"No more blank checks": Tan’s Intel turnaround slashes jobs, cancels expansion

New CEO scraps projects in Europe and trims layers as losses widen.

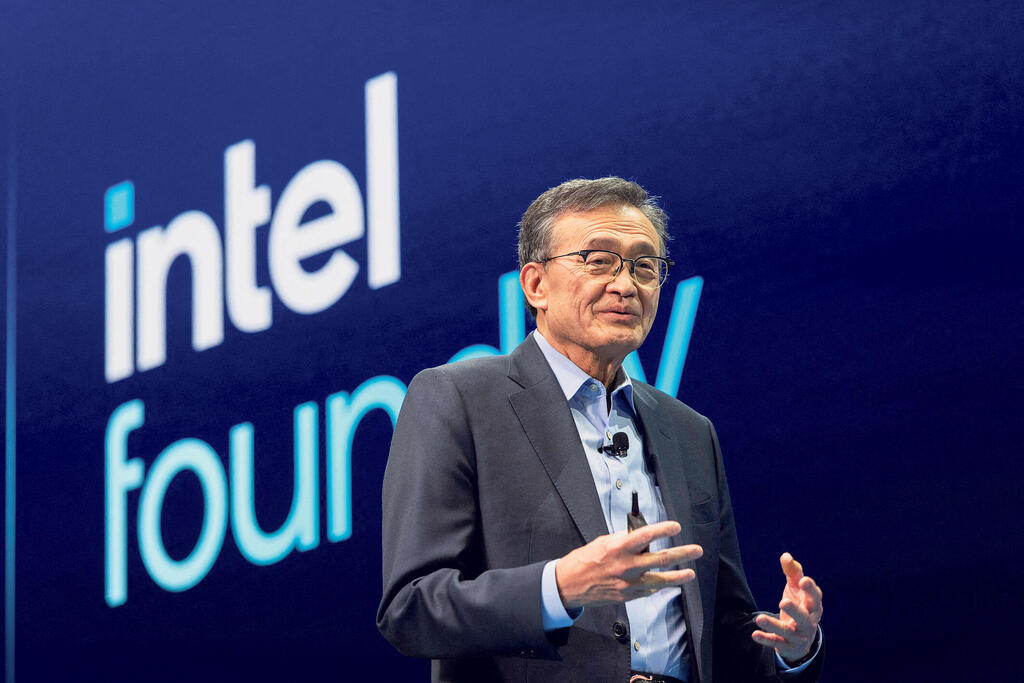

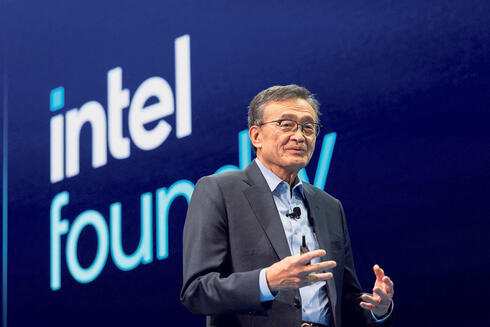

Intel is moving ahead with some of its largest job cuts in years and scaling back expansion plans, as new Chief Executive Lip-Bu Tan tries to restore financial discipline and reset the semiconductor giant’s course after years of uneven performance.

In a memo to employees on Thursday, Tan confirmed that Intel aims to bring headcount down to about 75,000 by year-end, from 99,500 at the end of 2024. The cuts include departures already made in the second quarter, which also saw Intel eliminate about half its management layers and book $1.9 billion in restructuring costs.

During an all-hands video conference in April, Chief Financial Officer David Zinsner told staff that a report suggesting Intel would lay off more than 20,000 workers was inaccurate. He said at the time that the company had not yet finalized how many positions will be eliminated.

“Every investment must make economic sense,” Tan wrote in the message. “There are no more blank checks. We will build what our customers need, when they need it, and earn their trust through consistent execution.”

Intel’s latest quarterly results showed revenue of $12.9 billion for the three months ending June 28, slightly ahead of Wall Street expectations, and broke a four-quarter streak of declining sales. Still, the company posted a steeper-than-expected adjusted loss of 10 cents per share, with its unadjusted loss coming in at 67 cents per share, far worse than analysts’ forecasts.

Looking ahead, Intel expects third-quarter sales between $12.6 billion and $13.6 billion, above analyst estimates. But the company also projected a wider net loss than investors had anticipated, underlining the costs of Tan’s turnaround effort.

In his memo, Tan outlined three main priorities for what he called “a new Intel for a new era.” First, he said Intel will change its approach to its foundry business, citing past investments that were “too much, too soon — without adequate demand.” Projects in Germany and Poland have been cancelled, construction in Ohio has been slowed, and some operations in Costa Rica will be consolidated elsewhere.

Second, Tan said Intel will focus on revitalizing its core x86 ecosystem for personal computers and data centers. That includes new chips like Panther Lake for notebooks and Granite Rapids for servers, along with plans to reinstate simultaneous multi-threading, a feature that was dropped under previous leadership but is seen as critical to performance.

Third, the CEO wants to refine Intel’s AI strategy, shifting from a purely silicon-centric approach to a broader stack that includes software and systems, with a particular focus on inference and emerging “agentic” AI workloads.

Despite the scale of the restructuring, Intel’s stock has risen 14% this year as investors look for signs that Tan’s approach could restore the company’s competitiveness, especially in the AI market now dominated by rivals like Nvidia.

“Q2 was the first step in the right direction,” Tan told employees. “The future of Intel is ours to build — but we have no time to waste.”