Fintech mafia: How Israel’s veteran founders are shaping the sector’s future

Viola Group's latest report identifies 2026 as a pivotal year for Israeli fintech, marked by a return to economic reality and the emergence of the sector as a second pillar alongside cyber.

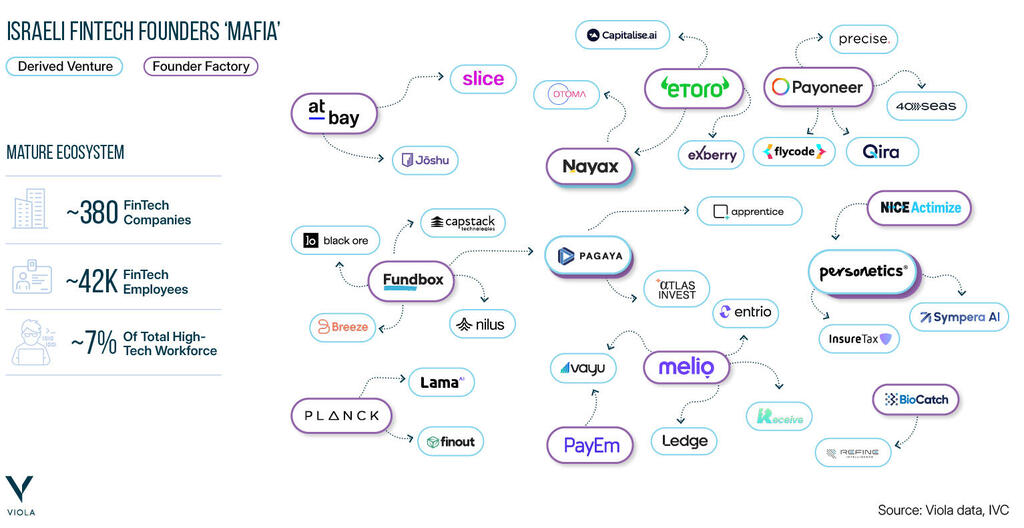

The Israeli fintech sector is witnessing the rise of a “Fintech Mafia,” a third generation of companies born out of established players, according to Viola Group’s latest report. This lineage, where firms like Apprentice and Atlas Invest originated from Pagaya, which itself was spun out of Fundbox, allows the ecosystem to retain what Viola principal Tal Abuloff describes as “institutional memory.”

“These founders are not only inspired by past successes, they’ve lived through regulatory cycles, scaling mistakes, and market downturns firsthand,” Abuloff explains. “The feedback loop from late-stage operators back into early-stage formation is one of Israel’s most underappreciated advantages.”

The emergence of this “mafia” illustrates how Israeli fintech is evolving into a mature, resilient sector. Abuloff notes that vertically integrated, deeply tailored solutions, owning both the financial layer and the customer experience, are now the norm. Portfolio players such as Duetti, PayZen, and Faye exemplify this shift, with the next phase of fintech being driven by “depth, not breadth,” targeting Agentic AI, insurtech, embedded ecosystems, vertical fintech, and stablecoin-based infrastructure.

Regarding AI, Abuloff warns against underestimating its incremental value inside financial institutions. “The greatest impact of AI in the sector will be less about flashy consumer use cases and more about deeper improvements in risk, decisioning, fraud, and operational efficiency,” she says, areas where Israeli teams already have a notable edge.

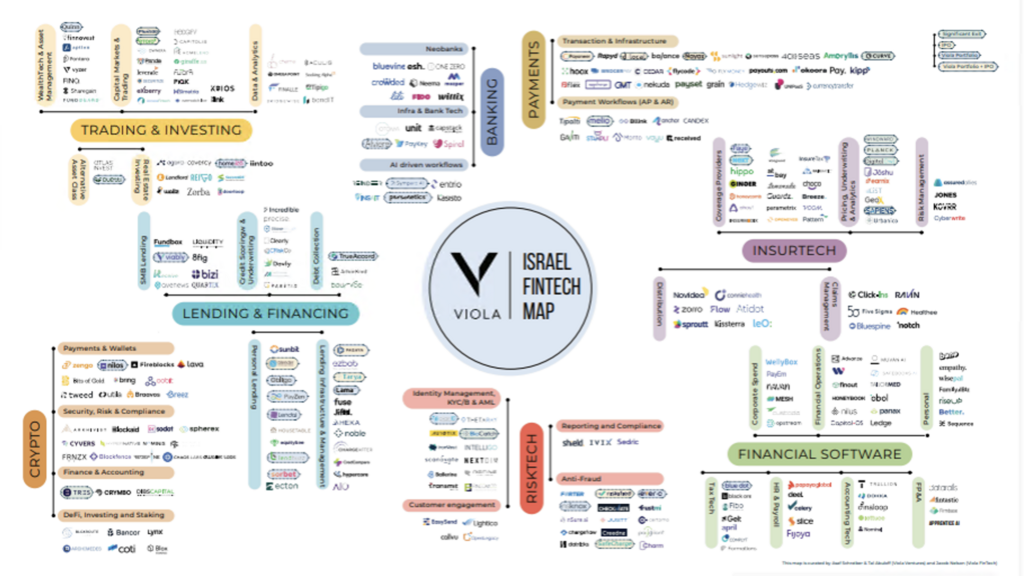

The report situates this maturation within the broader fintech cycle. Following the acceleration of 2020-21, the contractions of 2022-24, and the “comeback” of 2025, Viola’s latest report argues the case for a new fintech cycle. Characterized by discipline, integrated platforms, and scale, the report predicts 2026 will be “the reset” year for the sector, which now accounts for 7% of the Israeli tech workforce.

“When we describe 2026 as a reset, we're not talking about a rebound to prior peaks, but a return to economic reality,” says Abuloff. “The companies that remain are leaner, more focused, and operating from a much healthier baseline.”

The report shows that by 2025, it became evident that the fintech downturn was cyclical rather than secular, with private markets providing the first clear signs of a rebound. Private funding stabilized at around $1.4 billion, even as a growing share of overall investment was directed toward the cybersecurity sector.

The report attributes the multi-year contraction to rising interest rates, closed capital markets, and a general repricing of risk. For Abuloff, the correlation between fintech funding and interest rates was one of the report's most striking takeaways. “When you step back from the headlines, the relationship is almost impossible to ignore: as the cost of capital rose, fintech funding predictably contracted, and as rates stabilized, activity followed. That matters because it reframes the last cycle,” she emphasized. “Rather than signaling a loss of relevance, it shows that fintech behaved exactly as you’d expect in a higher-rate environment, and that normalization, not abandonment, is what we’re beginning to see now.”

Meanwhile, after an extended freeze, fintech was among the first sectors to test the thawing global IPO market in 2025. The report notes that fintech exits reached $5.8 billion that year, bringing the number of Israeli fintech unicorns and public companies on par with cybersecurity, which stands at 13 unicorns and 10 public companies.

To Abuloff, the data confirms fintech’s emergence as the “second pillar” of Israel’s high-tech ecosystem. “Cyber remains Israel’s most visible export in terms of scale, liquidity, and global brand,” she says. “The parity in unicorns and IPOs isn’t about competition between sectors; it reflects the fact that fintech has become a durable, repeatable source of meaningful outcomes rather than a cyclical bet.”

However, while the report identifies a pipeline of Israeli fintech IPOs in place, including Lendbuzz, Deel, and Tipalti, Abuloff expects 2026 to be defined more by M&A than a broad reopening of the public markets. “The public markets are open, but only selectively, and the bar is very high,” she explains. “At the same time, incumbents are under pressure to innovate and are increasingly willing to acquire rather than build.” This trend follows a year where global fintech M&A volume reached its highest level since 2021.

Ultimately, Abuloff believes the report tells a story of an ecosystem growing up. “Israel’s tech sector is shifting from one driven by speed and capital availability to one shaped by experience and judgment,” she says. “You see it in the kinds of companies being built, the problems they’re choosing to tackle, and the way founders think about regulation, risk, and go-to-market from day one. It’s a quieter phase, but also a more resilient one.”