Medtronic to acquire Israeli AI cardiology firm CathWorks for $585 million, deal could reach $1 billion

AI cardiac diagnostics firm joins med-tech giant after commercial partnership.

Medical device giant Medtronic announced on Tuesday that it will exercise its option to acquire Israeli company CathWorks. The acquisition follows a strategic partnership signed in 2022, under which the companies jointly marketed CathWorks’ FFRangio system in the U.S., Europe, and Japan. The deal is valued at $585 million, with the potential for additional earn-out payments subject to the achievement of future milestones. In 2022, Medtronic also provided CathWorks with a $75 million loan. Industry estimates suggest the total consideration could ultimately reach $1 billion.

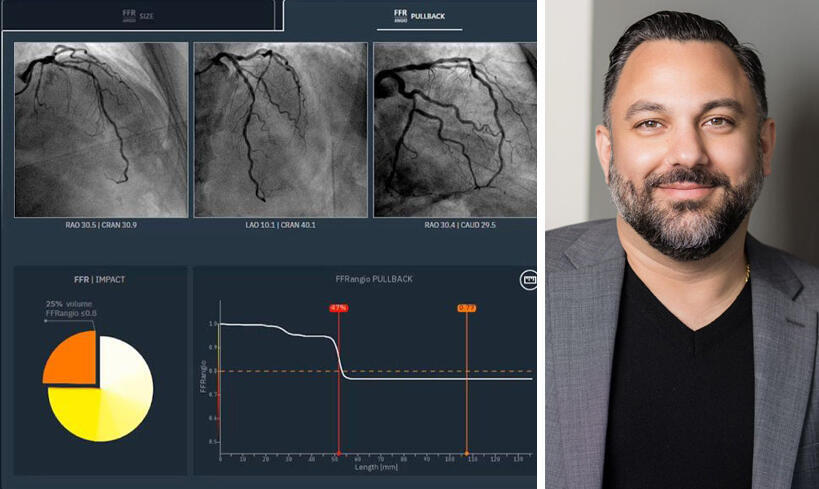

CathWorks’ FFRangio system uses artificial intelligence and advanced computational science to deliver a full physiological assessment of coronary arteries directly from routine X-ray angiography. Until now, the conventional FFR test required an invasive procedure involving pressure wires and drugs to stimulate blood flow. The Israeli technology eliminates the need for those wires, saves valuable time, and enables physicians to make more accurate treatment decisions in real time.

“Medtronic is thrilled to move forward with our option to officially acquire CathWorks. Through our co-promotion agreement, we’ve seen how CathWorks can disrupt the traditional wire-based FFR segment and leverage the power of data and AI to deliver innovative solutions that assist physicians at every step of a patient's journey, from diagnosis to treatment,” said Jason Weidman, senior vice president and president of the Coronary & Renal Denervation business, which is part of the Cardiovascular Portfolio at Medtronic. “This acquisition allows Medtronic to transform the cath lab with a technology that provides real-time data, informs individualized treatment approaches, and drives new standards of care.”

CathWorks employs about 100 people, 50 of them in Israel, and Medtronic is expected to retain the entire Israeli team.

To date, the company has raised $83 million from investors including Israeli fund Triventures, one of its earliest backers, Deerfield Management, Corundum Open Innovation, Pontifax, BioStar Ventures, Quark Venture, and Planven.

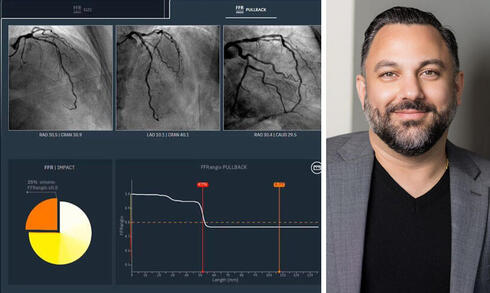

CathWorks was founded in 2013 by Guy and Ifat Lavi together with Prof. Ran Kornowski. The current CEO is Ramin Mousavi, an Iranian-American executive who previously held senior roles at Baxter and Edwards Lifesciences.

In a conversation with Calcalist, Mousavi said: “I’m very excited. We’ve been working toward this for a long time, and this is validation for all the hard work of a company founded by prominent Israeli entrepreneurs. It’s a beautiful journey and wonderful news for patients. I’m an Iranian-American running an Israeli company, born in Iran, I moved to the United States at 16 and grew up in California. Working with the Israeli team has shown me not only the innovation Israelis are known for, but also extraordinary resilience, especially during difficult times. A deep connection has been created between our cultures that goes beyond this acquisition.”

Mousavi added that more than 100,000 patients have already been treated using the technology in collaboration with Medtronic. He also spoke emotionally about developments in Iran and the broader region, expressing hope for a more stable future.

"The current regime in Iran is truly evil and it is hard to believe the huge number of people who have emigrated in a few days. This is a horror and there is no substitute for human life and this is a government that is the source of all evil in the world,” he said. “Without this government, there is no Hezbollah, Hamas and terrorism. My hope is that the faster they disappear, the better the world will be. This is a case where we must get rid of this government and this terrible regime.

"I have visited Israel quite a few times and it is an amazing country and our countries are very similar geographically and also in terms of food,” he added. “In Israel I felt like I was in my homeland in Iran and Israelis are direct and warm people and I really enjoyed the historical atmosphere and the beaches and everything happening there.”.

Triventures has been operating since 2010 and manages four funds totaling hundreds of millions of dollars. The fund has invested in more than 30 companies and recorded 12 exits, including V-Wave, Orthopace, 6over6, BurnAlong, and Zingbox. Triventures maintains offices in Tel Aviv and Silicon Valley and counts strategic investors such as Johnson & Johnson, Medtronic, Boston Scientific, Samsung, Nikon, as well as major hospital networks in Israel and the U.S.

Medtronic established its Israeli operations in 1974 and has since acquired Israeli companies for approximately $4 billion.