Intel braces for sixth straight loss as new CEO faces foundry reckoning

Shareholders want answers on Tan’s bet to pivot from 18A to 14A amid mounting writedown risks.

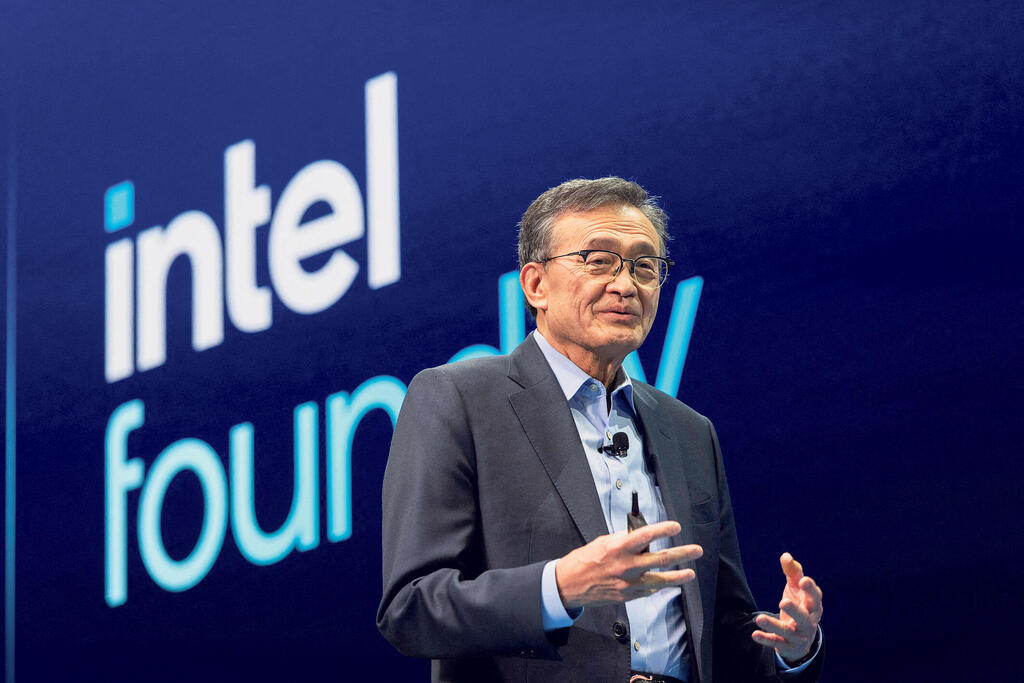

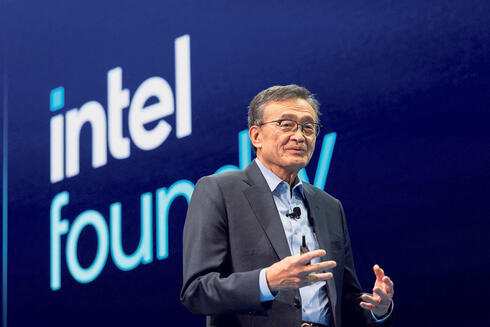

Faced with slumping quarterly sales and mounting losses, Intel shareholders are eager to hear new CEO Lip Bu-Tan’s plans for the chipmaker’s struggling contract manufacturing business.

Intel is expected to report its sixth consecutive net loss on Thursday, while revenue is forecast to drop for a fifth straight quarter, according to estimates from LSEG data.

The storied chipmaker, once a symbol of America’s semiconductor dominance, has stumbled in recent years due to a string of strategic missteps. Rival Nvidia has surged ahead in the booming artificial intelligence chip market, while AMD continues to gain share in Intel’s core personal computer and server segments.

CEO Tan has shifted focus to a next-generation chipmaking process called 14A in a bid to attract major external customers, moving away from 18A, the technology his predecessor Pat Gelsinger had poured billions into developing. This pivot could result in a large writedown, an expense investors won’t welcome, even though Intel says the new process will help it compete more effectively with TSMC, the world’s leading contract chip manufacturer.

Longer-term guidance about the company’s 14A plans “will hold more weight this earnings call than anything else,” Stifel analysts wrote in a note ahead of the results.

Intel is projected to post a net loss of about $1.25 billion for the April–June quarter, while revenue is expected to decline by more than 7% to $11.92 billion. Last year was Intel’s first unprofitable year since 1986.

Potential writedowns could total hundreds of millions, if not billions, according to analysts, and may delay the timeline for the foundry business to reach break-even. Intel’s CFO David Zinsner said in May that the unit is expected to break even by 2027, assuming external customers generate low- to mid-single-digit billions in revenue.

Intel’s foundry unit is forecast to bring in about $4.49 billion in sales this quarter, but analysts note that most of this comes from chips Intel produces for its own use.

Since taking over as CEO in March, Tan has also prioritized shedding non-core assets. In April, Intel agreed to sell a 51% stake in its Altera programmable chip business for $4.46 billion. The company is reportedly weighing sales of its network and edge units too.

Intel’s stock has gained 16% so far this year, outperforming the broader chip index, which is up about 13%. Investors will watch closely to see if Tan pursues further asset sales, flattens the company’s management structure, or expands the global layoffs announced last year.

The broader industry backdrop is still murky. Like other chipmakers, Intel faces customers hesitant to spend amid ongoing trade tensions under U.S. President Donald Trump. Revenue from Intel’s personal computer unit is expected to decline about 2% to $7.25 billion for the quarter, after customers pulled forward orders to the first quarter to hedge against tariff risks.

Analog chipmaker Texas Instruments flagged similar headwinds on Tuesday, sending its shares down 11% after hours. Chip-equipment giant ASML and TSMC have also warned that tariff-related uncertainty is clouding their outlooks.

One bright spot: revenue from Intel’s data center unit is expected to rise about 20% to $3.66 billion, signaling a rebound in demand for traditional server chips after several weak quarters.