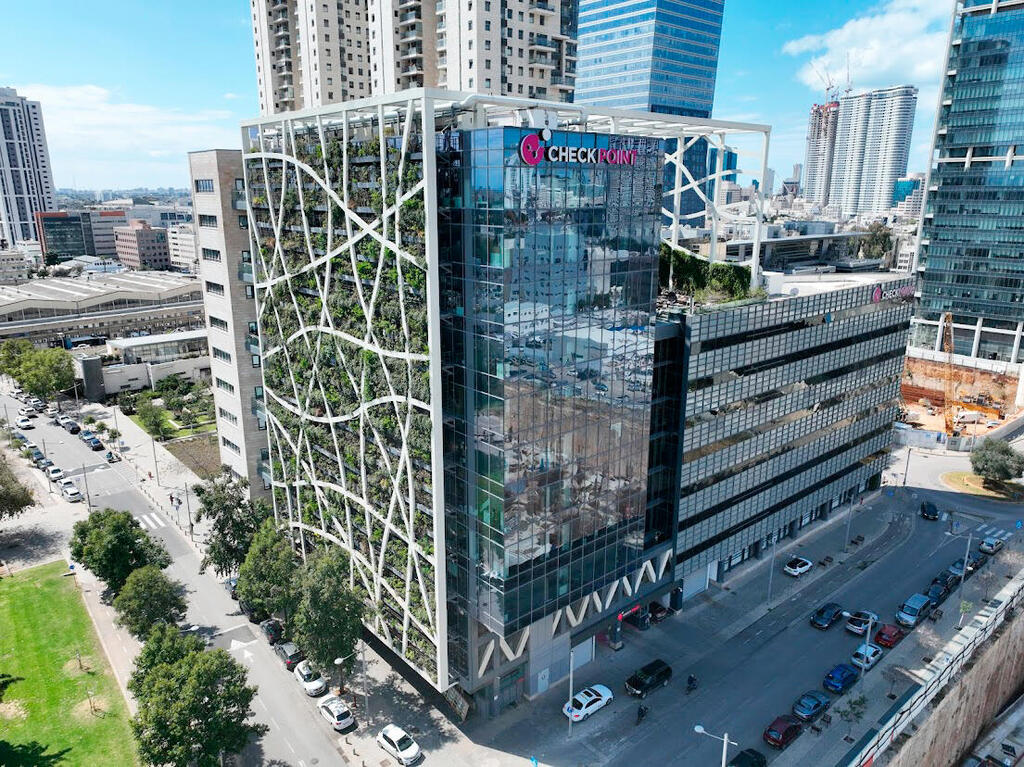

Check Point - Market cap: $17.81 billion

The veteran company is often regarded as the dull oldtimer in the cybersecurity space, but that didn’t prevent it from continuing to display impressive profitability in 2023 and reaching an all-time high share price after rising over 18% since the start of the year. Check Point ended the third quarter with revenues of $596 million and an improved bottom line that displayed a 19% jump in net income to $1.75 per share. Check Point was also busy in the acquisitions market in 2023, paying $490 million for local cyber startup Perimeter 81 in August in one of the largest M&A’s in its history, while also acquiring Atmosec, an early-stage Israeli startup, for a far smaller sum in September.

Nice - Market cap: $12.86 billion

Unlike the other names on the list, Nice’s share price has shown little growth over the past year, climbing less than 7% overall. However, a rally of almost 32% in the stock price over the last two months at least ensured it ends the year in the green, as it continued to display steady profitability. Earnings per share came in at $2.27 in the third quarter, representing 18% growth. Cash flow from operations grew 28% to $121 million. Nice has also been active on the acquisition front, purchasing LiveVox, an AI-driven proactive outreach provider, in a deal valued at $350 million in October, This strategic move is aimed at bolstering Nice's product offerings with artificial intelligence (AI) capabilities, specifically designed for the management of service systems within companies.

monday.com - Market cap: $9.14 billion

Monday.com shares soared over 88% so far this year. The company reported rapid growth in its third quarter as well as increased profitability, a trend expected to continue in the last quarter of the year. Monday, an enterprise software company, concluded the third quarter with revenues of $189.2 million and said it expects to achieve a growth rate of 40% annually, predicting annual revenues between $723-725 million this year. If it maintains the current growth rate, it will become a billion-dollar company in 2024. In addition to growth, the company is continuing to improve its operational efficiency, and in the third quarter, its operating loss fell to $2.5 million compared to a loss of $28 million in the same quarter last year. The company reported a net profit of $7.5 million in the third quarter, compared to a loss of $23 million in the same quarter in 2022.

CyberArk - Market cap: $9.08 billion

CyberArk is one of the oldest cybersecurity companies in Israel, being founded back in 1999. However, it continues to go from strength to strength, with its share price currently trading at an all-time high. Since the beginning of the year, its share price has climbed by nearly 88% on the back of some strong reports. Total revenue in the third quarter was $191.2 million, up 25% from $152.7 million in the third quarter of 2022. Annual Recurring Revenue (ARR) was $705 million, an increase of 38% from 2022. CyberArk made a transition to the SaaS model over recent times, expanding its product portfolio to a broad platform in the field of identity management. This subfield is gaining renewed interest as some of the biggest cyber hacks this year were achieved by impersonating employees.